Entering a Transaction - Transaction Rows (Journal Postings)

This page describes the fields in the matrix in the Transaction record window. Please follow the links below for descriptions of the other parts of the Transaction record window:

---

In the centre of the 'Transaction: New' and 'Transaction: Inspect' windows are the rows of the Transaction, where you should list the individual journal postings that make up the Transaction. These must balance (the debits must equal the credits) before you can save the Transaction.

The Transaction row matrix is divided into seven horizontal flips. When you click (Windows/macOS) or tap (iOS/Android) a flip tab (marked A-G), the two or three right-hand columns of the grid will be replaced.

If you are using Windows or macOS, you can add rows to a Transaction by clicking in any field in the first blank row and entering appropriate text. To remove a row, click on the row number on the left of the row and press the Backspace key. To insert a row, click on the row number where the insertion is to be made and press Return.

If you are using iOS or Android, you can add rows by tapping the + button below the matrix. To remove a row, long tap on the row number on the left of the row and select 'Delete Row' from the resulting menu. To insert a row, long tap on the row number where the insertion is to be made and select 'Insert Row' from the resulting menu.

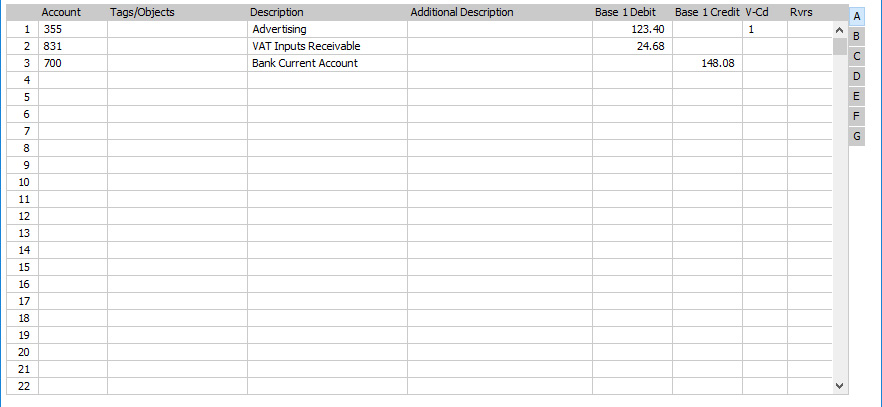

Flip A

- Account

- Paste Special

Account register, Nominal Ledger/System module

- Specify here the Account to which the debit or credit value in the row is to be posted.

- You can also enter the Code of an Autotransaction to this field. You can use Autotransactions to automate the entry of frequently used Transactions, not only reducing labour but also ensuring the correct Accounts are used every time.

- Tags/Objects

- Paste Special

Tag/Object register, Nominal Ledger/System module

- You can assign up to 20 Tags/Objects, separated by commas, to each Transaction row. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- If you don't use Objects, you can use the Skips Object option in the Transaction Settings setting to have the insertion point skip over this field when you press Return or Enter (but not Tab).

- If you enter more than one Tag/Object, they will automatically be sorted alphabetically when you move to the next field.

- If you have specified a Tag/Object On All Rows in the Transaction Settings setting, that Tag/Object will be placed here automatically when you enter a debit or credit amount.

- Description

- The Account Name will be entered here automatically when you enter an Account Number in the field above. You can change the Description in a particular Transaction row if necessary.

- You can use the Skips Description option in the Transaction Settings setting to have the insertion point skip over this field when you press Return or Enter (but not Tab).

- If you have entered a Language in the Company Info setting in the System module, if you have entered an appropriate translation of the Account Name on the 'Texts' card of the Account record and if you are using the Account Description in Company Language option in the Transaction Settings setting in the Nominal Ledger, then the appropriate translation of the Account Name for the Company Info Language will be brought in.

- Additional Description

- Use this field to record any further comments about the row as necessary.

- The Additional Description will be included in the Transaction Journal and Transaction Summary reports. If you need it to be printed on Transaction forms, add the "Other Comment, Row" field to the Form Template.

- Base 1 Debit, Base 1 Credit

- Use one of these fields to enter the debit or credit value of a Transaction row. Enter a value in Base Currency 1 as specified in the Base Currency setting in the System module or in your home Currency if you are not using the Dual-Base Currency system.

- The debits total must equal the credits total before you can save the Transaction: each Transaction must therefore have at least two rows.

- If you are using the Warn On Unusual Amount option in the Transaction setting and you have specified using the Normal Amount options in an Account record that the Account can only have amounts posted to one side (debit or credit) you will be warned ("Not a normal amount for this account") if you attempt to post a figure to the other side. Note that this warning will not be enforced and you will be able to override it.

