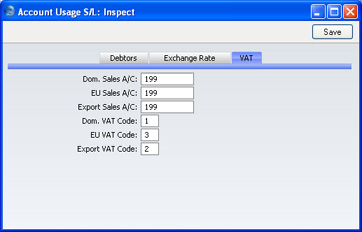

Account Usage S/L - VAT Card

- Dom. Sales A/C, EU Sales A/C, Export Sales A/C

- When an Invoice is approved, the values excluding VAT of the Items are individually credited to a Sales Account.

- It can be useful to maintain more than one Sales Account to keep a record of the sales of different types of product. For this reason, you can specify a separate Sales Account for each Item. Enter here the Account Code of the Account that you wish to be used as your default Sales Account, to be credited when no Sales Account has been specified for a Price, Item or Item Group.

- You should define three default Sales Accounts: which one will be used in a particular Invoice will depend on the Zone of the Customer concerned (set on the 'Company' card of the Customer record). If you leave the EU and Export Sales Accounts empty, the Domestic Sales Account will be used for all sales, irrespective of Zone.

- Dom. VAT Code, EU VAT Code, Export VAT Code

- VAT Codes determine the VAT Account that will be used when an Invoice is posted to the Nominal Ledger and the rate at which VAT will be charged. VAT Code records are set up using the VAT Codes setting in the Nominal Ledger.

- You can specify a separate VAT Code for each Item. Enter here the VAT Code that you wish to be used as a default, to be used where no VAT Code has been specified for a Customer, Item or Item Group. Normally, if your company is registered for VAT, this will be the VAT Code representing the standard rate. Otherwise, it will be a zero rate VAT Code.

- You should define three default VAT Codes: which one will be used in a particular Invoice will depend on the Zone of the Customer concerned (set on the 'Company' card of the Customer record).

- Note that, for Customers in the "Inside EU" and "Outside EU" Zones, VAT will not be charged on any Invoices raised, irrespective of the VAT Code specified here. If you want to charge VAT to such Customers, place them in the Inside EU (Post VAT)" and "Outside EU (Post VAT)" Zones.