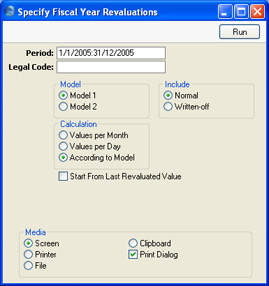

Fiscal Year Revaluations

The Fiscal Year Revaluations report is designed to satisfy a statutory reporting requirement in Portugal. Please refer to your local Hansa representative for full details.

The report requires that you define a hierarchical structure of Asset Categories, as illustrated in the section describing the Mother Category field in the Asset Categories setting.

- Period

- Paste Special

Reporting Periods setting, System module

- Specify the time period for which depreciation will be calculated. This period should consist of a single fiscal year.

- Legal Code

- The report shows the effects of a single Official Revaluation on the depreciation of your Assets. Specify here the Legal Code of the Official Revaluation that you are interested in. You must enter a Legal Code or the report will be empty.

- Model

- Use one of these alternatives to determine which of the two Depreciation Models specified in each Revaluation record is to be used to calculate depreciation.

- Include

- Use these options to specify whether normal (active) Assets or those that have been written off are to be listed in the report. Assets marked as Inactive are classified as "normal" in this instance, unless they have been included in an approved Disposal record.

- Calculation

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details of the Per Day and Per Month options. Choose the According to Model option if you want to use the Period specified in the Depreciation Model of each Asset. If an Asset uses a Declining Balance Depreciation Model, the calculation method will always be Per Month, irrespective of the option that you choose here.

- Start From Last Revaluated Value

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details of this option.