- V-Cd

- Paste Special

VAT Codes setting, Nominal Ledger

- Default taken from Account

- You can mark each row in a Transaction with a VAT Code. This Code may be brought in automatically when you enter the Account number, or you can enter it yourself. No calculation ensues: the field is for reporting purposes only. Nevertheless, take care to ensure you enter the correct VAT Code (if any), since it will affect the accuracy of the figures for Net Sales and Net Purchases in your VAT Return, as shown in the illustration of the VAT Report Definition.

- Rvrs

- This field will only be visible in Lithuania, Poland and the UK (i.e. it will be visible when the VAT Law in the Company Info setting is "Lithuanian", "Polish" or "Default"). Please refer to the Reverse Charge VAT in Sales Invoices' page for details.

Flips B-D: Multi Currency accounting

If you are using the

Dual-Base Currency system, every Transaction row should contain debit or credit values in Base Currency 1 and in Base Currency 2. If you enter a value in Base Currency 1 (in the Base 1 Debit or Base 1 Credit fields on flip A), a converted value in Base Currency 2 will be placed in the Base 2 Debit or Base 2 Credit field on flip B automatically. Alternatively, you can enter a value in Base Currency 2 and a converted value will be placed in the relevant Base Currency 1 field. The conversion rate will be shown in the Base Rate 1 and Base Rate 2 fields on flip D.

If a Transaction is in a Currency other than Base Currency 1 or 2, specify the Currency on flip C together with values in that Currency. If the Account that you have entered on flip A is one in which you have specified a Currency, this Currency will be brought in automatically. When you specify the Currency or it is brought in from the Account, the current Exchange Rates will be brought in to flip D.

Please refer here for full details about these features.

If you are entering a Transaction in your home Currency and you are not using the Dual-Base or simple conversion systems, you can ignore flips B-D.

Flip E

You can use a Transaction to record a payment against a Sales or Purchase Invoice. In the first row of the Transaction, specify the Bank Account to be debited (in the case of a Sales Invoice) or credited (in the case of a Purchase Invoice). On the next line, on flip E, specify the Invoice(s) being paid as described below. The Debtor or Creditor Account as appropriate will be brought in automatically from the Invoice.

Invoices and Purchase Invoices paid off in this manner will no longer be treated as open, but records in the Receipt or Payment registers will not be created.

You can also create Invoices and Purchase Invoices using flip E. Again, records will not be created in the Invoice or Purchase Invoice registers, but such Invoices will appear in any Open Invoice 'Paste Special' list until they have been paid off: in this respect they are treated as normal Invoices. On separate rows of the Transaction, specify the Debtor/Creditor Account, Sales/Purchase Account(s) and Output/Input VAT Account. No defaults will be offered. On flip E in the row posting to the Debtor/Creditor Account, set the T (Type) field to "C" (for "Customer") or "S" (for "Supplier") as appropriate and enter a Customer or Supplier and an Invoice Number.

Setting the T (Type) field to "C" or "S" in a Transaction row means that you can only use that row to create or pay off an Invoice. There is therefore no need to turn off the Sub-ledger Checking options in the Account Usage S/L and P/L settings. You will only be able to use an Account that has been protected by this feature in a row in which the Type is "C" or "S".

In Transactions generated automatically from Sales and Purchase Invoices, Receipts and Payments, the fields on flip E will contain values if you are using the Invoice Info. on N/L Transaction (in the case of the Sales Ledger) and Supp. Info. on Trans. (Purchase Ledger) options in the Account Usage S/L and P/L settings.

- T (Type)

- Paste Special

Choices of possible entries

- Use this field to specify whether the Transaction row is a debtor or creditor posting. Enter "C" (for "Customer") if you are registering a Receipt or Sales Invoice or "S" (for "Supplier") if you are registering a Payment or Purchase Invoice. The 'Paste Special' lists attached to the Serial No and Company fields will vary, depending on what you have entered here.

- You should only use "C" or "S" if the row is a posting to the Debtor or Creditor Accounts. Balancing postings to Sales, Purchase, VAT and Bank/Cash Accounts should carry the default entry of "M". You should also use "M" in all other Transactions.

- Ser. No.

- Paste Special

Open, approved Purchase or Sales Invoices

- Once you have entered "C" or "S" in the Type field, you must enter a Sales or Purchase Invoice Number here before you can save the Transaction.

- Enter an existing Invoice Number to signify the Invoice that you want to be paid off. When you press the Tab or Enter key, its Customer or Supplier Number will appear in the Company field, the appropriate Debtor or Creditor Account will be brought in, and the outstanding amount will be placed in the Credit (Sales Invoice) or Debit (Purchase Invoice) field.

- Enter a non-existent number to signify that a new Invoice is to be created.

- Due Date

- Paste Special

Choose date

- Once you have entered a Sales or Purchase Invoice in the Serial No field, its Due Date will be shown here.

- If you are creating a new Invoice, enter a Due Date as appropriate.

- Company

- Paste Special

Customers or Suppliers in Contact register

- Once you have entered a Sales or Purchase Invoice in the Serial No field, its Customer or Supplier will be shown here.

- If you are creating a new Invoice, enter a Customer or Supplier as appropriate.

- If the Type is "C", the 'Paste Special' list will contain Customers. If the Type is "S", it will contain Suppliers. If the Type is "M", the 'Paste Special' list will not open.

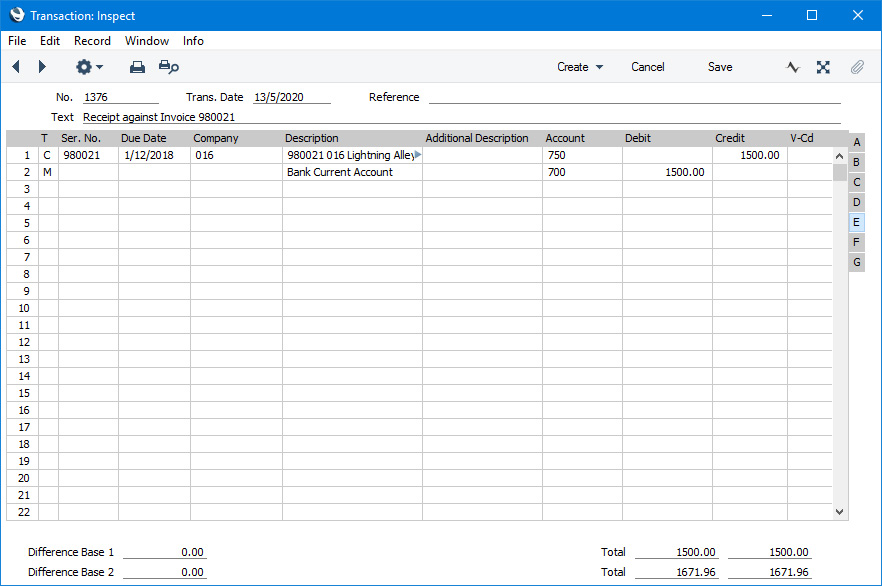

An example Receipt against a Sales Invoice entered using the Transaction screen is shown below (flip E is shown in the illustration).

When you enter "C" or "S" to the Type field and a Sales or Purchase Invoice Number to the Serial Number field, the Debtor or Creditor Account (750 in the illustration above) will be brought in automatically, and the outstanding amount will be placed in the Credit or Debit field as appropriate. If the original Invoice was in a foreign Currency, the outstanding amount will be converted using the Exchange Rate in the Invoice. If the Exchange Rate has changed since the Invoice was raised or received, you can optionally have a new row added automatically to the Transaction, posting the gain or loss to the Rate Gain or Loss Accounts specified in the

Rate Gain/Loss setting. If you would like to make use of this option, select the

Calculate Rate Differences option in the

Transaction Settings setting.

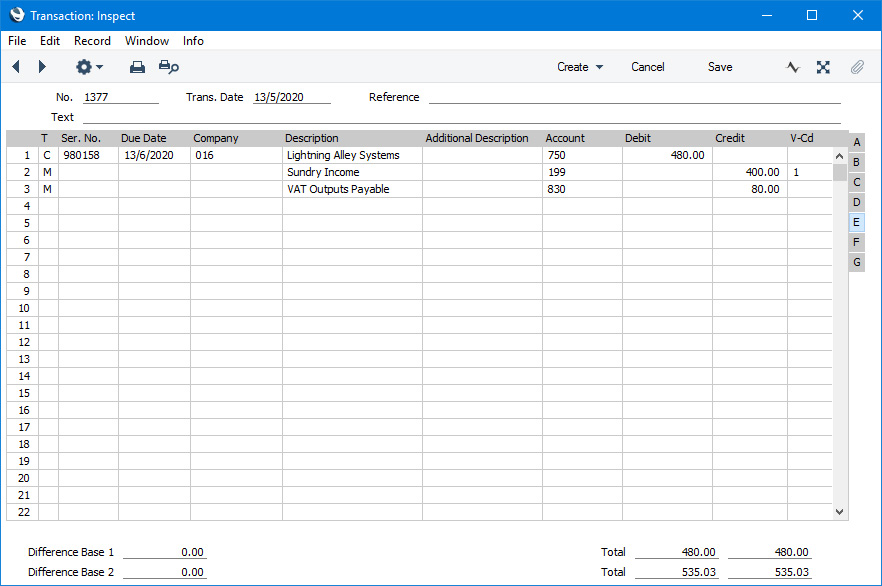

An example creation of a Sales Invoice is shown below (again, flip E is shown in the illustration).

