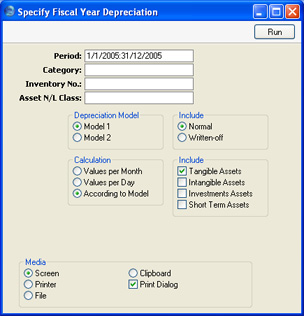

Fiscal Year Depreciation

The Fiscal Year Depreciation report is designed to satisfy a statutory reporting requirement in Portugal. Please refer to your local Hansa representative for full details.

The report requires that you define a hierarchical structure of Asset Categories, as illustrated in the section describing the Mother Category field in the Asset Categories setting.

When printed to screen, the report has nine columns of information. When sent to a printer, there are 15 columns, including Non-Fiscal Cost.

- Period

- Paste Special

Reporting Periods setting, System module

- Specify the time period for which depreciation will be calculated. This period should consist of a single fiscal year. Any Assets purchased after this period are shown in the report, but depreciation is shown to be zero.

- Category

- Paste Special

Asset Categories setting, Assets module

- Range Reporting Alpha

- To report on the Assets belonging to a range of Categories, specify that range here. You must specify a range of Categories, otherwise the report will be empty.

- Inventory No.

- Paste Special

Asset, Assets module

- Range Reporting Alpha

- Enter one or more Assets to be shown in the report.

- Asset N/L Class

- Paste Special

Asset N/L Classes, Assets module

- Limit the selection to Assets belonging to a single Asset Class.

- Assets do not have an Asset Class field: each Asset belongs to an Asset Category, and each Category in turn belongs to an Asset Class.

- Depreciation Model

- Use one of these alternatives to determine which of the two Depreciation Models specified on the 'Models' card of each Asset record is to be used to calculate its depreciation.

- Include

- Use these options to specify whether normal (active) Assets or those that have been written off are to be listed in the report. Assets marked as Inactive are classified as "normal" in this instance, unless they have been included in an approved Disposal record.

- Calculation

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details of the Per Day and Per Month options. Choose the According to Model option if you want to use the Period specified in the Depreciation Model of each Asset. If an Asset uses a Declining Balance Depreciation Model, the calculation method will always be Per Month, irrespective of the option that you choose here.

- Include

- Check the boxes to include Assets of different types in the report. The type of an Asset depends on the Category to which it belongs. At least one option must be chosen or the report will be empty.