Price Variances

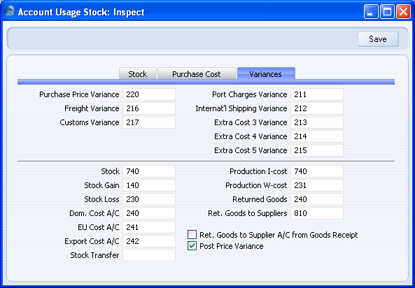

Price Variances can occur when goods are received into stock with estimated values. You may not know at the time of placing a Purchase Order exactly how much the extra costs such as transport, customs duties, port charges, taxes etc. will be: usually this will be when importing goods. In some cases, the exact costs of the goods themselves will not be known. You therefore need to estimate these costs when you issue the Purchase Order. When you receive the goods into stock, you still may not know how much they will be, so the goods will be signed into stock using the estimated figures taken from the Purchase Order. When the Purchase Invoice arrives, there may be differences between the actual prices (on the Invoice) and what you estimated (received into stock and posted to the various Accruals Accounts). Any such differences (Price Variances) between the Purchase Invoice and the Goods Receipt will be posted to Price Variance Accounts, from the Purchase Invoice or from the Goods Receipt, whichever arrives last. These differences will then be shown in the Profit & Loss report together with the cost of goods sold. This feature allows postings to the various Accruals Accounts from the Purchase Invoice and the Goods Receipt to balance, because the Variances are kept separate. Follow these steps to configure the Price Variances feature: - Switch on the Post Price Variance option on the 'Stock' card of the Account Usage Stock setting.

- On the 'Variances' card of the same setting, specify Variance Accounts for Purchase Accruals, Freight, Customs and each of the Extra Costs:

- You can define a separate Purchase Price Variance Account in an Item Group record, if the Item Group is not to use the default set in step 2 above. You must also check the Use Item Groups for Cost Accounts option in the Cost Accounting setting if you want to use the Variance Accounts in Item Groups.

- Switch on the Transfer Each Item Separately option in the Purchase Invoice Settings setting in the Purchase Ledger. Do not switch on the Always use Full Qty from Purch. Ord. option in the same setting.

- If you need to account for Variances in Customs, Freight and the other Extra Costs, switch on the Extra Costs Invoices from Different Suppliers option in the Purchase Order Settings setting. If you do not switch on this option, you will only be able to account for Variances in Item prices.

- If it is likely that you will need to enter Purchase Invoices before you have received any goods, switch on the Purchase Invoices before Goods Receipt option in the Stock Settings setting. This will cause the Invoice before Goods Receipt box to be checked by default in new Purchase Orders. If you are not using the Purchase Invoices before Goods Receipt option, you can switch on the Invoice before Goods Receipt option in individual Purchase Orders if necessary.

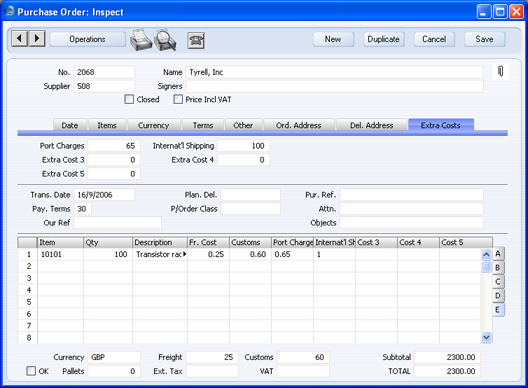

Having completed the configuration work described above, you can now use the Price Variances feature, as follows: - Start by entering a Purchase Order in the normal way. If you do not know the costs of the Item, Freight, Customs and/or any of the Extra Costs, you will need to estimate them so that you can print and issue the Purchase Order. Note that the Freight, Customs and Extra Costs are not included in the Purchase Order total, because it is possible that these will not be paid to the Supplier quoted in the Purchase Order but to a transport company or government revenue department.

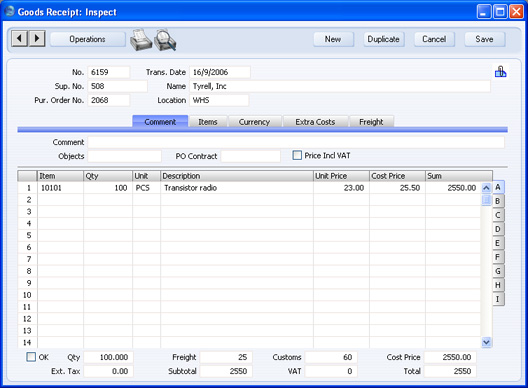

- When the goods arrive, open the Purchase Order and select 'Create Goods Receipt' from the Operations menu. All prices will be copied from the Purchase Order to the Goods Receipt, and this time they are included in the total. Usually, the documentation accompanying the goods will not contain any pricing information, and warehouse staff may only be able to enter quantities and not prices. However, if the pricing information is known, you can update the figures in the Goods Receipt if necessary.

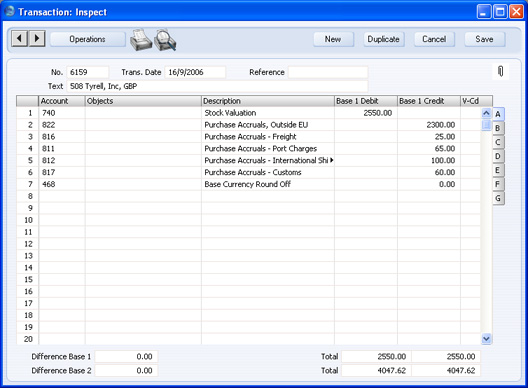

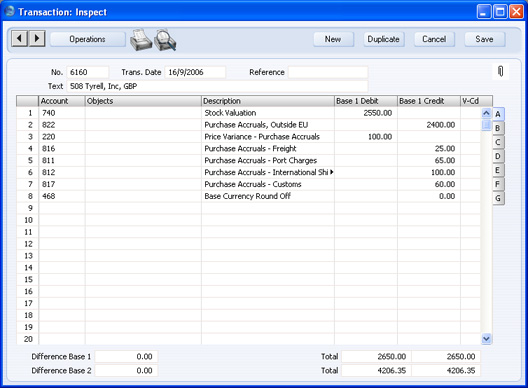

- When you approve and save the Goods Receipt, a Nominal Ledger Transaction will be created, debiting the Stock Account and crediting the appropriate Accrual Accounts (in the example, the Purchase, Customs, Freight and Extra Cost 1 and 2 Accrual Accounts) as normal:

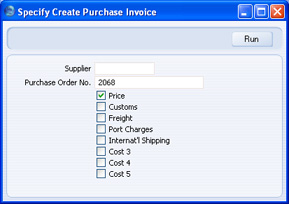

The posting to the Stock Account includes the Extra Costs. When the Item is sold the value of the Cost of Sales posting will include the Extra Costs if your Cost Model is Weighted Average, FIFO or LIFO (or Cost Price, if that is being updated automatically to the Weighted Average or Last Purchase Cost). - When the Purchase Invoice arrives, return to the Purchase Order and select 'Create Purchase Invoice' from the Operations menu. Because you are using the Extra Costs Invoices from Different Suppliers option in the Purchase Order Settings setting, the Purchase Invoice is not created immediately. Instead, the following dialogue box opens:

Proceed as follows, depending on what has been included in the paper Purchase Invoice:- If the Purchase Invoice includes the Item(s) on the Purchase Order, leave the Supplier field empty (the Supplier will be taken from the Purchase Order). If the Invoice includes any of the Extra Costs as well, leave the Price box checked and check other boxes as appropriate. Then, click the [Run] button.

- If the Purchase Invoice does not include the Item(s) on the Purchase Order (i.e. it is for one or more of the Extra Costs only), specify the Supplier using 'Paste Special', specify the Extra Costs boxes as appropriate, remove the check from the Price box and click the [Run] button.

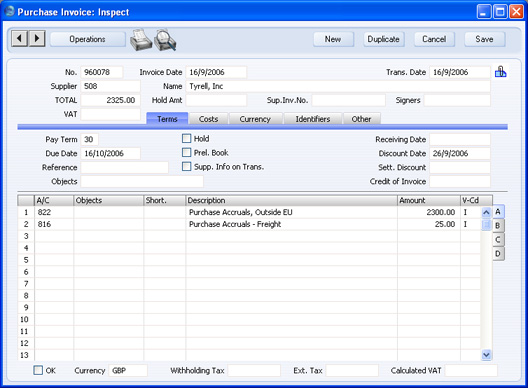

Since it is possible that you will receive separate Invoices for the Item(s) and the Extra Costs, you can return to the Purchase Order to create the various Invoices at any time. You will not be able to create more than one Invoice for the Item(s). The example illustrated below shows an Invoice for the Items and the Freight:

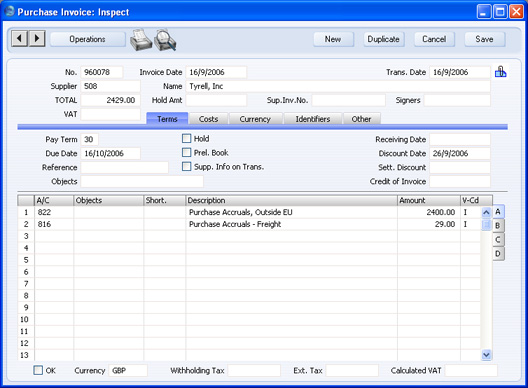

The values of the Item and of the Freight are taken from the Purchase Order. The Purchase Accruals Account for the Item is chosen in the usual way for the Transfer Each Item Separately option (please refer to the description of the 'Create Purchase Invoice' function for details). The Freight Accruals Account is taken from the 'Account Usage Stock' setting. - If the amounts on the printed Purchase Invoice are different to the defaults, change them as necessary:

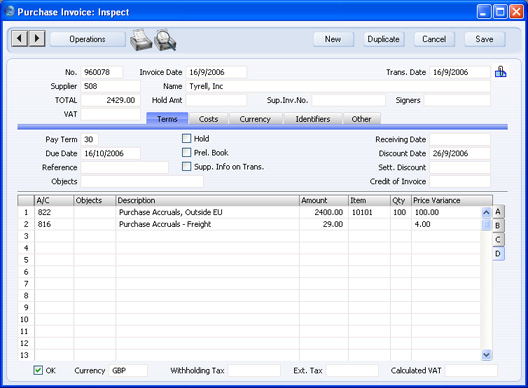

- When the Invoice is correct, approve it in the usual way. The differences between the Goods Receipt and Purchase Invoice amounts will be copied to the Price Variance field on flip D (so, if you made any changes to the figures in the Goods Receipt in step 2, they will be included in the Variance figures):

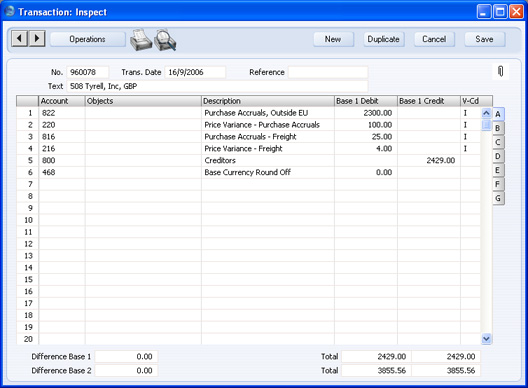

In the resulting Nominal Ledger Transaction, the Variance amount for the Item will be posted to the Purchase Price Variance Account specified in the Item Group to which the Item belongs, if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting. If you are not using this option, the Item does not belong to an Item Group, and/or the Item Group does not have its own Variance Account, the Purchase Price Variance Account in the Account Usage Stock setting will be used. The Variance amounts for the Extra Costs will be posted to the appropriate Variance Accounts specified in the Account Usage Stock setting:

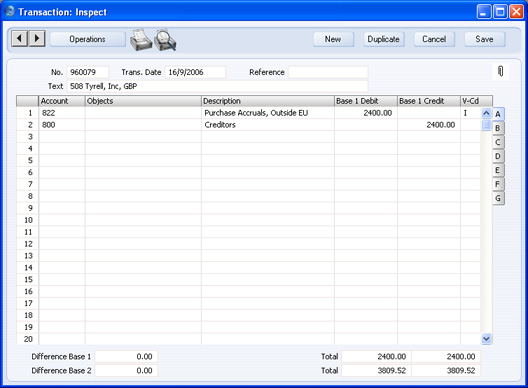

Thus, in the example the Goods Receipt credited 1000 to the Purchase Accruals Account, and the Purchase Invoice balanced this by debiting the same amount. If you were not using the Price Variance feature, the Purchase Invoice would debit 1100 to the Purchase Accruals Account, creating an imbalance of 100 that you would have to adjust manually. - In some cases, you may receive the Purchase Invoice before you receive the goods. In this case, switch on the Invoice before Goods Receipt option on the 'Terms' card of the Purchase Order. It will be switched on by default if you are using the Purchase Invoices before Goods Receipt option in the Stock Settings setting. This will allow you to create the Purchase Invoice from the Purchase Order as normal but before the receipt of any goods. The figures on the Purchase Invoice will be copied from the Purchase Order as before, and you can change them if necessary. The resulting Nominal Ledger Transaction will not contain any postings to the Variance Accounts:

When the goods arrive, open the Purchase Order and select 'Create Goods Receipt' from the Operations menu. Again, all prices will therefore be copied from the Purchase Order to the Goods Receipt. Usually, the documentation accompanying the goods will not contain any pricing information, and warehouse staff may only be able to enter quantities and not prices. However, you can change the figures if necessary. When you approve the Goods Receipt, the resulting Nominal Ledger Transaction will contain postings to the appropriate Variance Accounts. The second Transaction (from the Goods Receipt in this case, from the Purchase Invoice in the first example) will always contain the Variance postings:

- If you need to return an Item to its Supplier, create a record in the Returned Goods to Supplier register in the usual way. When the time comes to enter the Credit Note, you must do so from the Returned Goods to Supplier window (by selecting Create Credit Note' from the Operations menu). If there is a difference in the value of the returned Item between the Returned Goods to Supplier record and the Credit Note, this will be posted as a Variance.

|