N/L Accruals - The N/L Accruals Setting

The N/L Accruals feature in Standard ERP:

See also:

---

The N/L Accruals feature that allows you to post Sales and Purchase Invoices to the Nominal Ledger on an accruals basis. An Invoice value will be posted to an Accrual Account and then gradually transferred to a Sales or Purchase Account over the course of a pre-determined period. To use this feature, you should first create a record in the N/L Accruals setting specifying the Accrual Account and the rate at which an Invoice value will be transferred to the Sales or Purchase Account. You should then regularly run the 'Generate N/L Accrual Transactions' Maintenance function to transfer the balances gradually. to the Sales or Purchase Account. This page describes the N/L Accruals setting: please refer here for details about the 'Generate N/L Accrual Transactions' Maintenance function.

The N/L Accruals setting is in the Nominal Ledger. To enter a new N/L Accrual record or to edit an existing one, first ensure you are in this module and then open the 'Settings' list by clicking (Windows/macOS) or tapping (iOS/Android) the [Settings] button in the Navigation Centre. You can also use the Ctrl-S (Windows) or ⌘-S (macOS) keyboard shortcuts. Double-click or tap 'N/L Accruals' in the list. The 'N/L Accruals: Browse' window will be opened, listing the N/L Accrual records that you have previously entered. Double-click or tap a record in the list to edit it, or add a new record by selecting ''New' from the Create menu (Windows/macOS) or + menu (iOS/Android). When the record is complete, save it by clicking the [Save] button or by tapping √. You can also click the close box or tap < and choose to save changes. To close it without saving changes, click the close box or tap <.

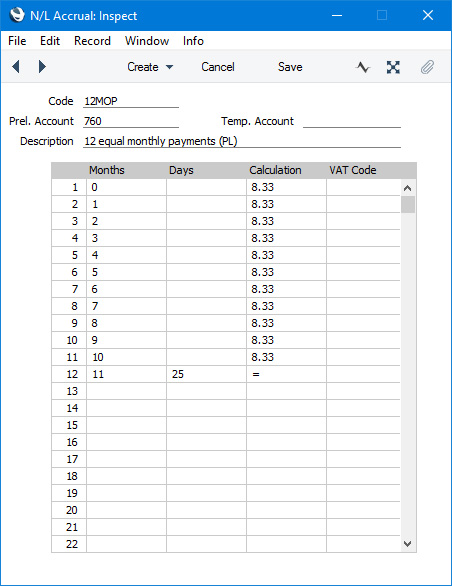

- Code

- Enter the unique Code by which the N/L Accrual record will be identified from elsewhere in Standard ERP. The Code should be one that you have not already used for an Autotransaction.

- Prel. Account

- Paste Special

Account register, Nominal Ledger/System module

- Specify here an Accrual Account, which will usually be a Balance Sheet Account.

- When you specify the N/L Accrual record in a Sales Invoice row, this Account will be credited with the full value of the Invoice row (excluding VAT) in the resulting Nominal Ledger Transaction. You will then gradually move the value out of this Account into the Sales Account by regularly running the 'Generate N/L Accrual Transactions' Maintenance function.

- When you specify the N/L Accrual record in a Purchase Invoice row, this Account will be debited with the full value of the Invoice row (excluding VAT). Again, you will gradually move the value out of this Account into the Purchase Account by regularly running the 'Generate N/L Accrual Transactions' Maintenance function.

- Description

- Enter a name for the N/L Accrual record, to be shown in the 'N/L Accruals: Browse' window and the 'Paste Special' list.

Use the grid to define the formula that is to be used when creating the record in the

Simulation register.

