Revaluate Asset Acquisition Value - Example

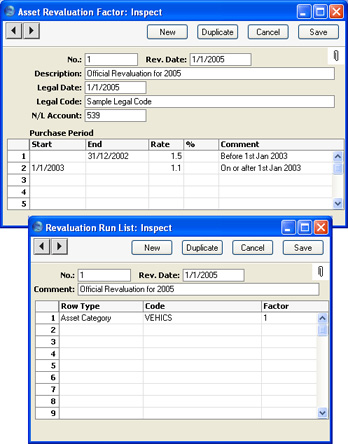

In this example, the

Revaluation Factor and

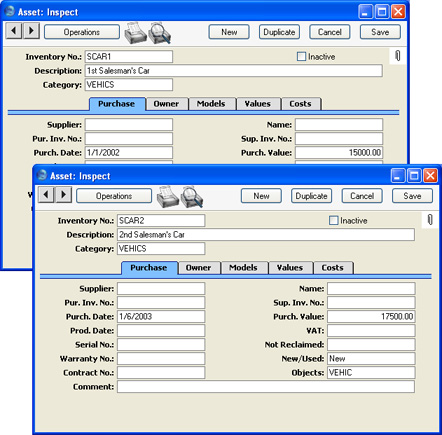

Run List illustrated above will be applied to these two Assets (because they both belong to the "VEHICS" Asset Category specified in the Revaluation Run List):

The first Asset has a Purchase Date of 1st January 2002, and therefore will be revalued by a Factor of 1.5 (determined in the Revaluation Factor), while the second Asset was purchased on 1st June 2003 and therefore will be revalued by a Factor of 1.1.

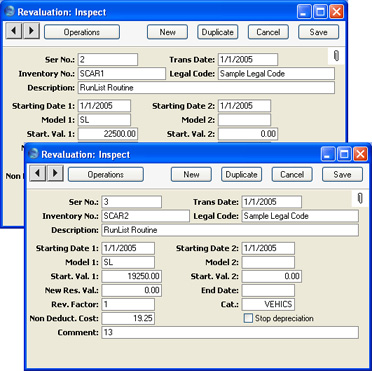

When the 'Revaluate Asset Acquisition Value' function is run, "1/1/2005" is entered as the Run List Date, to ensure the correct Run List is used. The function will create these two Revaluation records (one for each Asset):

The new value of the first Asset is 15000 x 1.5 = 22500. The new value of the second Asset is 17500 x 1.1 = 18250. These new values appear in both the Starting Value 1 and 2 fields, and will be used as the basis for depreciation calculations the next time these are carried out. How they will be used will depend on whether the Start From Last Revaluated Value option is used. Please refer to the page describing the

'Create Depreciation Simulations' Maintenance function for further details and an example.