Introduction to the Account Reconciliation Register

You will most commonly use this register to perform bank reconciliations, checking bank statements against the bank account Transactions recorded in your HansaWorld Enterprise database. To carry out this task, follow these steps:

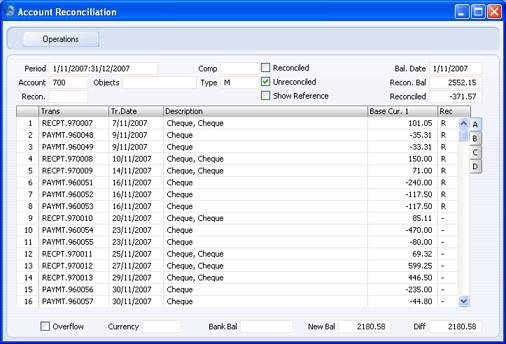

- Click the [Account Reconciliation] button in the Master Control panel. The 'Account Reconciliation' window is opened.

- Enter a Period, using 'Paste Special' if necessary to access a list of reporting periods. The Period should be large enough to cover all likely journal postings (Transaction rows) to the Bank Account.

- Enter the Account Number representing your bank account. If necessary, specify an Object as well.

- Click the Unreconciled check box. All unreconciled postings with the specified Account/Object combination will be listed. The figure in the Recon. Bal field shows the balance previously reconciled and should equal the opening balance in the bank statement.

If you have entered a Company and/or a Transaction Type, only those postings for the specified Account with that Company/Transaction Type combination (on flip E of the Transaction screen) will be listed.

If the number of unreconciled postings is greater than 300, the Overflow box at the bottom of the window will be marked automatically. If this happens, enter a shorter Period to reduce the number of postings in the list.

The list is in chronological order. Select 'Sort on amount' from the Operations menu to sort the list by amount (largest first).

The Description column shows both the Text from the Transaction header and the Description from the Transaction row representing the posting, separated by a comma. If you want it to show the Reference from the Transaction header instead, check the Show Reference box before checking the Unreconciled and/or Reconciled boxes. If you check the Show Reference box afterwards, the list will not be redrawn.

Flip A shows posting values in Base Currency 1 (usually your home Currency). If your bank statement is in another Currency, use flip B (which shows posting values in Base Currency 2) or flip C (which shows values in any foreign Currency that may have been used in a posting).

- Compare the list of postings with the bank statement. Where a posting is correctly shown on the statement, enter an "R" to the Rec field. The posting value will be added to the Reconciled total, which shows the total reconciled in this session, and to the New Bal figure, which represents the closing balance for the Account. If the Account is a Currency Account, the Reconciled and New Bal figures will be in Currency.

If the list of unreconciled postings is long, use the 'Search' function on the Operations menu to help locate each posting. You can also use the 'Account Reconciliation' function on the same menu to print an Account Reconciliation report, if you prefer to work from paper.

If you know that you can reconcile every posting in the list, select 'Mark all rows as Reconciled' from the Operations menu. An "R" will be placed in the Rec field in every row and the Reconciled and New Bal figures will be updated appropriately.

You can enter the closing balance in the bank statement in the Bank Bal field in the bottom of the window. The Diff field will show the difference between the Bank Bal and the New Bal.

If you enter a Currency in the Currency field in the bottom of the window, the Recon. Bal, the New Bal and the Diff will be calculated from postings made to the specified Account in the specified Currency only.

- If a posting appears in the bank statement but not in the list of unreconciled postings, you should add the posting to the Transaction register. Examples of such postings might be payments into or out of your account by standing order, or bank charges.

You can do this without closing the 'Account Reconciliation' window by selecting 'Create N/L Transaction' from the Operations menu. Enter the Transaction following the usual procedure described here. When you have saved it, return to the 'Account Reconciliation' window and select 'Update' from the Operations menu. Any postings to the specified Account in the new Transaction will be added to the list of unreconciled postings.

- If the value of a posting shown in the 'Account Reconciliation' list differs from that shown in the bank statement, you should use the 'Create N/L Transaction' function to enter a correcting Transaction to the Transaction register. Alternatively, place the cursor in the Account Reconciliation row containing the erroneous posting, select 'Open N/L Transaction' from the Operations menu to open and update the Transaction. Refer to the Correcting Transactions' for full details of correcting and updating Transactions. When you have done this, return to the 'Account Reconciliation' window, select 'Update' from the Operations menu and mark both the original posting and the correction as reconciled.

- You can assign an arbitrary code to the postings reconciled on a particular day or from a particular statement so that you can identify them later. Enter the code in the Recon. field on flip D.

- If you enter a Recon. Code in the Recon. field in the header before checking the Unreconciled box, the Code will be applied to all postings automatically (it will only be saved for postings that you go on to reconcile). If you enter a Recon. Code in the Recon. field in the header before checking the Reconciled box, only those postings with the Recon. Code will be included in the list.

If the list includes Reconciled Transactions, you can sort it by Recon. Code by selecting 'Sort on Recon. Code' from the Operations menu. The sort order will be descending, so Transactions without Recon. Codes will be at the end of the list.

You can use the Reconciliation Descriptions setting to attach longer descriptions to your Recon. Codes. If you are using this setting, you can use 'Paste Special' from the header and from flip D to choose the correct Recon. Code. You can have these longer descriptions printed in the .

- When you have checked the postings in the list agree with the bank statement and marked them with "R" in the Rec field, the figure in the New Bal field should be the same as the closing balance in the bank statement. If you entered the closing balance in the bank statement in the Bank Bal field, the Diff field should contain zero.

Note that you have not saved anything yet and closing the window now will cause you to lose the reconciliation information you have entered in this session. To save this information, select 'Confirm Reconciliation' from the Operations menu before closing the 'Account Reconciliation' window by clicking the close box.

! | Closing the 'Account Reconciliation' window without having selected 'Confirm Reconciliation' will lose all changes made. |

|

- The Nominal Ledger contains two reports that you can use to help with the task of reconciling the bank statement.

The Account Reconciliation report is essentially a print-out of the postings listed in the 'Account Reconciliation' window. You can use this report if you prefer to compare a paper print-out with the bank statement.

The Bank Reconciliation report will take the closing balance from your last bank statement and calculate a new balance, taking all unreconciled postings into account. This new balance should be the same as the current balance for the Bank Account in your database. If the two balances are different, the probable reason is that there is still at least one unreconciled posting that you can reconcile with the bank statement.

In order to ease the task of bank reconciliation, it is recommended that, in the Purchase Ledger, you enter separate Payment records to represent each cheque issued and, in the Sales Ledger, you enter a single Receipt record recording every cheque paid into the bank on a single paying-in slip. This will ensure that single Transactions will match single lines on the bank statement.

You should also think about the Separate Row per Customer on Bank A/C check box in the Account Usage S/L setting, and the equivalent Separate Row per Payment Row on Bank A/C check box in the Account Usage P/L setting. If these check boxes are off, when you enter a Receipt or Payment with several rows, the resulting Nominal Ledger Transaction will contain a single posting to the Bank Account. If these check boxes are on, such Transactions will contain separate postings to the Bank Account for each Receipt or Payment row. The Description in each posting will show the Invoice Number and Customer Name (or Purchase Invoice Number and Supplier Name), so you should use these options if you want this information to appear in the Account Reconciliation register and report.