Consolidation - Examples - Subsidiary Company is itself a Holding Company

This page describes using the Consolidation module using an example in which one of the subsidiary companies (or "Daughter" Companies) has its own subsidiary company (or "Grand Daughter" Company).

---

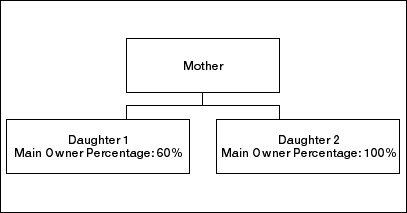

For this example we will start from the following company structure:

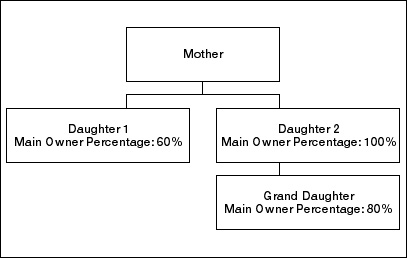

We will add a fourth Company to the structure. The new Company is 80% owned by the second Daughter Company:

Standard ERP Consolidation supports multi-level company structures, such as a Daughter company owning part of another Company (or many companies).

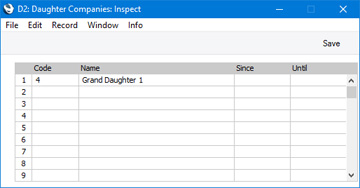

In the second Daughter Company, we have recorded its ownership of the Grand Daughter Company in the Daughter Companies setting:

In the Grand Daughter Company, we have used the

Main Owner Percentage register to specify that it is 80% owned by the second Daughter Company:

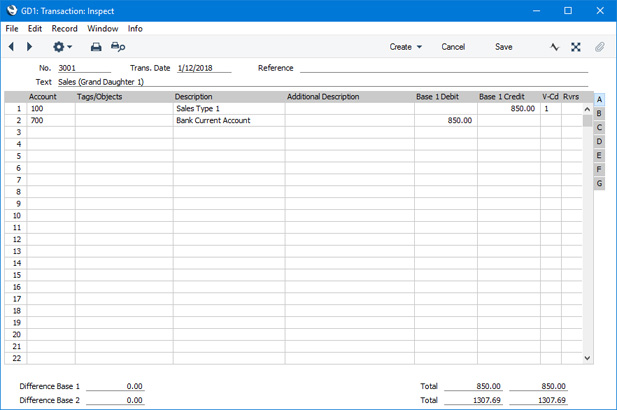

The Grand Daughter Company contains the following Transaction:

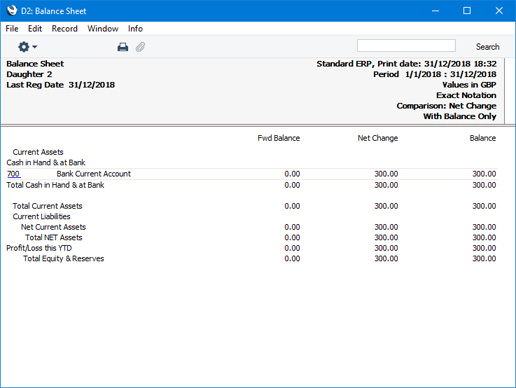

Working in the Consolidation module of the second Daughter Company, we will first produce a

Balance Sheet without using the

Include Daughter Companies option. The balance of the Bank Account is calculated from a Transaction in the Daughter Company:

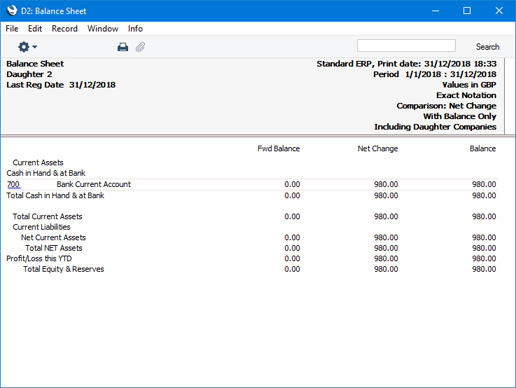

When we produce the same report using the

Include Daughter Companies option, the balance will be calculated from Transactions in the second Daughter Company and the Grand Daughter Company:

We have selected the

Reduce Minorities option for the Bank Account in the Grand Daughter Company, so the Net Change is calculated as follows:

| 300.00 | | from D2 |

| + | 850.00 | x 80% | from GD1 (80% owned by D2) |

| 980.00 | | |

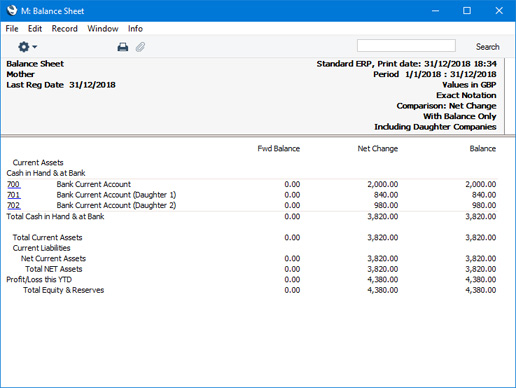

A Balance Sheet produced from the Mother Company using the Include Daughter Companies option will appear as follows:

The Net Change is calculated as follows:

| 2,000.00 | | from M |

| + | 1,400.00 | x 60% | from D1 (60% owned by M) |

| + | 300.00 | | from D2 |

| + | 850.00 | x 80% | from GD1 (80% owned by D2) |

| 3,820.00 | | |

Note that the balance of Account 702 includes the balances of the Bank Accounts in both the second Daughter Company and the Grand Daughter Company.

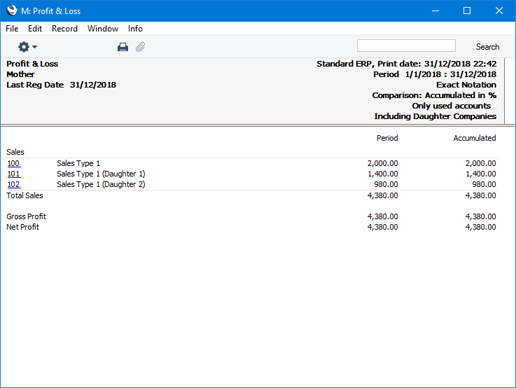

The Profit & Loss Report produced from the Mother Company using the Include Daughter Companies option will appear as follows:

We have selected the

Reduce Minorities option for the Sales Account in the Grand Daughter Company, so the Total is calculated as follows:

| 2,000.00 | | from M |

| + | 1,400.00 | | from D1 (60% owned by M, Reduce Minorities off) |

| + | 300.00 | | from D2 |

| + | 850.00 | x 80% | from GD1 (80% owned by D2, Reduce Minorities on) |

| 4,380.00 | | |

---

Consolidation examples:

Go back to: