Regional Sales Taxes

You can use the Regional Sales Taxes setting together with the

Regions setting to configure a system of regional sales taxes. The setting was designed for use in Argentina, but may be of use in other countries with similar taxes.

Regional sales taxes will not be charged to or be payable by Customers: instead, your company as the selling company will be liable. Regional sales taxes will not be posted to the Nominal Ledger from Invoices (i.e. they will not be recorded immediately sales are made). You should periodically produce the Regional Taxes report and use the information it contains as a basis for reporting to the tax authorities.

To work with Regional Sales Taxes, follow these steps:

- Enter the sales tax regions in the Regions setting.

- Assign a Region to each Customer, using the field on the 'Delivery' card, and to each record in the Delivery Addresses setting in the Sales Orders module.

- Change to the Customs module and, in the Commodity Code register, enter Commodity Codes to represent the various activities undertaken by your business (i.e. the various types of goods and services that you sell).

- Assign a Commodity Code to each Item or Item Group using the Commodity Code field on the 'Recipe' card of the Item record or the Commodity/EAN field on the 'Freight' card of the Item Group record. The Commodity Code will be taken from the Item Group if the field in the Item is blank.

- Enter the sales tax rates for each Region, using the Regional Sales Taxes setting in the Sales Ledger.

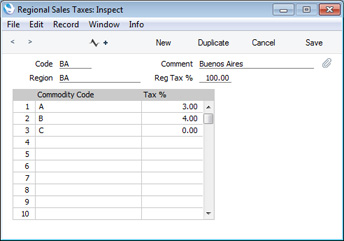

After specifying a Code and Comment, choose the Region using 'Paste Special'. In the Reg Tax % field, specify the proportion of your sales that will be liable for regional sales tax. Usually this will be 100% but may vary depending on various factors such as turnover. In the grid, list the Commodity Codes (again using 'Paste Special') and the tax rates applied to each one (i.e. list the specific tax rates for each type of product or service that you sell).

For example, referring to the illustration above, if you sell an Item with Commodity Code B to a Customer in the BA Region for 1000.00 (i.e. the Sum excluding VAT), the Regional Sales Tax will be calculated by applying the Reg. Tax % from the header and then the Tax % from the relevant row (1000.00 * 3.00% * 4.00% = 1.20).

After following these steps and entering Invoices as normal, the

Regional Taxes report will display the regional sales taxes that are payable.

---

Settings in the Sales Ledger:

Go back to: