Entering a Purchase Invoice - Settlement Discount Examples

A Supplier might issue you with a Purchase Invoice in which they offer you a settlement discount if you pay the Invoice by a specified date. If you receive such a Purchase Invoice, follow these steps:

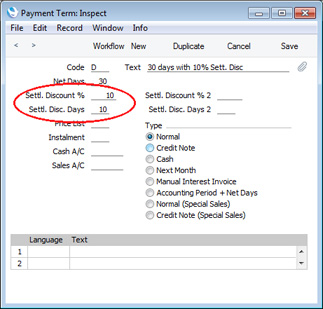

- Create a record in the Payment Terms setting containing the details of the settlement discount. Enter the discount percentage in the Settl. Discount % field and the number of days for which the settlement discount offer is valid in the Settl. Disc Days field:

The Type should be "Normal", and you should also specify the number of Net Days to allow Due Dates to be calculated.

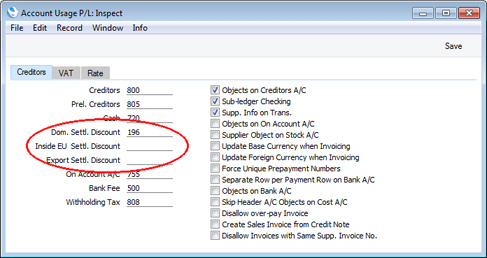

- Specify Settlement Discount Accounts in the Account Usage P/L setting. If necessary, you can enter different Accounts to be used depending on the VAT Zone of the Supplier:

The value of the settlement discount will be credited to the Settlement Discount Account when you pay the Purchase Invoice.

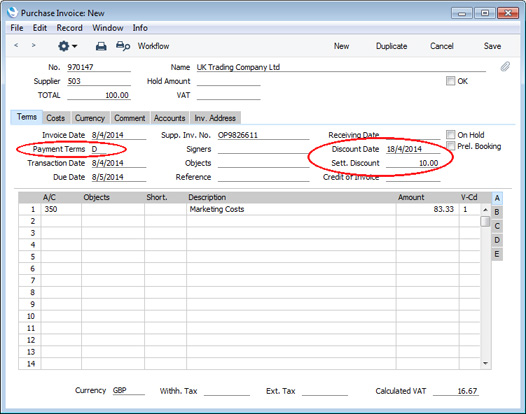

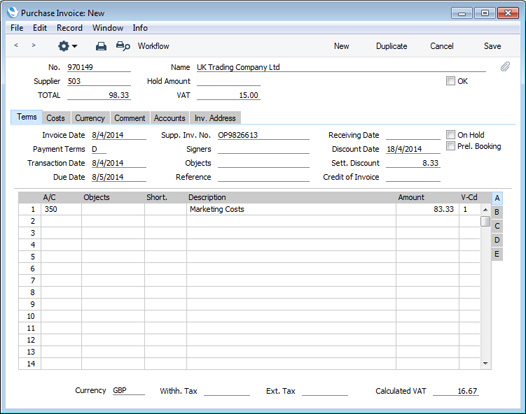

- Enter the Purchase Invoice in the usual way. After you enter the TOTAL and the Payment Term from step 1, the Discount Date and Sett. Discount fields will be filled in automatically:

The settlement discount will be calculated using the formula:

- TOTAL x Settlement Discount %

- Mark the Purchase Invoice as OK and save. The settlement discount will not affect the postings in the Nominal Ledger.

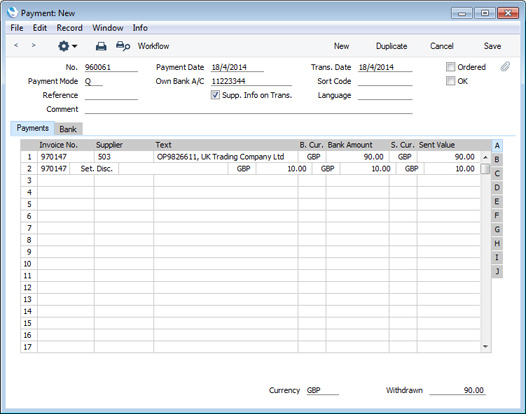

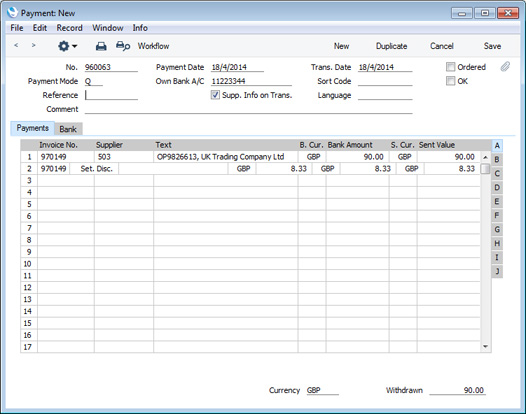

- When you need to pay the Purchase Invoice, create a new record in the Payment register. When you specify the Purchase Invoice Number, an extra row containing the settlement discount will be added to the Payment automatically, providing the Transaction Date is on or before the Discount Date. The Sent and Bank Amount will be changed to the outstanding amount less the settlement discount:

The Payment register is described in more detail here.

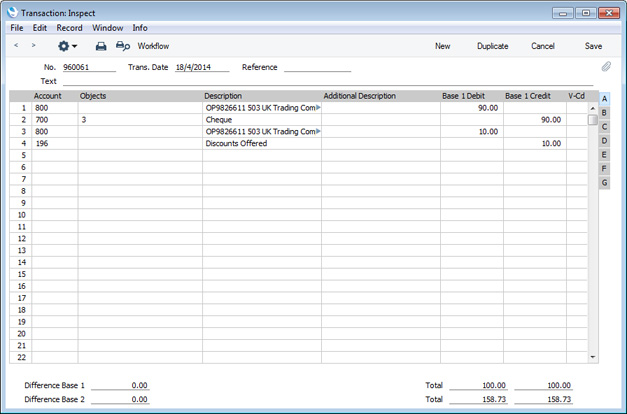

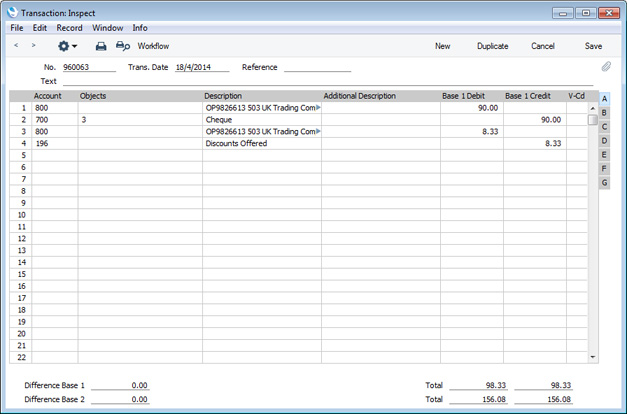

- Mark the Payment as OK and save. In the resulting Nominal Ledger Transaction, the settlement discount will be credited to the Settlement Discount Account that you specified in step 2:

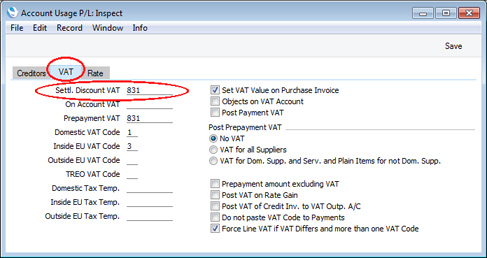

- In some countries, the posting of the settlement discount from the Payment should include a VAT element. If you need such a posting, specify a Settl. Discount VAT Account on the 'VAT' card of the Account Usage P/L setting:

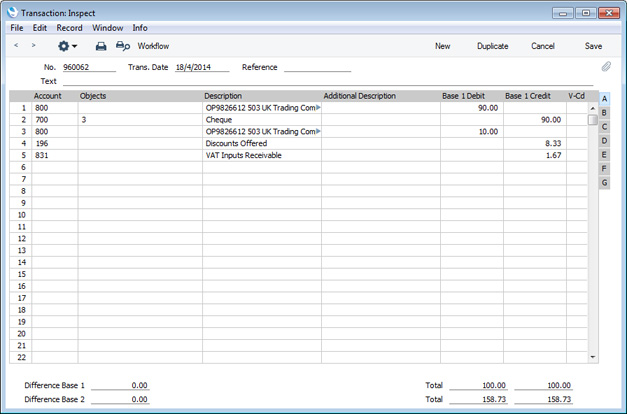

- The existence of a Settl. Discount VAT Account means that the settlement discount less VAT will be credited to the Settlement Discount Account that you specified in step 2, and the VAT element will be credited to the Settlement Discount VAT Account:

The VAT element will be calculated using the following formula (with example figures in brackets):

| Settlement Discount (10.00) * Purchase Invoice VAT Total (16.67) |

| Purchase Invoice Total (including VAT) (100.00) |

The VAT total in this equation will be taken from the VAT field in the header of the Purchase Invoice being paid or, if this is empty, from the Calculated VAT field in the footer of that Purchase Invoice.

- The settlement discount in step 3 was calculated by applying the settlement discount percentage to the Purchase Invoice TOTAL, as follows:

- total row Amounts (83.33) + VAT (16.67) = TOTAL (100.00)

- TOTAL (100.00) * Sett. Discount (10%) = 10.00

In some countries (e.g. the UK), settlement discounts do not include VAT. VAT is therefore calculated on the total of the row Amounts after subtracting the settlement discounts, as follows:

- total row Amounts (83.33) - Sett. Discount (10%) = 75.00

- 75.00 * VAT (20%) = 15.00

- total row Amounts (83.33) + VAT (15.00) = TOTAL (98.33)

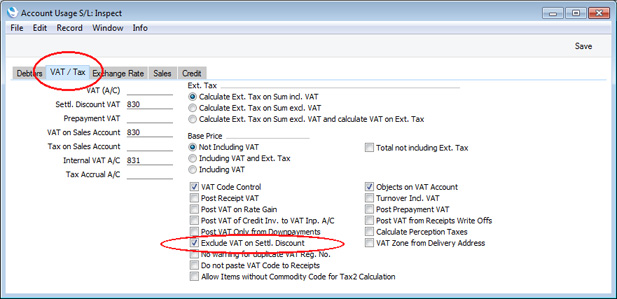

If you are in the UK and receive Purchase Invoices with settlement discounts calculated in this way, you should tick the Exclude VAT on Settl. Discount option on the 'VAT / Tax' card of the Account Usage S/L setting in the Sales Ledger (this option applies to both the Sales and Purchase Ledgers):

You should also remove any Settl. Discount VAT Account from the Account Usage P/L setting so that there is no VAT element in the posting of settlement discount from a Payment (as described in steps 7 and 8 above).

- If you enter a Purchase Invoice with a settlement discount calculated as described in the previous step, the VAT total in the Supplier's Invoice will not be the same as the figure that appears in the Calculated VAT field in the footer. You will need to copy the VAT total from the Supplier's Invoice to the VAT field in the header. This will ensure that the settlement discount is calculated correctly (and also that the correct figure will be posted to the Input VAT Account):

If the Purchase Invoice is one with several rows (possibly with different VAT Codes), you may need to enter the correct VAT figures in each row (in the VAT field on flip C) to ensure the correct amounts are posted to the Input VAT Accounts. This is described in more detail in step 5 of the 'Domestic, Inside EU (Post VAT) and Outside EU (Post VAT) VAT Zones' example on the VAT Examples page.

- When you pay the Purchase Invoice, the settlement discount will be deducted as already described in step 5:

- In the Nominal Ledger Transaction resulting from the Payment, the settlement discount will be credited to the Settlement Discount Account, again as already described. There will be no VAT element as the Settl. Discount VAT Account field in the Account Usage P/L setting should be empty:

---

In this chapter:

Download:

Go back to: