Account Usage P/L - VAT Card

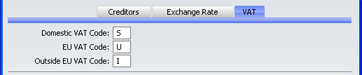

Dom. VAT Code, EU VAT Code, Export VAT Code

VAT Codes determine the VAT Account that will be used when a Purchase Invoice is posted to the Nominal Ledger and the rate at which VAT will be charged. VAT Code records are set up using the VAT Codes setting in the Nominal Ledger.

You can specify a separate VAT Code for each Account. Enter here the VAT Code that you wish to be used as a default, to be used whenever an Account that does not have its own VAT Code is used in a Purchase Invoice. Normally, if most of your company's Suppliers are registered for VAT, this will be the VAT Code representing the standard rate. Otherwise, it will be a zero rate VAT Code.

You should define three default VAT Codes: which one will be used in a particular Purchase Invoice will depend on the Zone of the Supplier concerned (set on the 'Company' card of the Customer record for the Supplier).