Interest

You can charge interest on overdue Invoices (those that remain unpaid once the Payment Terms have expired). To charge interest, you will need to raise an Invoice of a special type, known as an "Interest Invoice". In most respects, an Interest Invoice is similar to a "normal" Invoice. However, Interest Invoices will be printed using a different Form Template, and are marked with an "I" in the right-hand column of the 'Invoices: Browse' window.

You can raise Interest Invoices using two methods:

- You can use the 'Create Interest Invoices' Maintenance function in the Sales Ledger.

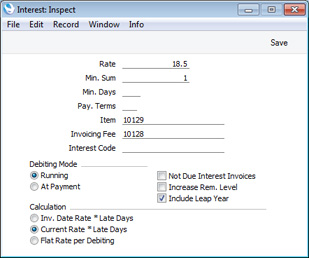

The operation of this function will be controlled by the options that you select in this setting. Here you should determine the interest rate, the minimum amount that you wish to charge, the minimum numbers of days delayed, the Payment Terms for the Interest Invoice and the interest calculation method. You should also specify in this setting whether interest should be charged on Invoices that were outstanding during a specified period, or on outstanding Invoices that were paid during the specified period.

You must tick the Interest box on the 'Terms' card of the Contact record for each Customer that is to be charged interest for late payment.

! | If you have not ticked the Interest box for a particular Customer, the 'Create Interest Invoices' function will not create Interest Invoices for them, no matter how late their payments are. | |

- You can enter an Interest Invoice directly to the Invoice register. To do this, use a Payment Term in which the Type is "Manual Interest Inv.". In such an Invoice, no reference will be made to this setting and so you will be free to use an ad hoc interest rate.

To open the Interest setting, ensure you are in the Sales Ledger and then click the [Settings] button in the Navigation Centre. Double-click 'Interest' in the 'Settings' list. Fill in the fields as described below. Then, to save changes and close the window, click the [Save] button. To close the window without saving changes, click the close box.

- Rate

- Enter the rate of interest to be used in interest calculations.

- If you are using the first or second Calculation options (below), enter an annual rate of interest. If you are using the third Calculation method, enter the interest rate that you wish to charge each time you raise an Interest Invoice.

- The Interest Rate that you specify here will be copied to each new Invoice, to be shown on the 'Price List' card. If you have specified an Interest Rate on the 'Terms' card of a Contact record for a particular Customer, that figure will be copied to Invoices instead of the one specified here.

- If you need to charge interest at different rates depending on the outstanding value of each overdue Invoice and/or depending on the interest period, leave this field empty and instead use the Interest Code field below.

- Min. Sum

- Use this field if you need to specify a minimum amount to charge. The 'Create Interest Invoices' function will not create an Interest Invoice for a Customer if the total interest chargeable (including VAT if appropriate but excluding any invoicing fee) is less than this minimum figure.

- Min. Days

- You should only use this field if the Debiting Mode (below) is "At Payment" (otherwise leave it empty). Enter the minimum number of days overdue that an Invoice must be when it is paid in order for the 'Create Interest Invoices' function to create an Interest Invoice for it.

- For example, if the Min. Days is 5, interest will not be charged on an Invoice that was paid when it was overdue by four days (measuring from its Due Date). If the Invoice was paid when it was overdue by six days, interest will be charged for all six days.

- Pay. Terms

- Paste Special

Payment Terms setting, Sales/Purchase Ledger

- Specify the Payment Term that the 'Create Interest Invoices' function should use in Interest Invoices. If you leave this field empty, the normal Sales Payment Term for the Customer will be used.

- Item

- Paste Special

Item register

- Specify here a Plain or Service Item, the purpose of which is to control the accounting of interest charges in Invoices created by the 'Create Interest Invoices' function. In this Item record, you should specify the Sales Account that is to be credited with interest charges (one for each Zone if necessary) and the VAT Code that will determine whether VAT will be charged on interest and if so the rate at which it will be charged and the Output VAT Account that will be credited (again, one VAT Code for each Zone).

- If you do not specify an Item here, or you specify an Item in which the Sales Accounts and VAT Codes are blank, they will be taken from the Account Usage S/L setting.

- Invoicing Fee

- Paste Special

Item register

- If you need an invoicing fee to be added to each Interest Invoice by the 'Create Interest Invoices' function, specify here the Item from the Item register that represents this fee. The Item should be a Plain or Service Item. In this Item record, you should specify a Base Price (i.e. the invoicing fee), a Sales Account (one for each Zone if necessary) and a VAT Code (again, one for each Zone). The 'Create Interest Invoices' function will add the Item once to each Interest Invoice it creates, irrespective of the number of overdue Invoices on which interest is being charged.

- Interest Code

- Paste Special

Interest Codes setting, Sales Ledger

- Interest Codes and Interest Terms allow you to charge interest at different rates depending on the outstanding value of each overdue Invoice and/or depending on the interest period. If you need to use this feature, specify here the Interest Code that you wish to be used as a default. You can enter a different Interest Code in the Interest field on the 'Price List' card of an individual Invoice if necessary.

- If you specify an Interest Code in this field, the Rate (above) will not be used.

- Please refer here for more details about Interest Codes and Interest Terms, together with examples.

- Debiting Mode

- Use these options to control when the 'Create Interest Invoices' function will charge interest on overdue Invoices.

- Running

- The function will create Interest Invoices charging interest on Invoices that were outstanding during a specified period. Very late Invoices may therefore cause more than one Interest Invoice to be raised.

- For example, an Invoice becomes due on March 25th and is paid on May 10th. If you run the 'Create Interest Invoices' function at the end of every month, interest will be charged three times: at the end of March (for six days as interest is not charged for the Due Date itself), at the end of April (for 30 days) and at the end of May (for ten days), making a total of 46 days.

- At Payment

- The function will create Interest Invoices charging interest on outstanding Invoices that were paid during the specified period. So, only one Interest Invoice will be raised for a particular outstanding Invoice, no matter how late it was when it was paid.

- In the example above, interest will be charged once at the end of May, for the whole overdue period of 46 days.

- Not Due Interest Invoices

- Check this box if you would like Invoices with a zero interest rate to be listed in Interest Invoices. Interest will not be charged on these Invoices.

- Increase Rem. Level

- Each Invoice contains a code (the Reminder Level, visible on the 'Price List' card) that indicates the number of times it has been subject to a Reminder and included in an Open Invoice Customer Statement.

- Select this option if you want the Reminder Level in each overdue Invoice to be increased by the 'Create Interest Invoices' function.

- When you print Reminders (using the Reminders form), the Reminder Level will determine the message that will be printed on each Reminder (providing you have included the "Reminder Text" field in the Form Template). You should define these messages in the Reminder Texts setting before printing Reminders.

- Include Leap Year

- If you are using the first or second Calculation options (below), the interest rate (including interest rates taken from the Interest Terms setting) will be treated as an annual rate.

- By default, in all calculations, the interest rate will be converted into a daily rate by dividing by 365 before being multiplied by the number of days in the interest period. For example, if the interest rate is 18.5%, interest for the month of April will be calculated using the following formula:

- 18.5% x 30/365

If you would like the annual rate to be converted into a daily rate in leap years by dividing by 366, select this option. As a result, interest for April in a non-leap year will still be calculated using the formula above, but in a leap year it will be calculated as follows:

- 18.5% x 30/366

If the interest period includes part of a leap year, the daily rate will be calculated by dividing by 365 or 366 as appropriate. For example, interest for the months of December and January where December is in a leap year will be calculated as follows:

- (18.5% x 31/366) + (18.5% x 31/365)

- Calculation

- Select one option to specify how the interest rate is to be chosen and used in the interest calculation by the 'Create Interest Invoices' function:

- Inv. Date Rate * Late Days

- Interest will be calculated using the interest rate that was valid on the day when an overdue Invoice was issued. This interest rate will be taken from the 'Price List' card of that Invoice, and will be treated as an annual rate.

- For example, the interest rate is 18.5%. An Invoice for 120.00 (including VAT) becomes due for payment on March 25th. Assuming the Min. Sum to be zero, interest will be charged for the last six days of March as follows:

- 120.00 x 18.5% x 6/365 = 0.36

- Interest will be charged for April as follows:

- 120.00 x 18.5% x 30/365 = 1.82

- If the original Invoice is paid on May 10th, interest will be charged for the first ten days of May as follows:

- 120.00 x 18.5% x 10/365 = 0.61

(The division by 365 in this example depends on whether the year is a leap year and on the Include Leap Year option above.)

- As this option takes interest rates from each overdue Invoice, interest will not be calculated for a particular Invoice if the Interest field in that Invoice is blank. This is a possible cause of interest not being calculated when you expect. You can of course remove the interest rate from a particular Invoice if you do not want interest to be charged, but ticking the No Interest box on the 'Identifiers' card would be a more usual method of achieving this. The No Interest box will also be obeyed by the Current Date Rate option immediately below.

- Current Date Rate * Late Days

- This option is similar to the one above, with one exception. It uses the interest rate valid on the day when you run the 'Create Interest Invoices' function. This interest rate will be taken from the 'Terms' card of the Customer record or, if that is blank, from this setting.

- Flat Rate Per Debiting

- Use this option if interest is to be charged based simply on the fact that an Invoice is overdue, not on the number of days it is overdue. In this case, the interest rate is an absolute rate, not an annual figure.

- This option uses the interest rate valid on the day when you run the 'Create Interest Invoices' function, taken from the 'Terms' card of the Customer record or, if that is blank, from this setting.

- Using the example above, interest will be charged for the last six days of March as follows:

- 120.00 x 18.5% = 22.20

- Interest will be charged for April as follows:

- 120.00 x 18.5% = 22.20

- If the original Invoice is paid on May 10th, interest will be charged for the first ten days of May as follows:

- 120.00 x 18.5% = 22.20

Note: if you have specified an Interest Code in this setting, interest rates will be taken from the connected Interest Terms record, irrespective of whether you have chosen the Inv. Date Rate or Current Date Rate options above. Further, if you have specified an Interest Code in the Interest field in an Invoice, that Interest Code will take priority over the Interest Code in this setting. However, selecting the Flat Rate option will mean that the interest rates in the Interest Terms setting will be treated as absolute rates.

---

Settings in the Sales Ledger:

Go back to:

|