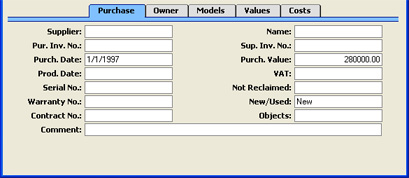

- Flik Inköp

- Supplier

- Paste Special

Suppliers in Customer register

- The Supplier from whom the Asset was purchased: enter the Supplier Number or use the 'Paste Special' function. When you press Return, the Supplier's name will be entered into the field to the right. In the case of an Asset created from a Purchase Invoice, this will be taken from the Supplier field of the Purchase Invoice.

- Name

- The Supplier's Name is entered by Hansa after you have entered the Supplier Number.

- Pur. Inv. No.

- The number of the Invoice representing the purchase of the Asset, as recorded in your Purchase Ledger. In the case of an Asset created from a Purchase Invoice, this will be taken from the Purchase Invoice.

- Sup. Inv. No.

- The Supplier's number of the Invoice representing the purchase of the Asset. In the case of an Asset created from a Purchase Invoice, this will be taken from the Sup. Inv. No. field of the Purchase Invoice.

- Purch. Date

- Paste Special

Choose date

- The date the Asset was purchased. In the case of an Asset created from a Purchase Invoice, this will be taken from the Purchase Invoice Date.

- This date should agree with the Transaction Date used in the Nominal Ledger Transaction representing the purchase of this Asset.

- Purch. Value

- The purchase price of the Asset, excluding VAT. In the case of an Asset created from a Purchase Invoice, this will be taken from the Amount field of the Purchase Invoice row.

- Hansa will use the value in this field as the basis for the depreciation calculation when it is calculated using the Depreciation Model 1 specified on the 'Models' card. The first Depreciation Model will not calculate depreciation if this field is blank (unless you choose to use the Fiscal Value on the 'Values' card to calculate depreciation). You can specify a separate Purch. Value 2 on the 'Models' card for use with Depreciation Model 2.

- If you purchased the Asset before you started using Hansa to calculate depreciation, you should still record the original purchase price here, and you should enter the depreciation from the pre-Hansa period to the Init. Depr field on the 'Models' card. If you are using a Declining Balance Depreciation Model, Hansa will subtract the Initial Depreciation from the Purchase Value and use the result (the net book value) as the basis for the depreciation calculation. If you are using a Straight Line Model, the original purchase price will be used as the basis for the depreciation calculation.

- If you need to change the basis for the depreciation calculation, do not make the change here, but use the Revaluation register instead. This will ensure an accurate history is maintained for the Asset and that depreciation continues to be calculated accurately.

- If the Quantity on the 'Owner' card is greater than one, this field should contain a figure for the Purchase Value per unit, not the total Purchase Value. Please refer to the description of the Quantity field on the 'Owner' card for details about how its relationship to the Purchase Value and therefore its role in calculating depreciation changed in Hansa version 4.2.

- Prod Date

- Paste Special

Choose date

- If the Asset was one produced by your company, enter its production date here. It is advisable to enter this date in the Purchase Date field above as well, because you can use the Purchase Date as a search criterion in some reports.

- VAT

- The VAT charged on the purchase price of the Asset. In the case of an Asset created from a Purchase Invoice, this will be calculated using the Amount and VAT Code fields of the Purchase Invoice row.

- Serial No.

- Enter the Serial Number of the Asset if it has one.

- Not Reclaimed

- This field can be used in Portugal, where the VAT paid when purchasing an Asset is sometimes not reclaimable (e.g. if the Asset is a car). If the VAT has not been reclaimed for the Asset, enter the amount of VAT here. This figure is for information only, and will be shown in the Asset History - Portugal report.

- Warranty No.

- If the Asset is subject to a warranty agreement, record the number of the agreement here.

- New/Used

- Paste Special

Choices of possible entries

- Specify here whether the Asset was New or Used when it was purchased. The Portuguese Fiscal Year Depreciation and Fiscal Year Revaluations reports have separate sections for New and Used Assets.

- The third choice in the 'Paste Special' list, Repaired, is used for spare parts that are to be treated as Assets. For example, if you fit a new hard disk to a computer (an existing Asset), you should enter the hard disk as a Repaired Asset and you should record the Inventory Number of the computer in the Part Of field on the 'Owner' card. The hard disk will appear on the line above the computer in the Portuguese Fiscal Year Depreciation and Fiscal Year Revaluations reports.

- Contract No., Subsidy Value

- This field is used together with the Subsidy Value on the 'Values' card in certain countries (e.g. Portugal) when the Asset was purchased with the help of a subsidy from the European Union. These fields record the number of the EU contract authorising the subsidy, and the value of the subsidy.

- The Subsidy Assets report lists Assets with a Subsidy Value, showing the depreciation of the Asset and of the subsidy. In countries such as Portugal, depreciation of a subsidy is treated as income. You should enter a Nominal Ledger Transaction manually to record this income, using the figures shown in the report.

- Objects

- Paste Special

Object register, Nominal Ledger/System module

- Default taken from Purchase Invoice, Asset Category

- If the Asset belongs to a certain Object in your accounts, and if its depreciation is to be charged against this Object, then enter the Object Code here. You can enter several Objects, separated by commas.

- You can also assign Objects to Asset Classes; any Objects that you specify for this Asset will be in addition to those specified for the Asset Class.

- In any Nominal Ledger Transactions representing the depreciation of this Asset, any Objects specified here and in the Asset Class (Obj. field) will be assigned both to the credit posting to the Depreciation Account and to the debit posting to the Cost Account.

- Comment

- Any comment.

|