Create Interest Invoices

This function creates Invoices for interest on late payment and places them in the

Invoice register. These Invoices are not approved, and it is therefore possible to modify or delete any of them before they are approved.

Interest Invoices can use a different Number Series to that used by other Invoices. If you would like to make use of this feature, specify the Number Series to be used in the Number Series Defaults setting in the System Module. Otherwise the first number sequence in the Number Series - Invoices setting will be used.

In order to create Interest Invoices, a number of conditions must be met:

- The Interest setting must be completed with the correct interest conditions.

- An interest Item and, if appropriate, an interest fee Item, must be present in the Item register. If you intend to use special Sales Accounts for interest and interest fees, specify these in the Item records.

- For each Customer to whom Interest Invoices can be issued, switch on the Interest check box (on the 'Company' card of the Customer screen).

If this function does not create any Interest Invoices when expected and the conditions mentioned above have all been met, the probable causes are:

- You have specified an Int. Invoice Date in the specification window that would result in Interest Invoices that are already due for payment. For example, if the Payment Terms in the Interest setting are 30 days and you specify an Int. Invoice Date that is more than 30 days ago, no Interest Invoices will be created. You should therefore change the Payment Terms or specify a more recent Int. Invoice Date.

- There is no valid record in the Number Series - Invoices setting. This might be a fault in the setting itself, or it might be because the default Invoice Number in the Number Series Defaults setting is not in a valid Number Series. This problem will usually occur at the beginning of a new year.

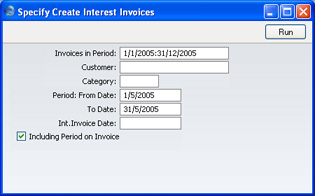

- Invoices in Period

- Paste Special

Reporting Periods setting, System module

- Interest will be charged on outstanding Invoices whose Invoice Dates fall within the period specified here.

- Customer

- Paste Special

Customers in Customer register

- Range Reporting Alpha

- Enter the Number of the Customer (or range of Customer Numbers, separated by a colon) for whom you want to generate Interest Invoices.

- Category

- Paste Special

Customer Categories setting, Sales Ledger

- If you want to limit the selection to a certain Customer Category, enter the Category number here.

- Period From Date, To Date

- Paste Special

Choose date

- The period for which the Interest Invoices are to be generated. The previous month is entered as the default. Edit the date range to suit your purposes.

- If the Debiting Mode in the Interest setting is Running, interest will be charged on all overdue Invoices. If the Calculation method in the same setting is Inv. Date Rate * Late Days or Current Rate * Late Days, interest will be charged daily for this period. If the Calculation method is Flat Rate per Debiting, a single interest rate will be levied on each overdue Invoice.

- If the Debiting Mode is At Payment, interest will only be charged on overdue Invoices for which payment was received during this period. If the Calculation method is Inv. Date Rate * Late Days or Current Rate * Late Days, interest will be charged daily for the entire overdue period. If the Calculation method is Flat Rate per Debiting, a single interest rate will be levied on each overdue Invoice for which payment was received.

- Int. Invoice Date

- Paste Special

Choose date

- Enter a date to be used as the Invoice Date in the Interest Invoices generated in this run. If no date is entered, the current date will be used.

- Including Period on Invoice

- Switch this option on if you want the period (as defined using the From Date and To Date above) to be shown in a separate row on the Interest Invoices.

If it is necessary to issue a Credit Note against an Interest Invoice, you cannot use the normal method of duplicating the original Invoice and changing the Payment Terms. Instead, follow these steps:

- Create a new record in the Invoice register. Do not duplicate the Interest Invoice.

- After entering the Customer, change the Payment Term to one that is of the type "Credit Note".

- In the first row of the specification area, a crediting message appears. Enter the number of the Invoice to be credited, using 'Paste Special' if necessary to bring up a list of open (unpaid) Invoices.

- Enter the Items for interest and invoicing fees with appropriate amounts. These Items for interest and invoicing fees should be the same as those specified in the Interest setting.

- Check everything and approve the Invoice.