Using Currencies in Payments - Exchange Rates at the Bank

This page describes the posting of bank rate gains and losses from Payments.

---

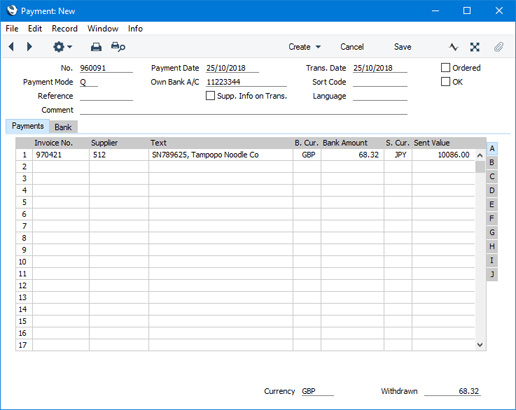

There will be occasions where the exchange rate used by the bank is not the same as the one you are using in Standard ERP. For example, if you receive a Purchase Invoice for JPY 10086 when JPY 147.62190 buys one GBP (Base Currency 1), you expect at the time of Invoice to pay out GBP 68.32. However, when you issue the payment, you discover that the bank will only take 65.00 from your account. When you enter the Invoice Number in a Payment, the Sent Value will default to JPY 10086, and the Bank Amount will default to GBP 68.32:

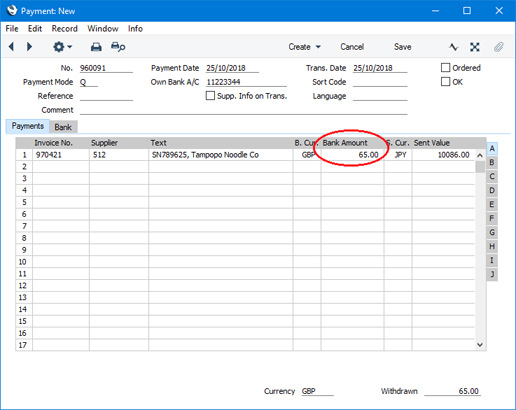

Change the Bank Amount to 65.00 (the Sent Value will remain JPY 10086):

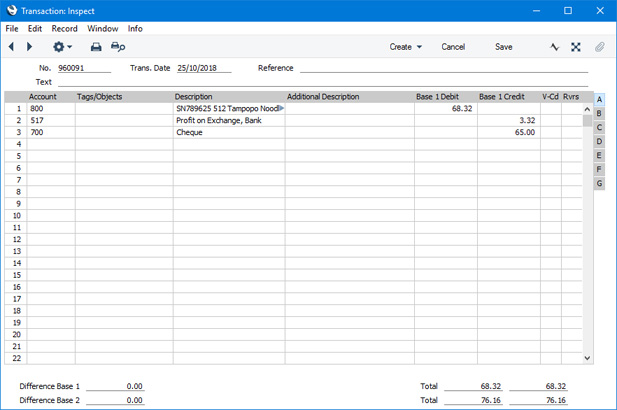

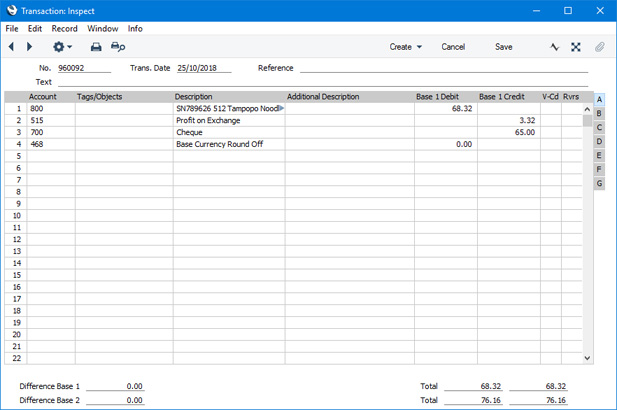

When you mark the Payment as OK and save, the gain of 3.32 will be recorded as a Bank Rate Gain and posted to the Bank Rate Gain Account specified on the

'Rate' card of the Account Usage P/L setting:

It is possible for a payment to generate postings to the Rate Gain or Loss Account and to the Bank Rate Gain or Loss Account. This will occur when there is an exchange rate fluctuation (a change in the exchange rate between the raising of an Invoice and its payment) and when you change the Bank Amount as well.

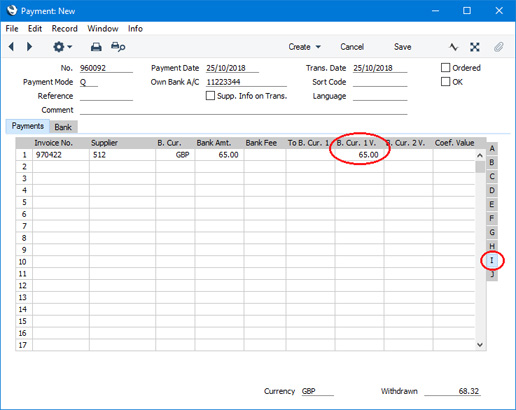

If you don't need to separate gains and losses resulting from bank rate differences from those resulting from exchange rate fluctuations, an alternative method is available. Leave the Bank Amount as 68.32 and enter 65.00 in the B. Cur. 1 V. field on flip I of the Payment:

If you use this method, the resulting Nominal Ledger Transaction will not include a posting to the Bank Rate Gain or Loss Account. Instead, the gain of 3.32 will be posted to the Rate Gain Account:

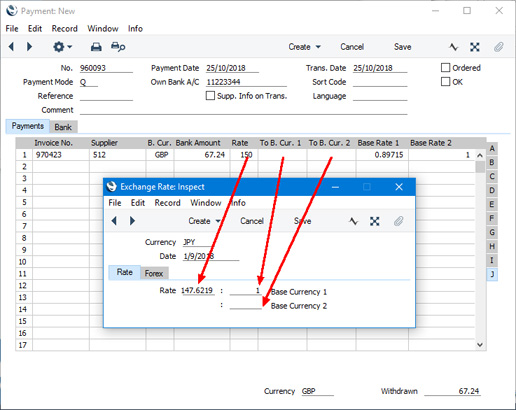

If you don't know the value at the bank (65.00 in this example), but you do know the exchange rate used by the bank, use the fields on flip J to enter that exchange rate. If the Bank Currency is Base Currency 1, this means the exchange rate between the Sent Currency and Base Currency 1. If the Bank Currency is not Base Currency 1, this means the exchange rate between the Bank Currency and Base Currency 1. A calculated value will then be placed in the B. Cur. 1 V. field (and in the Bank Amount field if the Bank Currency is Base Currency 1).

Each of these fields corresponds to one of the fields in the Exchange Rate record, as shown in the illustration below:

If you make an entry in one of these fields, you are effectively overriding the corresponding field in the Exchange Rate record. For example, the Exchange Rate in the illustration states that JPY 147.62190 will buy 1 GBP (Base Currency 1). In the Payment row, 150 has been entered in the Rate field, changing the exchange rate for that row to 150:1 (the To B. Cur. 1 and To B. Cur. 2 fields are blank in the Payment row, signifying that these figures are still to be taken from the corresponding fields in the Exchange Rate record).

As changing the exchange rate will cause a calculated value to be placed in the B. Cur. 1 V. field, the difference between the original Bank Amount and your amended figure will be posted to the Rate Gain or Loss Account (specified on the 'Rate' card of the Account Usage P/L setting).

---

Using Currencies in transactions of various kinds:

Go back to: