Switching Cost Accounting On

For cost accounting to operate, follow these steps:

- Define the Item Groups, following the procedure here. In each Group, ensure you define Cost and Stock Accounts and that you choose a Cost Model option. Although cost accounting transactions will be created for Items that do not belong to Item Groups, management of the system is easier using Item Groups since it is simple to change Cost and Stock Accounts and Cost Models for a particular Item Group.

If you would like Item Groups to be the basis of your cost accounting system, switch on the Use Item Groups for Cost Accounts and the Use Item Groups for Cost Model options in the Cost Accounting setting in the Stock module. It is then recommended that you assign every Stocked Item to an Item Group and that you specify Cost and Stock Accounts in each Item Group. If you are not using these options, the Cost and Stock Accounts and Cost Models specified in Item Groups will play no part in your cost accounting structure.

- Ensure that each Item for which cost accounting transactions are to be created have been defined as Stocked Items using the option on the 'Pricing' card of the Item screen. If you are using the Use Item Groups for Cost Accounts and/or Use Item Groups for Cost Model options, allocate all Stocked Items to Item Groups.

- Using the Account Usage Stock setting in the Stock module, define a Purchase Control Account, a Stock Account and a Stock Cost Account. You should specify Purchase Control and Stock Cost Accounts for each Zone. These will be used as defaults in the event that equivalent Accounts have not been defined for a particular Item Group: the roles of these Accounts are described on the Cost Accounting Transactions from Goods Receipts and Cost Accounting Transactions from Deliveries and Invoices pages. In the same setting, you should also define Extra Cost, Freight Cost and Customs Cost Accounts.

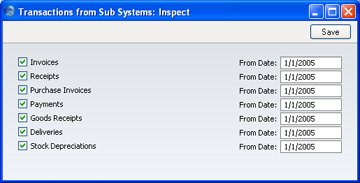

- Use the Sub Systems setting in the Nominal Ledger to determine when the cost accounting transactions will be created.

If you would like the cost accounting transactions to be created when Delivery Notes are approved, switch on the Deliveries check box. Otherwise, they will be created when Invoices are approved providing that the Invoices Update Stock option is switched on in the Account Usage S/L setting in the Sales Ledger.

You should also switch on the Goods Receipts option. This will ensure inward cost accounting postings are made, to balance the outward postings made on Invoice or Delivery. As a result, an inward movement will see a Purchase Control Account being credited and a Stock Account being debited, while an outward movement will credit the Stock Account and debit the Stock Cost Account.

- If, on the 'Cost Model' card of any of your Item Groups in step 1, you specified that the default Cost Model was to be used (to calculate the cost amount to be used in outward cost accounting transactions), define the default Cost Model using the Cost Model setting in the Sales Ledger. This default will also be used for Items that do not belong to Item Groups. It will also be used if you have not switched on the Use Item Groups for Cost Model option in the Cost Accounting setting.

- Further cost accounting attributes are set using the Cost Accounting setting in the Stock module: please refer here for full details.