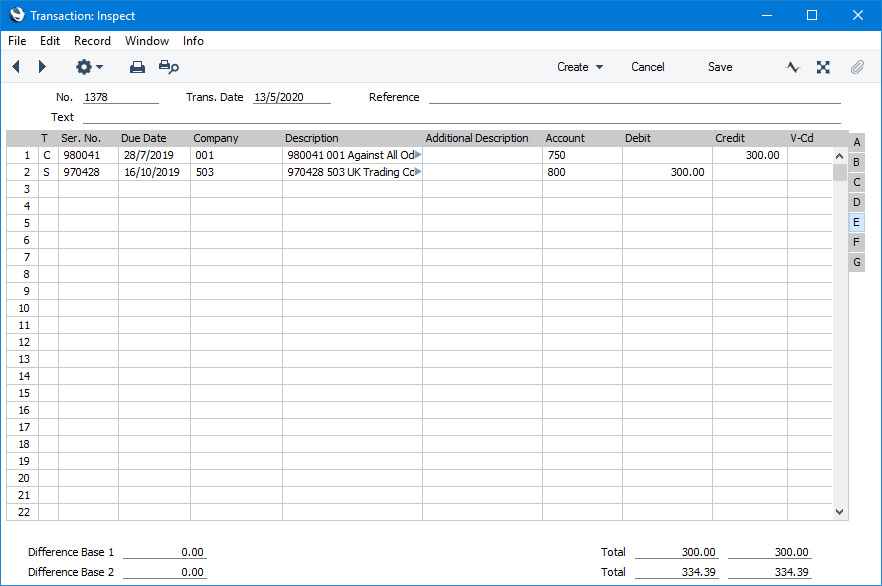

If a company is both a Customer and Supplier, you can use Flip E to enter a contra transaction in which you set Sales and Purchase Invoices against each other. If the values of the Sales and Purchase Invoices are not the same, the Invoice with the lower amount will be fully paid off, while the other will be partially paid off, so it will continue to be treated as open. In the example shown below, a Sales Invoice issued to Customer 001 has been set against a Purchase Invoice received from Supplier 504:

Flip F

- Corr

- If you are using the Check Corresponding A/C Rules option in the Transaction Settings setting, the Accounts used on each side (debit/credit) of a Transaction will be subject to certain rules (the "Corresponding Account Rules"). These rules mean you should enter Transactions in such way that clearly shows how each individual posting is balanced. You will not be able to save a Transaction that does not comply with these rules.

- It can be difficult to establish correspondence in some complex Transactions, where, for example, the first two lines are debit Accounts and there are then several credit lines. So, if you are using this option and you need to enter such a complex Transaction, you must establish correspondence manually using this field. Enter an arbitrary number in the Corr field in each Transaction row. Enter the same number in the rows that correspond to each other.

- Corresponding Account Rules are fully explained on the page describing the Transaction Settings setting.

Flip G

- Tax Account

- This field is used in Russia. Please refer to your local HansaWorld representative for details.

- Qty

- In a posting to a Stock Account in a Transaction created from a Sub System record that updates stock (e.g. from a Goods Receipt, Delivery or Invoice), the number of units added to or removed from stock will be recorded in this field. Quantities will be included in the Analytical Balance report if you print it using the Show Quantity option.

- Type

- Paste Special

Choice of possible entries

- This field is used in Argentina and Portugal.

- In Argentina, the 'Year End Simulation' Maintenance function will be used at the end of each financial year to create three Simulations:

| Simulation | Type |

| | |

| Closing Year: Swap Results to Equity | Year End Stage 1 |

| Closing Year: Swap Equity Accounts | Year End Stage 1 |

| Opening Year: Swap Equity Accounts | Year End Stage 2 |

- When Transactions are created from these Simulations, the appropriate Type will be copied to this field in each Transaction row.

- In Portugal, this field is used to classify each Transaction row when included in SAF-T exports. Use 'Paste Special' to choose the option that is appropriate for each Transaction. Every row in an individual Transaction must have the same Type so, if you change the Type in a row that change will copied to the other rows in the Transaction. You can change the Type in a Transaction that has been saved without the need for an Update Mark or a Correction Mark.

---

The Transaction register in Standard ERP:

Go back to: