Cost Model

If you are using cost accounting (maintaining stock valuations in the Nominal Ledger), when you approve an Invoice or Delivery, FirstOffice will automatically calculate the cost of the goods sold and debit this figure to a Cost Account and credit it to a Stock Account. The valuation method (Cost Model) used in this calculation is chosen as follows:

- if the Item belongs to an Item Group, and you are using the Use Item Groups for Cost Model option in the Cost Accounting setting in the Stock module, it will be the Cost Model specified on the 'Cost Model' card of the Item Group. If that Cost Model is "Default", then it will be the Cost Model, Invoice or the Cost Model, Delivery specified in this setting, depending on whether you created the cost accounting transaction from an Invoice or a Delivery;

- if the Item belongs to an Item Group, the Item Group does not have Cost and Stock Accounts, you are using the Use Item Groups for Cost Model option and you created the cost accounting transaction from an Invoice, it will be the Cost Model, Invoice specified in this setting;

- if the Item does not belong to an Item Group, or you are not using the Use Item Groups for Cost Model option, and you created the cost accounting transaction from a Delivery, it will be the Cost Model, Delivery specified in this setting;

- if the Item does not belong to an Item Group, or you are not using the Use Item Groups for Cost Model option, and you created the cost accounting transaction from an Invoice, it will be the Cost Model, Invoice specified in this setting.

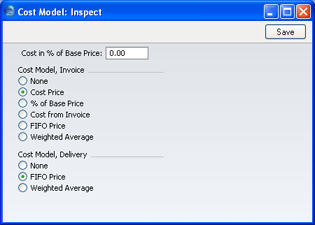

The options available for calculating the cost amount are listed below. Select one of the options in the Cost Model, Invoice area to be used when cost accounting transactions are to be created on Invoice, and in the Cost Model, Delivery area for when they are to be created on Delivery. Cost accounting transactions will be created on Delivery if you have determined in the

Sub Systems setting in the Nominal Ledger that Nominal Ledger Transactions will be created when Deliveries are approved. Otherwise, they are created on Invoice.

If you have determined that cost accounting transactions will be created on Delivery, it is recommended that you choose a Cost Model, Invoice as well, just in case Stocked Items are sold from an Invoice without a Sales Order (i.e. where a Delivery record has not been created).

If you are using the Use Item Groups for Cost Model option in the Cost Accounting setting, it is recommended that you choose a Cost Model, Invoice and a Cost Model, Delivery here as well, for use as defaults and in case you sell an Item that does not belong to an Item Group.

- None

- Select this option if you do not wish to use cost accounting.

- Cost Price

- Use the Cost Price of the Item (visible on the 'Costs' card of the Item screen). If you choose this option, it is recommended that you also choose one of the Update Cost Price at Goods Receipt options (again, on the 'Costs' card of the Item), to ensure the Cost Price is always up-to-date.

- % of Base Price

- Calculate the cost by applying a specified percentage to the Base Price (i.e. the retail price) of the Item. Specify the percentage in the Cost in % of Base Price field, just above this Cost Model selection area. This option can be used in cases where a consistent gross margin is required.

- Cost from Invoice

- Use the Cost Price of the appropriate row of the Invoice.

- FIFO Price

- A true FIFO (First In First Out) cost is used, based on the cost prices recorded in Goods Receipts.

- As its name suggests, First In First Out requires that you must make certain that you enter all stock transactions in strict chronological order. Failure to do this may cause your FIFO values to become incorrect. Do not, for example, enter a Goods Receipt with yesterday's date if you have already entered one with today's. This applies to Deliveries and Stock Depreciations as well. It is also recommended that you always approve stock transactions when you save them for the first time. Do not, for example, go back to an earlier unapproved Goods Receipt and approve it if there are later approved ones, unless you change the date as well.

- Weighted Average

- Use the Weighted Average Cost Price of the Item (the average unit price of all previous purchases, visible on the 'Costs' card of the Item screen).

- If you set the Cost Model, Invoice to Weighted Average, Weighted Average prices will also be used in Stock Movements and Stock Depreciations. If you set the Cost Model, Invoice to any other option, FIFO prices will be used in these transactions.

! | If you choose the Cost Price, % of Base Price or Weighted Average options, make sure that the appropriate field contains values for each Item. Otherwise, cost accounting Transactions with a zero amount may result. |

|

Please refer to the Cost Accounting page for full details of this feature.