Tax Templates - Workflow and Examples - Defining the VAT Report

This example describes using Tax Templates to collect and report sales tax.

The example is based on a store in a county where sales are subject to two taxes: the state sales tax (6%); and a county tax (1%). To begin with, the store will only sell to Customers in the same county.

After following the configuration steps and entering an Invoice, the next step is to define the VAT Report.

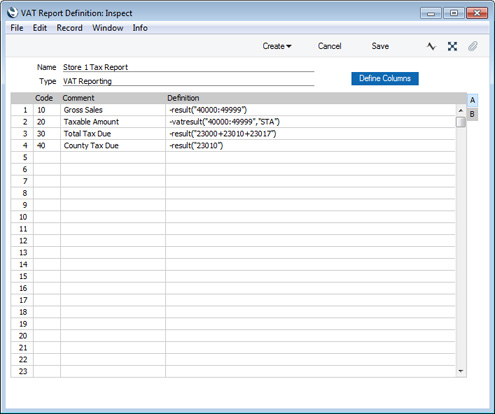

Before producing a VAT Report for the first time, you should specify how the figures in the report will be calculated and format the report so that it suits your specific requirements. This is known as "Defining" the VAT Report: a full description is here. An example report definition is illustrated below:

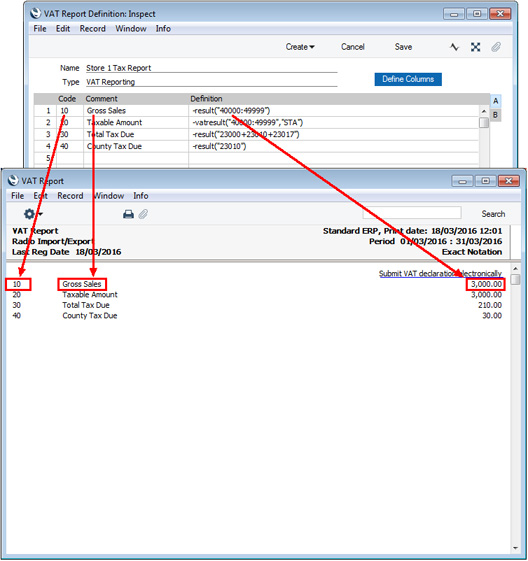

Each row in the definitions list will cause a line to be printed in the VAT Report, as shown in the illustration below:

In more detail the calculations in the report definition are as follows:

| Row 1 | -result("40000:49999") | The RESULT command will print the net change in a specified Account or Accounts over the report period i.e. the net amount posted to the Account. Accounts 40000:49999 are the Sales Accounts. This row will therefore print the total value of sales made during the report period. Sales figures are stored as negative figures in Standard ERP, so the negative sign will convert them to positive. |

| | |

| Row 2 | -vatresult("40000:49999","STA") | The VATRESULT command will print the net amount posted with a specified VAT Code to a specified Account or Accounts. This row will therefore print the total value of sales made with the "STA" VAT Code (i.e. the VAT Code representing the state tax). In other words, this row prints the total value of taxable sales. |

| | |

| Row 3 | -result("23000+23010+23017") | This row will print the total sales tax payable on sales made during the report period, calculated from three Accounts: 23000, the output Account for state tax; 23010, the output Account for county tax; and 23017, the output Account for the prepared food tax (not used in this example). |

| | |

| Row 4 | -result("23010") | 23010 is the output Account for county tax, so this row prints the total county tax on sales made during the report period. |

Tax Template Examples:

---

Settings in the Nominal Ledger:

Go back to: