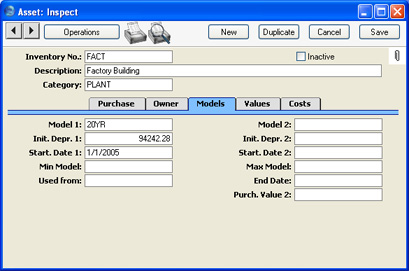

- Flik Modeller

Use this card to determine how depreciation is to be calculated for this Asset. Specify here the date from which depreciation calculations are to be made and the calculation model(s) to be used. These calculations are made using the

'Create Depreciation Simulations' Maintenance function. The calculations are based on the Purchase Value (on the

'Purchase' card), with an option to use the Fiscal Value on the

'Values' card instead. If you need to change the figure that is the basis for the depreciation calculation at any time, use the

Revaluation register.

For example, you have an Asset that was purchased on 1 January 2003 for 50,000. It is to be depreciated by 5% p.a. using a Declining Balance model. You will use Hansa to calculate its depreciation from 1 January 2004, when its Value was 47,500. Enter "1/1/2004" to the Start. Date field, "50,000" to the Purchase Value field on the 'Purchase' card and "2,500" to the Initial Depreciation field. Use the 'Create Depreciation Simulations' Maintenance function to calculate the depreciation for 2004. This function does not update anything in the Asset record: when you run the function again at the end of 2005, it will effectively calculate depreciation for both 2004 and 2005 to arrive at the figure for 2005.

Please refer to the page describing the 'Create Depreciation Simulations' Maintenance function for more details about how depreciation is calculated, together with examples.

- Model 1, Model 2

- Paste Special

Depreciation Models setting, Assets module

- Default taken from Asset Category

- The Depreciation Model contains the annual percentage by which depreciation is to be calculated, and specifies whether a Straight Line or Declining Balance calculation method is to be used.

- Hansa allows two alternative depreciation models for each Asset. All reports and depreciation calculation functions offer you the choice of using either Model. The first Depreciation Model will calculate depreciation using the Init. Depr. 1 and the Start. Date 1 (both below) and the Purch. Value on the 'Purchase' card or the Fiscal Value on the 'Values' card. The second Depreciation Model will calculate depreciation using the Init. Depr. 2 and the Start. Date 2 (both below) and the Purch. Value 2 (below) or the Fiscal Value on the 'Values' card. If there is no Purch. Value 2, the second Model will use the Purch. Value on the 'Purchase' card.

- If you need to change either Depreciation Model, do not do so here. Use the Revaluation register: this will ensure an accurate history is maintained for the Asset and that depreciation continues to be calculated accurately.

- Init. Depr. 1, Init. Depr. 2

- If some of the value of the Asset is to be depreciated immediately, enter that portion here.

- One common reason for using this field will be for an Asset purchased before the Start Date (below), in which case the depreciation prior to that date should be recorded here.

- For example, an Asset was purchased for 1000.00. Enter 1000.00 as the Purchase Value on the 'Purchase' card. It was depreciated by 200.00 before the Start Date, so enter 200.00 in the Init. Depr. field. This 200.00 depreciation is not posted to the Nominal Ledger, as it is assumed this was done in your previous system. When you calculate depreciation using a Declining Balance Model, the basis for the depreciation calculation is taken to be 1000.00 - 200.00 = 800.00. If the Depreciation Model is Straight Line, the basis for the depreciation calculation is the original Purchase Value, but the Initial Depreciation is taken into account when calculating the net book value of the Asset at the end of the depreciation period.

- If the Quantity on the 'Owner' card is greater than one, this field should contain a figure for the Initial Depreciation per unit, not the total Initial Depreciation.

- Start. Date 1, Start. Date 2

- Paste Special

Choose date

- Enter the date on which the depreciation calculation is to start. Depreciation will not be calculated if the Start Date for the selected Depreciation Model is blank.

- When new Assets are purchased, this date is normally the first day of the month in which the Asset was acquired. This is the default, calculated from the Purchase Date on the 'Purchase' card when you enter the Depreciation Model. Check however with the local legislation: in some countries, the date used is the first day of the financial year.

- For existing Assets, enter the date when you start using the Assets module to carry out depreciation calculations.

- If the date that you enter is not the first day of a month, it will usually be treated as such. If the Asset uses a Declining Balance Depreciation Model, the shortest period for which depreciation can be calculated is one month, and this period must start on the first day of a month. The day is only relevant if a Straight Line Depreciation Model is used and if depreciation is to be calculated per day.

- In some countries, it is necessary to create a Nominal Ledger Transaction when an Asset is put into use (i.e. before depreciation calculations can begin). You can do this using the 'Create Put in use Transaction' Operations menu function, and the ('Create Put in use Transactions' Maintenance function. These functions will only create Transactions for Assets whose Start Date 1 is blank. They will also copy the date of the Transaction to both Start Date fields, so depreciation can then be calculated.

- Min Model, Max Model

- Paste Special

Depreciation Models setting, Assets module

- Default taken from Asset Category

- These fields are used in Portugal. Please refer to the description of the Minimum and Maximum Model fields in the Asset Categories setting for details.

- Used from

- Paste Special

Choose date

- Enter the date when your company started using the Asset, if this is different to the Start Date above. This date has no effect on the calculation of depreciation, but it will be shown in the Asset History - Portugal report.

- The Start Date 1 is copied to this field as the default when you enter the Depreciation Model.

- End Date

- Paste Special

Choose date

- Enter the date when your company stopped using the Asset. This is for information only: this date will appear in the Asset History - Portugal report.

- Depreciation will still be calculated for an Asset with an End Date. If you want to stop the calculation of depreciation, you should first write the Asset off or sell it using a Disposal record and then mark it as Inactive.

- Purch. Value 2

- The purchase price of the Asset, excluding VAT, to be used by the Depreciation Model 2 as the basis for calculating depreciation. If you leave this field empty, it will use the Purch. Value on the 'Purchase' card instead. The second Depreciation Model will not calculate depreciation if this field and the Purchase Value are both blank (unless you choose to use the Fiscal Value on the 'Values' card to calculate depreciation).

- If the Quantity on the 'Owner' card is greater than one, this field should contain a figure for the Purchase Value per unit, not the total Purchase Value.