Cost Accounting - Part 1

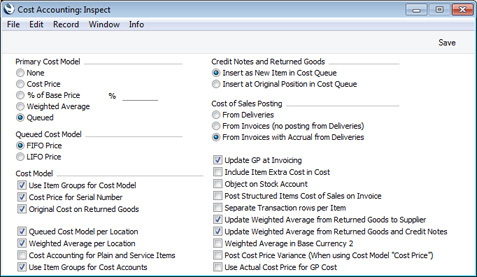

The Cost Accounting setting is where you can specify the costing method that you want to use to calculate stock valuations and the value of outgoing stock transactions, together with associated options.

To open the Cost Accounting setting, first ensure you are in the Stock module. Then, if you are using Windows or Mac OS X, click the [Settings] button in the Navigation Centre and then double-click 'Cost Accounting' in the 'Settings' list. If you are using iOS or Android, select 'Settings' from the Tools menu (with 'wrench' icon) and tap 'Cost Accounting' in the 'Settings' list. Fill in the fields as described below. Then, to save changes and close the window, click the [Save] button (Windows/Mac OS X) or tap √ (iOS/Android). To close the window without saving changes, click the close box (Windows/Mac OS X) or tap < (iOS/Android).

This page describes the Primary Cost Model options, the Queued Cost Model options and the Cost Model options in this setting. Please refer here for details about the other options.

- Primary Cost Model

- The Cost Model is the method that will be used to calculate the value of the Items that you hold in stock.

- For example, if you are maintaining stock valuations in the Nominal Ledger ("cost accounting"), when you mark an outgoing stock transaction (e.g. Invoice, Delivery, Work Sheet or Stock Depreciation) as OK and save, a Nominal Ledger Transaction will be created automatically, debiting the value of the goods to a Cost Account and crediting it to a Stock Account. The Cost Model is the valuation method that will be used to calculate the value of the goods removed from stock.

- The Cost Model will also be used by the Stock List report to calculate the value of your stock.

- Whenever it is necessary to calculate the stock value of an Item, the Cost Model will be chosen as follows:

- The Cost Model will be taken from the 'Cost Model' card in the relevant Item record.

- If the Cost Model in the Item is Default, if you are using the Use Item Groups for Cost Model option described below and if the Item belongs to an Item Group, the Cost Model will be taken from the Item Group to which the Item belongs.

- In all other cases (e.g. the Cost Model in the Item Group is Default, you are not using the Use Item Groups for Cost Model option and/or the Item does not belong to an Item Group), the Primary Cost Model that you choose here will be used.

In other words, you can choose an overall Cost Model in the Cost Accounting setting and then choose a different Cost Model for a particular Item or Item Group. You can also produce a Stock List using an alternative Cost Model, for comparison purposes. If you have set the Primary Cost Model to None in this setting because you don't need to use cost accounting (step 2 on the 'Switching Cost Accounting Off' page, you will still be able to choose a Cost Model each time you produce a Stock List report.

The chosen Cost Model will sometimes be bypassed if you are using the Cost Price for Serial Number option in the relevant Item or Item Group record or in this setting (described below). This option will ensure individual Cost Prices and Serial Numbers will be linked. When you sell an Item with a particular Serial Number, the appropriate Cost Price for that Serial Number will be used in the resulting cost accounting transaction. The Stock List report will use the appropriate Cost Prices for the Serial Numbers in stock. In effect, Cost Price for Serial Number is a Cost Model that can only be used with Items with Serial Numbers.

The following Cost Model options are available:

- None

- Select this option if you do not wish to use a Cost Model. Outward cost accounting transactions will not be created. You will need to choose a Cost Model each time you produce a Stock List report, otherwise it will not contain a valuation (you can do this in the report specification window).

- Cost Price

- This option will use the Cost Price of each Item (visible on the 'Costs' card of the Item record) as the unit cost value in outgoing stock transactions and the unit value in the Stock List.

- This option will be most useful with Items whose Cost Prices do not change. If Cost Prices do change, the stock valuation in the Stock List report will be different to that in the Nominal Ledger (unless you adjust the stock valuation in the Nominal Ledger yourself by journal i.e. by entering a Nominal Ledger Transaction manually). You may also consider using the Post Cost Price Variance (When using Cost Model "Cost Price") option in this setting (described here, in case you receive an Item into stock at a cost that is different to its Cost Price. If you choose this option, it is recommended that you also choose "None" as the Update Cost Price at Goods Receipt options (also on the 'Costs' card of the Item), to ensure the Cost Price remains constant. If an Item's Cost Price does change, you can change it yourself and will therefore be aware of the need to update the stock valuation in the Nominal Ledger.

