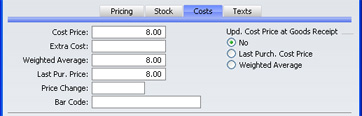

Entering an Item - Costs Card

- Cost Price

- Used as default in

Orders, Invoices, Goods Receipts

- You should record the Cost Price of the Item here. Since the figure will be used in calculating the Gross Profit of Sales Orders, it is important that it relates to the same Unit and Price Factor values as the Base Price on the 'Pricing' card. Depending on the setting of the Update Cost Price at Goods Receipt options (see below), the figure can be updated automatically from the figures used in Goods Receipts.

- Extra Cost

- Enter here any extra costs involved in the purchase of this Item, such as fixed freight costs. The figure will be included in the cost when calculating Gross Profit.

- Weighted Average

- This figure records the average unit cost price of this Item (including extra costs such as freight and customs duties). It is updated automatically from Goods Receipts whatever the setting of the Update Cost Price at Goods Receipt options (see below), using the Calc FIFO Value rounding rules set in the Round Off setting in the System module. You can recalculate the Weighted Average of an Item using the 'Update Item Cost Price' Maintenance function in the Stock module.

- Last Pur. Price

- This figure records the last unit cost price (including extra costs such as freight and customs duties) used when purchasing this Item. It is updated automatically from approved Goods Receipts whatever the setting of the Update Cost Price at Goods Receipt options (see below).

- Price Change

- This field shows the date of the last change to the Cost Price for the Item and is updated automatically.

- Upd. Cost Price at Goods Receipt

- FirstOffice can update the Cost Price of an Item automatically. If you are using this feature, the update will occur whenever you approve a Goods Receipt.

- The automatic updating of Cost Prices can be useful if you are using cost accounting (maintaining stock values in the Nominal Ledger) and your goods-out values are based on Items' Cost Prices. In this scenario, it is advantageous if the Cost Prices are always kept up-to-date. Cost Accounting is fully described here.

- In both cases, a price in a Goods Receipt will be rounded up or down according to the Calc FIFO Value rounding rules set in the Round Off setting in the System module before it is used to update the Cost Price of the Item.

- These options are used to control this feature:

- No

- Select this option if this feature is not to be used for this Item.

- Last Purch Cost Price

- If you choose this option, the Cost Price is changed to the Cost Price of the Item on the most recent Goods Receipt (i.e. the price including extra costs such as carriage and customs duties). You will tend to use this option for Items whose prices do not often change, or where the long-term pattern is for prices to fall or rise.

- Weighted Average

- This option changes the Cost Price to the average unit Cost Price of all previous Goods Receipts (including extra costs such as freight and customs duties). This option will be useful where prices fluctuate without a pattern, perhaps due to changing exchange rates.

- Bar Code

- Record the Item's Bar Code here.

- Providing the Bar Code does not clash with your Item Codes, you can enter it instead of the Item Code whenever you need to refer to this Item (in Orders or Invoices, for example).