Key Financial Ratios - Defining Key Ratios

- To change the report definition of the Key Financial Ratios report, first select 'Settings' from the File menu and double-click 'Report Settings' in the subsequent list. Then highlight 'Key Financial Ratios' in the list on the left-hand side of the 'Report Settings' window and click the [Definition] button. The 'Definition of Key Financial Ratios: Inspect' window is opened.

- Enter the definitions for your Key Ratios.

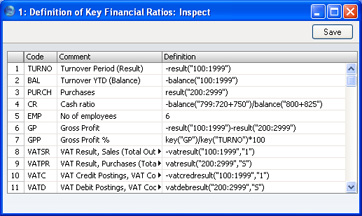

The following illustration shows a sample list of defined Ratios. In this list, all the functions available for use in defining Key Ratios are illustrated.

The fields on the screen are as follows:

- Row

- Each Ratio is defined on its own numbered row in this window.

- Code

- A unique code identifying each Key Ratio: this can be used to refer to the Key Ratio when calculating others (see the illustration).

- Comment

- The name of the Ratio, to be shown on the report.

- Definition

- The formula used to calculate the value of this Key Ratio.

Several commands are available for use by formulae in the Definition field. They are not case sensitive.

If you are an existing user of FirstOffice or Office/2 updating to version 4.1 or later, note that the syntax used in the Key Ratio formulae changed in this version. All parameters should now be enclosed in quotation marks. The order of parameters for the VATRESULT, VATBALANCE, VATCREDRESULT and VATDEBRESULT commands has been transposed.

- RESULT("Account Code")

- This command returns the net change during the period for the Account specified in the brackets. Some examples of the use of this command are as follows:

- RESULT("100")

- Returns the net change in Account 100 for the specified period.

- RESULT("100:1999")

- Returns the sum of the net changes in Accounts 100 to 1999 for the specified period. The Accounts used are determined using an alpha sort, rather than a numeric one. Thus Account 1000001 will be included in the example range, while Account 200 will not.

- -RESULT("100:1999")

- As the previous example, but the sign of the final figure is changed. This is useful when displaying figures for sales, which are stored as negative figures in FirstOffice. Prefixing the RESULT command with a minus sign will cause sales to be displayed as positive figures in the report.

- RESULT("100+120:1999")

- Takes the net change in Account 100 and adds it to the sum of the net changes in Accounts 120 to 1999.

- CREDRESULT("Account Code")

- This command returns the total credit posting during the report period to the Account specified.

- DEBRESULT("Account Code")

- This command returns the total debit posting during the report period to the Account specified.

- BALANCE("Account Code")

- This command returns the closing balance for the Account specified. It therefore differs from the RESULT command in that balances brought forward from previous periods are taken into account.

- The command can return the sum of the balances of specified Accounts in the same manner as the RESULT command: please refer to the description of the RESULT command above for examples.

- CREDBALANCE("Account Code")

- This command returns the closing credit balance for the Account specified. It therefore differs from the CREDRESULT command in that balances brought forward from previous periods are taken into account.

- DEBBALANCE("Account Code")

- This command returns the closing debit balance for the Account specified. It therefore differs from the DEBRESULT command in that balances brought forward from previous periods are taken into account.

- KEY("Code")

- The value of another Key Ratio can be included in the calculation. The Key Ratio referred to must already have been defined. If not, a zero value is used. Therefore, in the example illustration, the GPP line must appear below the GP and TURNO lines.

- Note that although the KEY command itself is not case sensitive, the reference to another Key Ratio is. Thus, in the example illustration, key("TURNO") and KEY("TURNO") are relevant, but key("turno") is not.

- OBJRESULT("Account Code","Object Code")

- This command is similar to RESULT, but in calculating the net change during the period for the Account specified, only postings with the specified Object Code are taken into account.

- The reference to the Object Code is not case sensitive.

- The command can return the sum of the balances of specified Accounts in the same manner as the RESULT command: please refer to the description of the RESULT command above for examples.

- OBJCREDRESULT("Account Code","Object Code")

- This command returns the total credit posting to the Account specified during the period, taking only transactions with the specified Object Code into account.

- OBJDEBRESULT("Account Code","Object Code")

- This command returns the total debit posting to the Account specified during the period, taking only transactions with the specified Object Code into account.

- VATRESULT("Account Code","VAT Code")

- This command is similar to RESULT, but in calculating the net change during the period for the Account specified, only postings with the specified VAT Code are taken into account.

- The reference to the VAT Code is not case sensitive.

- The command can return the sum of the balances of specified Accounts in the same manner as the RESULT command: please refer to the description of the RESULT command above for examples.

- VATBALANCE("Account Code","VAT Code")

- This command returns the closing balance for the Account specified, with only Transactions with the specified VAT Code taken into account. It therefore differs from the VATRESULT command in that balances brought forward from previous periods are taken into account.

- VATCREDRESULT("Account Code","VAT Code")

- This command returns the total credit posting to the Account specified during the period, taking only transactions with the specified VAT Code into account.

- VATDEBRESULT("Account Code","VAT Code")

- This command returns the total debit posting to the Account specified during the period, taking only transactions with the specified VAT Code into account.

- When you have finished defining Key Ratios, click [Save].

The illustration of the Key Ratio definitions shows examples of the various methods of calculating a Key Ratio. There are a few things to remember.

As the calculation uses FirstOffice's internal values, balances on e.g. sales Accounts will be shown as negatives, since they normally are in credit. You can solve this simply by reversing the sign for all such calculations: an example of this is in Key Ratio No. 1 in the illustration. The examples also show how to group different Accounts.

The value of a well-structured Chart of Accounts can easily be seen here. If all income related Accounts are found in a consecutive series, summing them all up becomes simple.