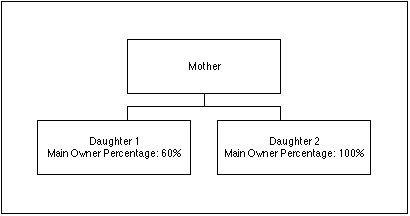

Holding Company with two Subsidiaries

This example has the following company structure:

For simplicity and clarity, a single Transaction will be entered to each Company. This is the Transaction in the Mother Company:

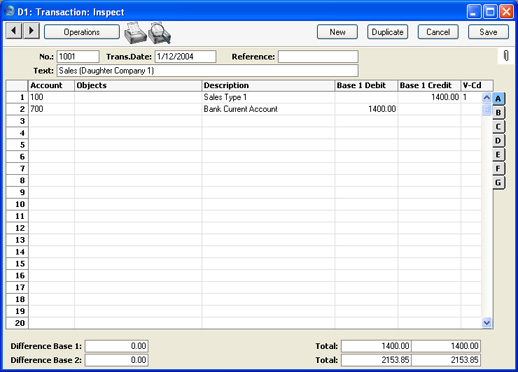

A similar Transaction is entered in the first Daughter Company:

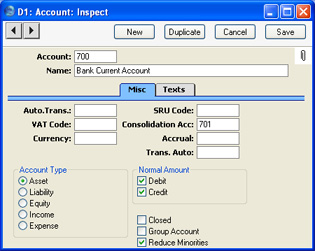

We have used the same Accounts in both Transactions, but in the Account records in the Daughter Company we have specified Consolidation Accounts:

This means that the Bank Accounts of the Mother and Daughter Companies will be separated when producing a consolidated Balance Sheet from the Mother Company. The Bank Account of the Daughter Company will be shown as 701, while that of the Mother Company will be shown as 700 as normal. Account 701 does not have to exist in the Daughter Company, but it must exist in the Mother Company. If it does not, the balance of the Daughter's Bank Account will not be included in consolidated reports.

In the Main Owner Percentage register of the Daughter Company, we specified that it was 60% owned by the Mother Company. As the Reduce Minorities box is checked, this means that 60% of the balance of the Daughter Company's Bank Account will be shown in consolidated reports produced from the Mother Company. However, for the purposes of the example, the Reduce Minorities box in the Sales Account (Account 100) in the Daughter Company is not checked. This means that the full balance of the Daughter Company's Sales Account will be shown in consolidated reports.

This is the Transaction entered in the second Daughter Company:

Now we produce a Balance Sheet Report from the Consolidation module in the Mother Company. The Include Daughter Companies box in the 'Specify Balance Sheet' window is not checked, so the balance on the Bank Account is calculated from the Mother Company's own Transaction only:

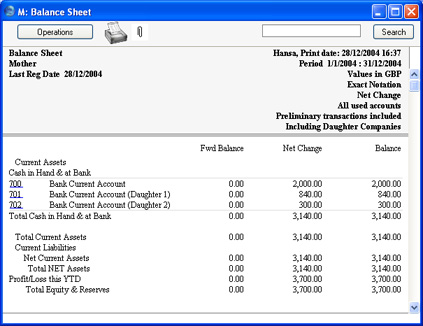

When the Include Daughter Companies box in the 'Specify Balance Sheet' window is checked, the balance on the Bank Account is calculated from Transactions in all three Companies. For clarity, we have shown each Company's Bank Account separately (by specifying Consolidation Accounts in the Bank Accounts of both Daughter Companies, as described above):

The Net Change is calculated as follows:

| 2,000.00 | | from M |

| + | 1,400.00 | x 60% | from D1 (60% owned by M) |

| + | 300.00 | | from D2 |

| 3,140.00 | | |

The figure for Total Net Assets is different to that for Profit/Loss this YTD because the Reduce Minorities box is checked for the Bank Account in the first Daughter Company but not for the Sales Account. So, the Total Net Assets figure includes 60% of the first Daughter Company's Bank Account, but the Profit/Loss this YTD includes 100% of its Sales Account.

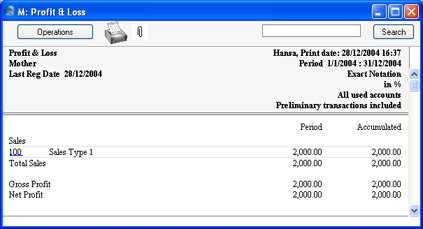

Next we produce a Profit & Loss Report from the Consolidation module in the Mother Company. The Include Daughter Companies box in the 'Specify Profit & Loss Report' window is not checked, so the balance on the Sales Account is calculated from the Mother Company's own Transaction only:

When the Include Daughter Companies box in the 'Specify Profit & Loss Report' window is checked, the balance on the Sales Account is calculated from Transactions in all three Companies. Again, for clarity, we have shown each Company's Sales Account separately:

As mentioned above, the Reduce Minorities box is not checked for the Sales Account in the first Daughter Company, so the report shows 100% from all Companies.