- % of Base Price

- This option calculates the unit cost value in outgoing cost accounting transactions and the unit value in the Stock List by applying a specified percentage to the Base Price (i.e. the retail price) of each Item. Specify the percentage in the % field immediately to the right. You can use this option in cases where a consistent gross margin is required. If you do not set a percentage (i.e. if you leave the % field blank), it will be assumed to be 100%.

- Weighted Average

- The unit cost in outgoing cost accounting transactions and the unit value in the Stock List will be the Weighted Average Cost Price of each Item (i.e. the average unit price of all previous purchases). The overall Weighted Average value of an Item is visible on the 'Costs' card of the Item record, while separate Weighted Averages for each Item in each Location are stored in the Weighted Average setting in the Stock module.

- The Weighted Average of an Item will be updated each time you receive a unit into stock, using the following formula:

| WA = | ((Qty in stock x Current WA) + (Qty on GR x Unit Pr. on GR)) | | (Qty in stock + Qty on GR) |

- (where GR means Goods Receipt).

- If you have more than one Location, you can choose whether the overall Weighted Average figure for all Locations or the Weighted Average for the Location in question will be used to calculate cost values. Please refer to the description of the Weighted Average per Location option here for details.

- If you let the stock of an Item to fall to zero, its Weighted Average will be reset the next time you receive units into stock.

- Queued

- This option calculates the unit cost value in outgoing cost accounting transactions and the unit value in the Stock List using a FIFO (First In First Out) or LIFO (Last In First Out) queue. The cost values in the queue will be the cost prices recorded in the Goods Receipts that brought the Items into stock. Choose FIFO or LIFO using the Queued Cost Model options below.

- The Queued Cost Model can provide a very precise stock valuation, especially for Items with variable Cost Prices. However, this precision also requires discipline. As their names suggest, First In First Out and Last In First Out require that you must make certain that you enter all stock transactions in strict chronological order. Failure to do this may cause your FIFO or LIFO values to become incorrect. Do not, for example, enter a Goods Receipt with yesterday's date if you have already entered one with today's. This applies to Deliveries and Stock Depreciations as well. It is also recommended that you always mark stock transactions as OK when you save them for the first time. Do not, for example, go back to an earlier Goods Receipt and mark it as OK if there are later ones that you have already marked as OK, unless you change the date as well. You can use options such as Chronology in Stock in the Stock Settings setting and Force Chronology for Invoice in the Account Usage S/L setting to help ensure you do not break this rule.

- If you have more than one Location, you can choose whether the overall FIFO or LIFO figure for all Locations or the figure for the Location in question will be used to calculate cost values. Please refer to the description of the Queued Cost Model per Location option here for details.

! | If you choose the Cost Price or % of Base Price options, make sure that the appropriate field contains values for each Item. Otherwise, cost accounting Transactions and Stock List valuations with zero amounts may result. | |

- Queued Cost Model

- If you set the Primary Cost Model (above) to Queued, use these options to choose whether you want to use a FIFO (First In First Out) or LIFO (Last In First Out) queue.

- FIFO

- When you deliver an Item or otherwise remove it from stock, the individual unit that you received into stock first will be the unit that you deliver first. In the Stock List report, Items will be valued in chronological order.

- LIFO

- When you deliver an Item or otherwise remove it from stock, the individual unit that you received into stock last will be the unit that you deliver first. In the Stock List report, Items will be valued in reverse chronological order.

If you have set the Primary Cost Model to None because you do not want to use the cost accounting feature, you should still choose a Queued Cost Model. In this case, you will need to choose a Cost Model each time you produce a Stock List report. If you choose the Queued Cost Model, the report will use the FIFO or LIFO queue as specified here (providing the equivalent choice in each Item or Item Group is Default).

- Cost Model

- Use these options to specify how the Cost Model should behave in certain specific circumstances.

- Use Item Groups for Cost Model

- When outgoing cost accounting transactions are generated from Deliveries, Invoices, Stock Depreciations, Stock Movements and Work Sheets, the value of those transactions will be calculated using the Cost Model specified in each Item record. If the Cost Model in an Item record is Default and you are using this option, the Cost Model will be taken from the Item Group to which the Item belongs. If that Cost Model again is Default, the Primary Cost Model described above will be used. If the Cost Model in an Item record is Default and you are not using this option, the Primary Cost Model described above will be used (i.e. the Cost Model in the Item Group will be ignored).

