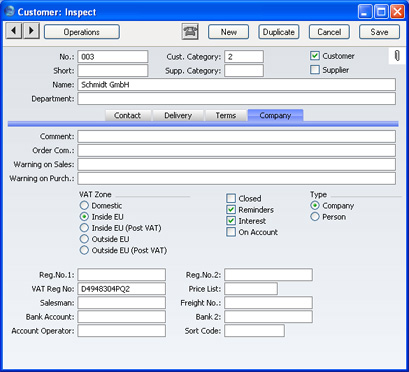

Entering a Customer - Company Card

- Comment

- This field can be used to record any additional information about the Customer. Comments entered here will be shown on Sales Ledger reports featuring this Customer.

- Order Com.

- Text entered here will appear as a default in the Comment fields of Orders and Invoices for this Customer.

- Warning on Sales

- Text entered here will be used to alert users whenever a Sales Order or Invoice is entered for this Customer.

- Warning on Purch.

- Text entered here will appear as a warning to alert users whenever a Purchase Invoice is entered for this Supplier.

- VAT Zone

- Used as default in

Sales Orders, Sales and Purchase Invoices

- Select a Zone for this company. This will be used in Sales Orders and in Sales and Purchase Invoices to control VAT calculation and accounting and the choice of Sales Account. Separate default sales VAT Codes and Sales Accounts can be assigned to each Zone on the 'VAT' card of the Account Usage S/L setting in the Sales Ledger. Separate default purchase VAT Codes can be assigned to each Zone on the 'VAT' card of the Account Usage P/L setting in the Purchase Ledger.

- For Customers in the "Within EU" Zone, it is important that their VAT Number is recorded (see below).

- When Sales Invoices are raised for Customers in the "Inside EU" and "Outside EU" Zones, VAT will not be charged, irrespective of the VAT Code. If you want to charge VAT to such Customers, place them in the Inside EU (Post VAT)" and "Outside EU (Post VAT)" Zones.

- Similarly, on the Purchase Side, VAT will not be calculated on Purchase Invoices received from Suppliers in the "Outside EU" Zone. If the Supplier is in the "Inside EU" Zone, VAT from Purchase Invoices will be debited to the Input Account from the VAT Code and credited to the Output Account from the VAT Code. If you want VAT to be calculated and debited to the Input Account from the VAT Code in the normal way, place your Suppliers in the Inside EU (Post VAT)" and "Outside EU (Post VAT)" Zones.

- Closed

- Check this box if the Customer or Supplier is no longer to be used (Customer records cannot be deleted if Sales Orders or Sales or Purchase Invoices have been raised in their name). Closed Customers will appear in the 'Customers: Browse' window but not in the Customers 'Paste Special' list. You will not be able to enter Sales Orders or Sales or Purchase Invoices for closed Customers. A closed Customer can be re-opened at any time.

- Reminders

- Check this box if the Customer is to receive Open Invoice Customer Statements and reminders for late payment. Please refer to the description of the Reminder document here for full details of this feature.

- Interest

- Check this box if the Customer is to be sent interest Invoices for late payments. Please click (here for full details of this feature.

- On Account

- Check this box if the company is a Customer from whom you want to be able to receive Prepayments and On Account Receipts (i.e. you want to allow them to pay before you have invoiced them) and/or the company is a Supplier to whom you want to be able to issue Prepayments and On Account Payments (i.e. to be able to pay them before you receive Invoices).

- Before you can enter Prepayments and On Account Receipts, you must specify an On Account A/C on the 'Exchange Rate' card of the Account Usage S/L setting. This Account will be credited with the value of these Receipts.

- On the purchase side, before you can enter Prepayments and On Account Payments, you must specify an On Account A/C on the 'Exchange Rate' card of the Account Usage P/L setting. This Account will be debited with the value of these Payments.

- Type

- Use these options to specify whether the Customer or Supplier is a company or a private individual. This will affect the check that the VAT Number is correct in Argentina and Paraguay.

- Reg No 1

- If the Customer is a limited company, enter their Company Registration Number here.

- Reg No 2

- This field is used in Finland, where companies have two registration numbers.

- VAT Reg No.

- It is important that you record the company's VAT Number here if they are in the "Within EU" Zone as this information is required for EU VAT reporting purposes.

- A check is made when you save the record that the VAT Number has not been used in any other Customer record. If this check fails, you will be warned, but you will still be able to save the record.

- Salesman

- Paste Special

Person register, System module

- Used as default in Sales Orders and Sales Invoices

- Enter the initials of the salesman responsible for this Customer's account. By default, Sales Orders and Sales and Purchase Invoices for this Customer will be attributed to the salesman entered here.

- Price List

- Paste Special

Price Lists setting, Sales Ledger

- Used as default in Sales Orders, Sales Invoices

- If you wish to assign a particular Price List to a Customer, you can do so here. It will determine the prices used in Sales Orders and Sales Invoices for this Customer.

- Note that you can also allocate Price Lists to Customer Categories. This makes it easy to allocate or change the Price List of a group or Customers in a single step. Any Price List specified here will override that of the Customer Category (if any) to which the Customer belongs.

- Please refer to the 'Price List' page for full details of how to use this feature.

- Freight No

- In some countries each Customer can be allocated a specific Freight Number that will be quoted on all Deliveries. Freight Numbers can be included on delivery documents if necessary.

- Bank Account

- Enter the company's main bank account number here. If the company is a Supplier, this bank account number will be transferred to any Purchase Invoices and Payments entered in their name, facilitating payment by the transfer of funds between banks.

- Bank 2

- This field is used by the 'Banking File' Export function. Please refer to your local FirstOffice representative for details.

- Account Operator

- Paste Special

Banks setting, Purchase Ledger

- Enter the name of the company's bank or building society here. If the company is a Supplier, their bank information will be transferred to any Purchase Invoices ('Identifiers' card) and Payments (flip C) entered in their name, facilitating payment by the transfer of funds between banks.

- Sort Code

- Enter the Sort Code (branch number) of the company's bank here.

Please click

here for details about the Language field added to this card by the Currencies, Languages and Advanced Pricing Value Pack.