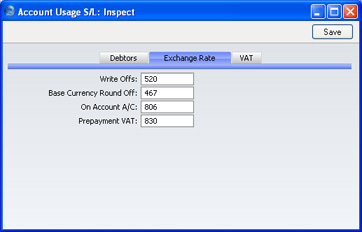

Account Usage S/L - Exchange Rate Card

- Write Offs

- Bad debts that you write off using the 'New Write-off' Operations menu function of the Receipt and the 'Write off Invoices' Maintenance function will be debited to the Account specified here.

- Base Currency Round Off

- Under the Dual-Base system, all Nominal Ledger Transactions should be expressible, and should balance, in both Base Currencies. The Account entered here will be used for postings to ensure that this is the case. Usually, it will only be used for Base Currency 2 values.

- This Account can only be defined in the Account Usage S/L setting and is used for all Transactions.

- This Account is only used if you have the Dual-Base Currency Value Pack, but even if you do not have this Value Pack you need to specify a valid Account before you can save the Account Usage S/L setting.

- On Account A/C

- If you receive Prepayments or On Account Receipts from a particular Customer without reference to a specific Invoice (usually before you have raised the Invoice), you may want to use a special Account for such Receipts. Specify that Account here, and switch on the On Account check box on the 'Company' card of the Customer in question. When you enter and approve a Prepayment or On Account Receipt, its value will be credited to this Account.

- The Account specified here will be overridden if a separate such Account has been specified in the Customer Category to which a Customer belongs.

- Prepayment VAT

- The Account specified here is used when the Nominal Ledger Transactions from Prepayment Receipts are to include a VAT element (i.e. if you are using the Post Prepayment VAT option on the 'Debtors' card). This is the case in the Baltic countries and Russia and for users of the Cash VAT scheme in the UK. When you record a Prepayment Receipt, you should specify the VAT Code and Amount on flip D. The VAT Amount will be debited to this Prepayment VAT Account and credited to the O/P Account for the VAT Code (or the VAT (C/A) Account specified on the 'Debtors' card) when you approve and save the Receipt.