- If you are using this option, it is recommended that all Stocked Items belong to Item Groups and that all Item Groups have Cost Models specified.

- Cost Price for Serial Number

- The Cost Price for Serial Number option is in effect an additional Cost Model that you can use with Serial Numbered Items. It allows you to ensure an individual Serial Number remains connected to its exact Cost Price from the moment you receive it into stock until the time you remove it from stock.

- If you choose not to use the Cost Price for Serial Number option, Cost Prices will be independent of Serial Numbers. When you remove a Serial Numbered Item from stock, the deduction from the stock valuation and, if you are using cost accounting, the value of the cost accounting transaction will be calculated using the Cost Model specified in the Item or Item Group or in this setting. For example, if you are using the Queued FIFO Cost Model, the Item with the oldest Cost Price will be removed from stock. This will happen irrespective of whether the Serial Number that you choose in the stock transaction is the oldest one.

- If you select this option, Cost Prices and Serial Numbers will be linked. When you remove a Serial Numbered Item from stock, the exact Cost Price of the chosen Serial Number will be deducted from the stock valuation, and this will be the value of any cost accounting transaction. This will not necessarily be the correct Cost Price that would be selected by the Cost Model.

- An example situation where using the Cost Price for Serial Number option can be advantageous is the one where stock can be purchased at special prices. An example might be the purchase of Items at special rates for sale to educational establishments or for demonstration purposes. When you move demonstration stock from stock to showroom or from showroom to showroom using Stock Movements or Stock Transfers, this method ensures that the special demonstration price remains connected to the Serial Numbers in question.

- Once you have made a decision whether to use the Cost Prices for Serial Number option, you should not change the state of this check box. If you switch the option on or off once you have started using the Stock module, it is very likely that inaccuracies will be introduced to the FIFO/LIFO queue and Weighted Average figures. If you do change the status of this check box, you should immediately run the 'Rebuild Stock' Maintenance function in the Technics module. This will rebuild the FIFO/LIFO queue and Weighted Average figures, but it will not change existing stock records (e.g. Deliveries) or the resulting Nominal Ledger Transactions. So, you may need to adjust the stock valuation in the Nominal Ledger yourself by journal (i.e. by entering a Nominal Ledger Transaction manually).

- You can override the option chosen here for an individual Item or, if you are using the Use Item Groups for Cost Model option above, Item Group.

- You must use the Cost Price for Serial Number option if you will use the Serial No. Item Sales Statistics report in the Sales Ledger. This option will allow Serial Numbers to be linked correctly to Suppliers in the report.

- Original Cost on Returned Goods

- One specific way in which you can receive an Item into stock is to receive a previously delivered Item back from a Customer. You can do this by creating a record in the Returned Goods register from the original Delivery or Sales Order.

- When you receive an Item into stock in this way, you may want to use the standard Cost Price of the Item from the Item register, or you may want to use the actual cost of that Item from the original Delivery. Select this option if you want to use the second method.

- For example, you are using the FIFO Cost Model and you have three Items in stock with costs 100, 200 and 300. The Cost Price in the Item record is 150. When you sell an Item, 100 will be removed from your Nominal Ledger stock value, since that was the value of the first Item received into stock (i.e. as calculated using the FIFO Cost Model). If the Customer returns the Item, you would find the original Delivery and create a Returned Goods record from it. If you are not using this option, the Item Cost and Unit Cost in the Returned Goods will be 150, the Cost Price from the Item. If you are using this option, the Item Cost and Unit Cost in the Returned Goods will be 100, since that was the precise cost of the returned Item in the Delivery.

- If you are not using this option, you can create a record in the Returned Goods register from the original Delivery or Sales Order using the 'Returned Goods' function on the Create menu. If you are using this option, you can only create the Returned Goods record from the original Delivery.

- If you are using a Queued Cost Model (FIFO or LIFO), the decision whether to use this option and the choice whether Returned Goods will return Items to their original position in the cost queue or to a new position (a choice made using the Credit Notes and Returned Goods options described here) may be mutually dependent.

Please refer here for details about the remaining options in this setting.

---

Settings in the Stock module:

Go back to:

|