Accounting Periods

When you enter an Invoice or Purchase Invoice, its Due Date will usually be calculated from its Invoice Date using its Payment Terms. However, in some countries (e.g. in southern Africa), Due Dates are not calculated directly from Invoice Dates in this manner. Instead, a Due Date will depend on the Period in which the Invoice Date falls. This Period may not necessarily be a calendar month.

To use this system, follow these steps:

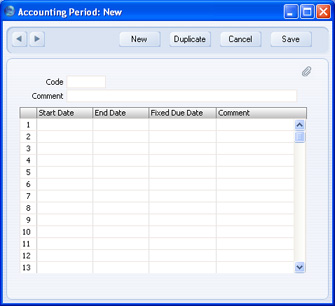

- To enter a new Accounting Period or to edit an existing one, first open the 'Settings' list by clicking the [Settings] button in the Master Control panel or using the Ctrl-S/⌘-S keyboard shortcut. Double-click 'Accounting Periods' in the list. The 'Accounting Periods: Browse' window is displayed, showing all Accounting Periods previously entered. Double-click a record in the list to edit it, or add a new record by clicking the [New] button in the Button Bar. When the record is complete, save it by clicking the [Save] button in the Button Bar or by clicking the close box and choosing to save changes. To close it without saving changes, click the close box.

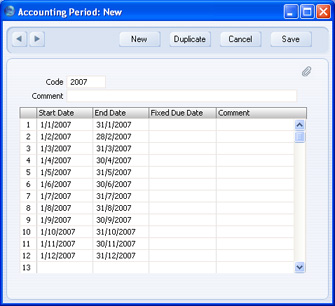

- Enter a Code for the Accounting Period. This must be the same as the Code of a Fiscal Year. When you press Tab or Return, the Fiscal Year will be divided into twelve periods, one for each calendar month, and these periods will be listed in the grid:

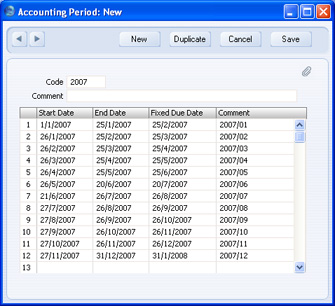

- Change the Start and End Dates of each Period as necessary. The Start Date of the first Period must be the same as the Start Date of the Fiscal Year. The End Date of the last Period must be the same as the End Date of the Fiscal Year. The Periods can be irregular in duration, but do not omit any dates.

- Specify Due Dates for each Period in the Fixed Due Dates column:

In the example illustrated above, an Invoice or Purchase Invoice dated between 21st June and 26th July will have a Due Date of 26th August.

If you do not specify a Fixed Due Date for a Period, then the End Date of that Period will also be its Due Date.

The Comment will be printed in reports if you decide to use Accounting Periods to determine the ageing periods in those reports. This is described in point 6 below.

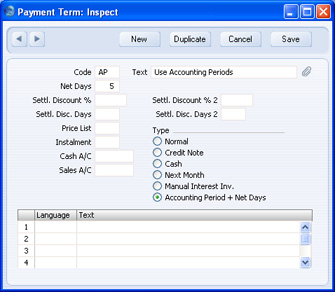

- If you want Accounting Periods to be used when calculating Due Dates, choose the Accounting Period + Net Days option in your Payment Term records:

In the example illustrated above, the Net Days is 5. This means a Due Date will be five days later than the Due Date specified in the Accounting Periods setting. So, our example Invoice or Purchase Invoice dated between 21st June and 26th July will now have a Due Date of 31st August, if it uses this Payment Term.

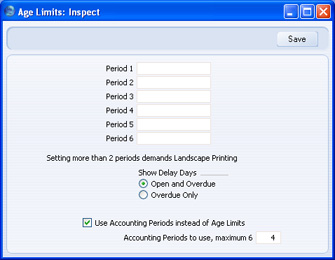

- You can also use Accounting Periods to determine the ageing periods in the Sales Ledger report (Aged and Aged Detailed options), the Purchase Ledger report (Aged option), the Customer and Supplier Status reports, the Payments and Receipts Forecast reports, and the Open Invoice Customer and Supplier documents. To do this, use the Use Accounting Periods instead of Age Limits option in the Age Limits setting in the Sales Ledger, and specify how many Accounting Periods you want to use:

If you are using this option, there is no need to specify Periods 1-6 for the purposes of debit and credit management, as illustrated above. However, you may still wish to do so as these fields provide the defaults for the Aged Stock Analysis report in the Stock module.

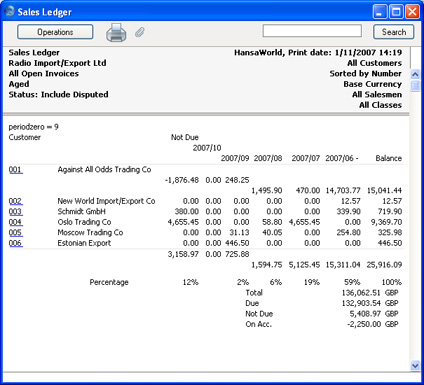

The example Sales Ledger report illustrated below was produced using the Aged option. It has four ageing periods as specified in the Age Limits setting (in addition to the Not Due column and the column for Invoices that are older than the last ageing period). These ageing periods are the four most recent Accounting Periods at the time the report is produced. The name (column heading) of each ageing period is taken from the Accounting Periods setting illustrated earlier in this section:

The due figure in each ageing period is calculated from the Invoices that became due during the corresponding Accounting Period. In the example illustration, the figures in the 2007/09 column are calculated from the Invoices that became due between 27th August and 26th September.