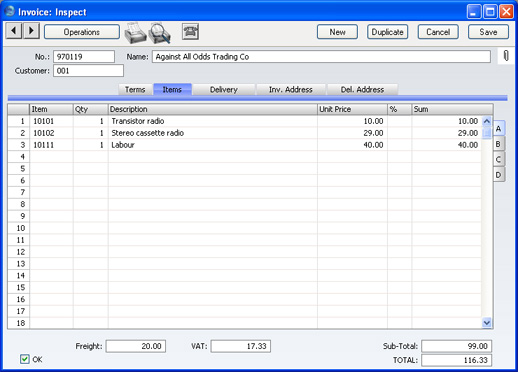

Entering an Invoice - Items Card

Use the grid on the 'Items' card to list the invoiced Items. This grid is divided into four horizontal flips. When you click on a flip tab (marked A-D), the two or three right-hand columns of the grid are replaced.

To add rows to an Invoice, click in any field in the first blank row and enter appropriate text. To remove a row, click on the row number on the left of the row and press the Backspace key. To insert a row, click on the row number where the insertion is to be made and press Return.

You can also bring Items into an Invoice by opening the 'Items: Browse' window, selecting a range of Items by clicking while holding down the Shift key, and then dragging them to the Item field in the first empty Invoice row. You can also copy a list of Item Numbers from a spreadsheet or word processor and paste them in the Item field in the first empty row.

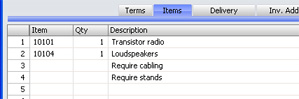

Flip A

- Item

- Paste Special

Item register

- With the cursor in this field, enter the Item Number or Bar Code for each Item ordered. Pricing, descriptive and other information will be brought in from the Item record. If you leave this field blank, you can enter any text in the Description field, perhaps using the row for additional comments to be printed on Invoice documentation.

- Qty.

- Enter the number of units sold. Press Return to calculate the Sum, and the cursor will move to the Item field on the next row.

- You must specify a Quantity before a Sum can be calculated for the Invoice row.

- In the case of Invoices created from Orders, the Quantity will default to that delivered. You can reduce this if necessary. If you need to invoice a greater Quantity than was delivered, you must do so by adding a new row to the Invoice. Ensure that the Update Stock box on the 'Delivery' card is checked so that stock levels are updated accordingly and, if appropriate, to cause cost accounting transactions to be created in the Nominal Ledger for the extra quantity. This box will only apply to Invoice rows that are not related to the Order.

- Description

- Default taken from

Item

- This field shows the name of the Item, brought in from the Item register. If you want to add an extra description, you can do so: there is room for up to 100 characters of text. You can also use the next line if necessary.

- Any rows of text that you have entered on the 'Texts' card of the Item record will be moved into the Description field, using the next rows if necessary.

- Unit Price

- The Unit Price of the Item according to the valid Price List for the Customer is brought in. If the Customer has no Price List specified, or the Item is not on the Price List in question, the Base Price from the Item record is brought in. This figure will include VAT if the Price List specified is one that is Inclusive of VAT or if you have specified on the 'Debtors' card of the Account Usage S/L setting that Base Prices include VAT.

- In multi-user systems, you can prevent certain users from changing any Unit Price in an Invoice using Access Groups (by denying access to the 'Change Unit Prices' Action).

- %

- Discount percentage. It can be changed to an adhoc rate if necessary.

- In the Round Off setting in the System module, you can determine whether the discount is to be applied to the Unit Price before it has been multiplied by the Quantity or to the Sum. In certain circumstances (where there is a very small unit price and a large quantity) this choice can cause the calculated discount to vary due to the rounding system used within FirstOffice. Please refer here for details and an example.

- Sum

- The total for the row: Quantity multiplied by Unit Price less Discount. Changing this figure will cause the Discount Percentage to be recalculated. This figure will include VAT if the Price List specified is one that is Inclusive of VAT or if you have specified on the 'Debtors' card of the Account Usage S/L setting that Base Prices include VAT.

Flip B

- A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Nominal Ledger Sales Account for this Item, which will be credited with the Sum in the Nominal Ledger Transaction generated by this Invoice. A default is offered, taken from the record in the Price register for the Item/Price List combination. If there is no such record, or it has no Sales Account specified, the default will be taken from the Item record, the Item Group or from the 'VAT' card of the Account Usage S/L setting. You can change this default in a particular Invoice row if necessary.

- V-Cd

- Paste Special

VAT Codes setting, Nominal Ledger

- The VAT Code entered here determines the rate at which VAT will be charged on this Item and the Output VAT Account to be credited. A default is offered, taken from the Sales VAT Code field in the Customer record. If that field is empty, the default is taken from the Item, the Item Group or from the 'VAT' card of the Account Usage S/L setting. You can change this default in a particular Invoice row if necessary.

- If you have checked the VAT Code Control option on the 'Debtors' card of the Account Usage S/L setting, the VAT Code specified here must be the same as that specified for the Sales Account in the Account register. If the VAT Codes don't match, you will not be able to save the Invoice.

Flip C

- Cost

- Default taken from

Item (Cost Price + Extra Cost)

- The unit Cost Price is used in Gross Profit and Margin calculations. You can change this figure if necessary.

- When you create Invoices from Orders, the Cost Price of each Item on the Invoice (and therefore its gross profit) can be taken from the Order or from the sum of the Cost Price and the Extra Cost from the Item record. If you wish to use the latter alternative, switch on the Update GP at Invoicing check box in the Cost Accounting setting in the Stock module. This can be more accurate if you are routinely updating Items' Cost Prices from Goods Receipts since these are likely to occur after the entry of the Sales Order.

- GP

- The Gross Profit for the Invoice row is calculated by subtracting the Cost Price (multiplied by the Quantity) from the Sum. The figure is therefore absolute, not a percentage.

- FIFO

- The average FIFO unit cost of the Items on this row. This figure is brought in automatically when the Invoice is approved, but is only shown for Stocked Items in Invoices that have not been generated from a Sales Order. For Invoices that have been generated from a Sales Order, FIFO values are shown in the appropriate Delivery record.

Flip D

- Object

- Paste Special

Object register, Nominal Ledger

- You can assign up to 20 Objects, separated by commas to this Item and all transactions generated from it. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- In the Nominal Ledger Transaction generated from this Invoice, any Objects specified here will be assigned to the credit posting to the Sales Account and, if you are using cost accounting, the debit posting to the Cost Account. This assignment will merge these Objects with those of the parent Invoice (shown on the 'Terms' card).

- P. Factor

- Default taken from

Item

- The Price Factor is the quantity of the Item that can be bought by the Unit Price. For example, if the Unit Price of an Item refers to a box of 24 units, its Price Factor will be 24. The Price Factor will be brought in to the Invoice from the Item record automatically. When you enter a Quantity, FirstOffice will recalculate the Sum using the formula Sum = (Quantity/Price Factor) * Unit Price.

Footer

The Invoice Footer contains various running totals as described below. Whenever an Invoice row is added or changed, these totals are updated.

- OK

- Checking this box approves the Invoice and causes it to be entered in the Sales Ledger. A corresponding transaction will also be created in the Nominal Ledger. If the Invoice was entered directly (rather than created from a Sales Order), stock levels of any Stocked Items on the Invoice will be adjusted. Because of these consequences, once this box has been checked and the Invoice saved, you will no longer be able to make changes to the Invoice. Exceptions to this rule are the Reminder Level and Last Reminder Date fields on the 'Delivery' card and the Salesman field on the 'Terms' card.

- You can use Access Groups to control who can approve Invoices and Credit Notes. To do this, deny access to the 'OKing Invoices' and 'OKing Credit Notes' Actions respectively.

- References in these web pages to approved Invoices are to Invoices whose OK check box has been switched on.

- Freight

- The Freight setting allows a fixed amount for Freight to be added automatically to each Invoice. If you are using this setting, the appropriate amount will be placed in this field when you enter a Customer Number. You can change the figure if necessary. The VAT Code and the Sales Account for the freight charge will be taken from the Item specified in the Freight setting.

- If you are not using the Freight setting, enter a freight amount if applicable. In this case, VAT will not be charged and the amount will be posted to the appropriate Sales Account for the Zone of the Customer, set on the 'VAT' card of the Account Usage S/L setting.

- VAT

- The VAT total for the Invoice.

- This figure is rounded up or down according to rounding rules set in the Round Off setting in the System module.

- In the Nominal Ledger Transaction resulting from this Invoice, any amounts lost or gained in this rounding process are posted to the Round Off Account specified in the Account Usage S/L setting.

- Sub-Total

- The total for the Invoice, excluding VAT.

- TOTAL

- The total for the Invoice, including VAT.

- This figure is rounded up or down according to rounding rules set in the Round Off setting in the System module. In the Nominal Ledger Transaction resulting from this Invoice, any amounts lost or gained in this rounding process are posted to the Round Off Account specified in the Account Usage S/L setting.

|