Operations Menu - Create NL Simulation

In some countries, it is necessary to record the change in value of an Asset in the Nominal Ledger. This function will create a Nominal Ledger Simulation for this purpose. Once you have checked and finalised this Simulation, you can convert it into a Transaction using the

'Transactions' function on the Operations menu of the 'Simulations: Browse' window.

You can only create one Simulation from a Revaluation. If a Simulation is not created, the probable causes are:

- You have already created a Simulation from the Revaluation.

- The Asset does not belong to an Asset Category, the Category does not belong to an Asset Class or the Asset Class has no Asset 1 Account.

- You have not specified a Capital Investment Account in the Account Usage Assets setting.

- There is no valid record in the Number Series - Simulations setting (in the Nominal Ledger). This problem will usually occur at the beginning of a new year.

- The operation of this function depends on the VAT Law in the Company Info setting in the System module. If the VAT Law is "Default" or "Russian", the function will create Simulations as described below. If the VAT Law is anything else, the function will have no effect.

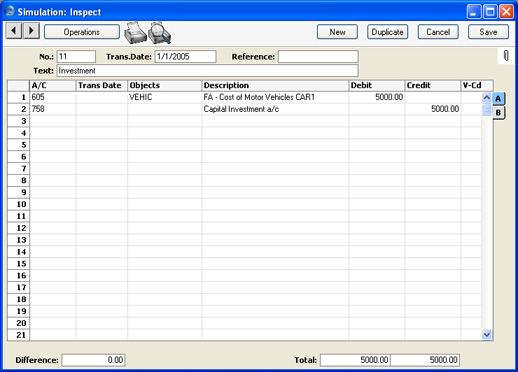

A sample Simulation created by this function when the VAT Law is "Russian" is shown below. The increase in value of the Asset represented by the Revaluation (compared to the Starting Value 1 in the most recent previous Revaluation or to the Purchase Value of the Asset if there is no previous Revaluation), is debited to the Asset Account specified in the

Asset Class and credited to the Capital Investment Account specified in the

Account Usage Assets setting. If the Asset has decreased in value, the postings are reversed. The Objects come from the

Asset Class (Obj. field) and the

Asset itself. The Date is the Transaction Date from the Revaluation. The Inventory Number of the Asset is added to the name of the Asset Account in the Description field in the appropriate row.

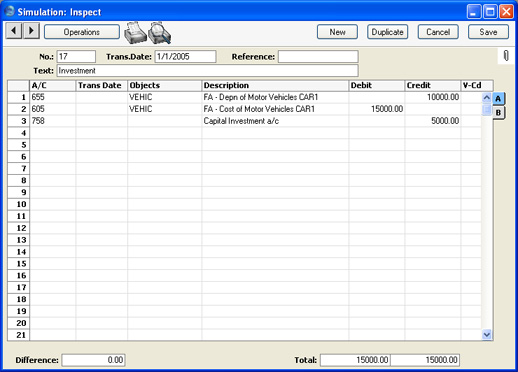

If the VAT Law is "Default", the Simulation is as follows:

In this Simulation, the previous depreciation of the Asset is credited to the Depreciation Account specified in the

Asset Class, and the increase in value represented by the Revaluation (compared to the Purchase Value of the Asset) is credited to the Capital Investment Account specified in the

Account Usage Assets setting. The increase in value represented by the Revaluation (compared to the net book value of the Asset at the time of the Revaluation) is debited to the Asset Account specified in the Asset Class. The Objects come from the Asset Class (Obj. field) and the

Asset itself. The Date is the Transaction Date from the Revaluation. The Inventory Number of the Asset is added to the names of the Asset and Depreciation Accounts in the Descriptions field in the appropriate rows.