VAT Codes

In order to comply with VAT regulations it is necessary to differentiate between domestic, EU and external trade. To solve this, FirstOffice makes use of VAT Codes, whereby any number of VAT Codes with different accounting specifications can be defined.

VAT Codes can be assigned to Customers, Suppliers and also to individual Sales and Purchase Accounts. The VAT Codes help FirstOffice to use the correct VAT percentage, to control the Nominal Ledger accounting and to provide VAT statistics. The standard VAT Codes used in the UK are supplied with the program.

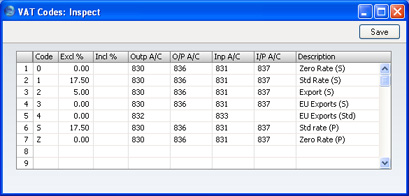

To edit the VAT Codes, double-click 'VAT Codes' in the 'Settings' list. The following window appears:

To edit a VAT Code, simply click in the field to be changed and overtype the existing entry. To add a new VAT Code record, scroll down to the first blank line. The information required for each VAT Code record is as follows:

- Code

- Each VAT Code record should be identified by a unique Code.

- Excl %

- Specify the percentage to be applied to a figure that excludes VAT in order to calculate the VAT amount.

- You must specify an Input or Output Account if the percentage is zero, as shown in the illustration above.

- Incl %

- Specify the percentage to be applied to a figure that includes VAT in order to calculate the VAT amount.

- Outp A/C

- Paste Special

Account register, Nominal Ledger/System module

- Specify here the VAT Outputs Account to be credited whenever this VAT Code is used in a sales transaction.

- In any Nominal Ledger Transaction resulting from Purchase Invoices from the EU Zone, VAT is debited to the Input Account of the selected VAT Code and credited to the Output Account. Therefore, it is recommended that you use a dedicated VAT Code for VAT on EU Acquisitions, with an Output Account that is not used in any other VAT Code.

- O/P A/C

- Paste Special

Account register, Nominal Ledger/System module

- This field is only used if you are using the Post Receipt VAT and/or Post Prepayment VAT options on the 'Debtors' card of the Account Usage S/L setting. Users of the Cash VAT scheme in the UK will need to use both options, users resident in the Baltic States may only need to use the Post Prepayment VAT option, and users in Poland may only need to use the Post Receipt VAT option.

- If you are using the Post Receipt VAT option, your output VAT liability is calculated from your Receipts, not from your Invoices. In this case, the Outp A/C will be treated as a preliminary VAT Output Account, to be credited whenever an Invoice is approved. When the Invoice is paid, the Transaction from the Receipt will include an extra VAT element, in which the VAT is moved from the Outp A/C to the O/P A/C. This therefore becomes the final VAT Output Account. The Post Receipt VAT option also posts VAT from On Account VAT Receipts (Receipts with no Invoice Number or Prepayment Number).

- If you are using the Post Prepayment VAT option, VAT will also be posted from Prepayment Receipts (Receipts with no Invoice Number but with a Prepayment Number). VAT will be credited to the O/P A/C and debited to the Prepayment VAT Account specified in the Account Usage S/L setting.

- In all cases, if a particular VAT Code does not have an O/P Account, the VAT (C/A) Account from the 'Debtors' card of the Account Usage S/L setting will be used instead.

- If you are using this feature, don't forget to alter the definition of the VAT Report so that it uses this Account and not the Outp Account.

- Inp A/C

- Paste Special

Account register, Nominal Ledger/System module

- Specify here the VAT Inputs Account to be debited whenever this VAT Code is used in a purchase transaction.

- I/P A/C

- Paste Special

Account register, Nominal Ledger/System module

- This field is only used if you are using the Post Payment VAT and/or Post Prepayment VAT options on the 'Creditors' card of the Account Usage P/L setting. This will be the case for users in Latvia and for users of the Cash VAT scheme in the UK. Users in Poland may only need to use the Post Payment VAT option.

- If you are using the Post Payment VAT option, the value of the input VAT that you can reclaim is calculated from your Payments, not from your Purchase Invoices. In this case, the Inp A/C will be treated as a preliminary VAT Input Account, to be debited whenever a Purchase Invoice is approved. When the Purchase Invoice is paid, the Transaction from the Payment will include an extra VAT element, in which the VAT is moved from the Inp A/C to the I/P A/C. This therefore becomes the final VAT Input Account.

- If you are using the Post Prepayment VAT option, VAT will also be posted from Prepayment Payments (Payments with no Invoice Number but with a Prepayment Number). VAT will be debited to the I/P A/C and debited to the On Account VAT Account specified in the Account Usage P/L setting.

- In all cases, if a particular VAT Code does not have an I/P Account, the Prepayment VAT Account from the 'VAT' card of the Account Usage P/L setting will be used instead.

- If you are using this feature, don't forget to alter the definition of the VAT Report so that it uses this Account and not the Inp Account.

- Description

- The description entered here will appear in the 'Paste Special' list, so should be detailed enough to ensure the correct VAT Code is always chosen.