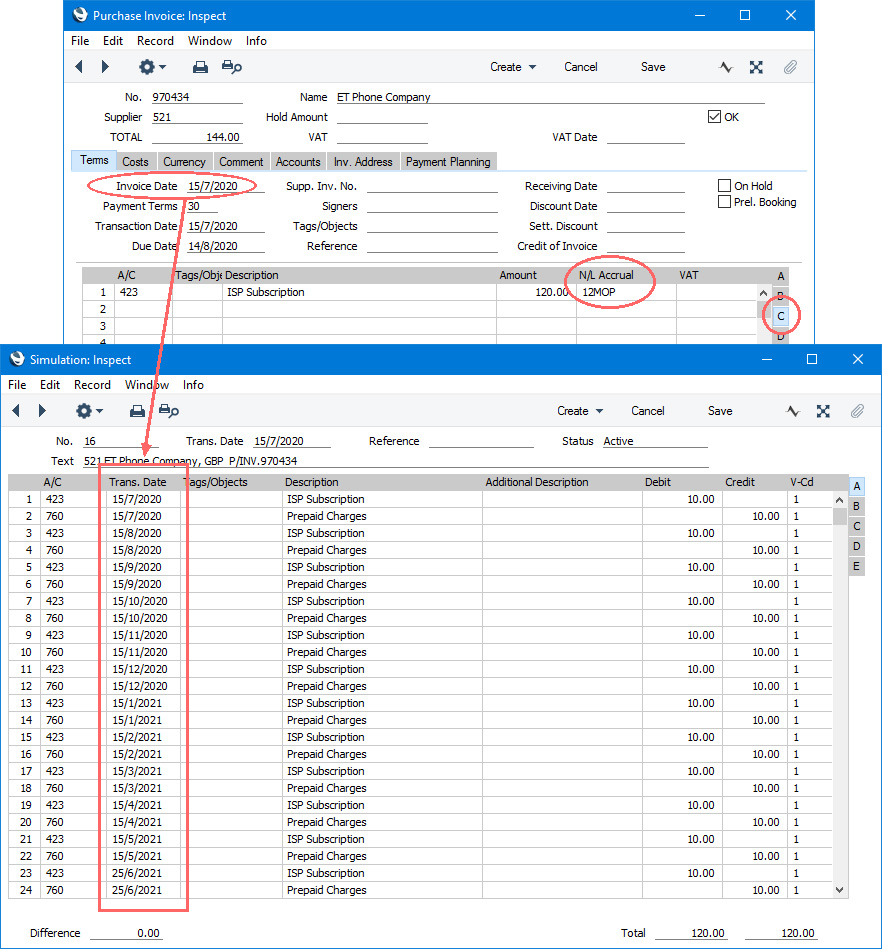

When you use the N/L Accrual record in a Sales or Purchase Invoice row and when you mark that Sales or Purchase Invoice as OK, two records will be created:

- A Nominal Ledger Transaction in which the full value of the row excluding VAT will be posted to the Accrual Account (i.e. to the Prel. Account specified above).

- A Simulation whose contents will be determined by the formula in the matrix in the N/L Accrual record. Each row in the N/L Accrual record will create a pair of balancing rows in the Simulation. Each pair of balancing rows will represent one instalment in the gradual process of moving the value of the Invoice row from the Accrual Account to the Sales or Purchase Account.

- Months, Days

- Use these two columns to specify how the Transaction Date of each balancing pair of debit and credit postings in the Simulation will be calculated. The Transaction Date of a pair of debit and credit postings will be used as follows:

- It will be used as the Date of the Nominal Ledger Transaction that will be created from the pair of postings by the 'Generate N/L Accrual Transactions' Maintenance function.

- When you run the 'Generate N/L Accrual Transactions' Maintenance function, you will specify a period. The function will create Nominal Ledger Transactions from Simulation rows with Transaction Dates that fall within the specified period.

- If the Transaction Date of a pair of debit and credit postings is to be a certain number of months after the Invoice Date, specify that number of months in the Months field. The day in the month will be the same as that of the Invoice Date. If you enter "0", the Transaction Date will be the same as the Invoice Date.

- For example, if you enter "2" in the Months field in a particular row and "2" in the Days field, the Transaction Date will be the 2nd of the month, two months after the Invoice Date.

- Calculation

- Specify here the percentage of the value of the Invoice row that is to be the value of the corresponding pair of debit and credit postings in the Simulation.

- In the last row, you can enter an equal sign (=) in this field to signify that the value of the corresponding pair of postings in the Simulation is to be the remaining value of the Invoice row. This ensures that nothing is lost when reducing the percentage to two decimal places.

- VAT

- Paste Special

VAT Codes setting, Nominal Ledger

- If you enter a VAT Code here, it will be copied to the corresponding pair of debit and credit postings in the Simulation (and, from there, to the Transaction). It will not affect the calculation, but will be used for reporting (e.g. VAT Return).

- If you leave this field empty, the VAT Code will be taken from the Invoice or Purchase Invoice row.

Shown below is a sample Simulation, created from a Purchase Invoice using the N/L Accrual record illustrated above. In this example each pair of balancing rows debits a Purchase Account and credits the Accrual Account with 8.33% of the value of the original Purchase Invoice row, on a monthly basis. The last two rows illustrate the use of the Days field in the N/L Accrual record.

---

Settings in the Nominal Ledger:

Go back to: