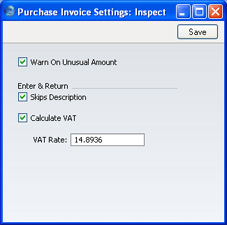

Purchase Invoice Settings

This setting contains some miscellaneous options controlling the behaviour of various aspects of the Purchase Invoice screen.

If you have the Purchase Orders Value Pack, this setting will contain some extra options not shown in the illustration below. These extra settings are described here.

- Warn On Unusual Amount

- When you define Accounts using the Account register (available in the System module or the Nominal Ledger), you should specify whether each Account will normally be used on the credit side of a transaction, the debit side or both. In the case of Accounts that will normally be used on one side only (for example, credit), a warning can be made to appear if you make an attempt, in the example, to debit the Account from the Purchase Invoice screen. The warning will not prevent the posting from taking place. If you would like this warning to appear, switch this option on.

- Enter and Return

- When pressing the Enter or Return key, you can determine whether the cursor is to skip over the Description field in each row of the Purchase Invoice screen using this check box. If so, you can still move the cursor into this field using the mouse or the Tab key if necessary.

- Calculate VAT

- Check the Calculate VAT box if you want FirstOffice to calculate the VAT amount for each Purchase Invoice when you enter a figure in the TOTAL field (in the Purchase Invoice header). The calculation will use the percentage entered in the VAT Rate field (below).

- This feature is a useful time saving device in countries with a single standard VAT rate when you need to enter several Purchase Invoices at once. You can quickly enter the TOTAL for each Invoice and a VAT calculation will then be performed automatically. In the occasional instance of a Purchase Invoice containing a line not subject to standard rate VAT, you can change the result of the calculation manually.

- The result of the calculation will be placed in the VAT field in the Purchase Invoice header. The purpose of this field is to provide a control figure. When you save the Purchase Invoice, the VAT total from the Invoice rows (shown in the Calc. VAT field in the footer) should be the same as this control figure. You will not be able to save the Purchase Invoice if this is not the case.

- VAT Rate

- Enter here the figure to be used in the VAT calculation if the Calculate VAT check box (above) is switched on.

- The figure should be the percentage of the TOTAL that represents the VAT. This can be obtained using the formula:

- Standard Rate VAT x 100

- (100 + Standard Rate VAT)

- For example, if standard rate VAT is 17.5%, the formula gives 1750/117.5, which is 14.8936, the figure to be entered.