Nominal Ledger Transactions from Stock Depreciation transactions

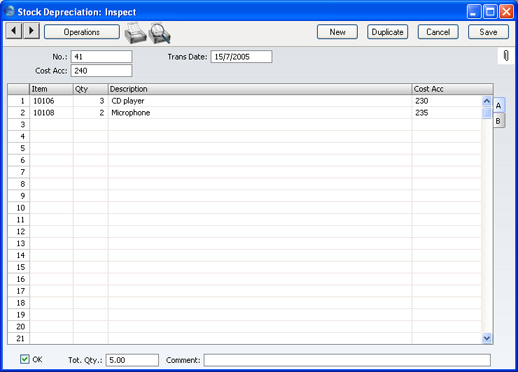

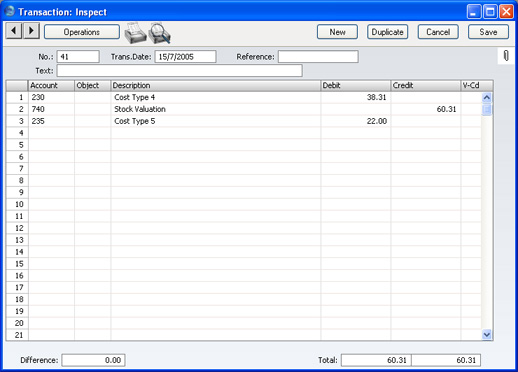

An example Nominal Ledger Transaction created from the above Stock Depreciation record is shown below. This Transaction will be generated automatically when you approve and save a Stock Depreciation record if you have so determined in the

Sub Systems setting in the Nominal Ledger.

The Debit Account(s) in the Nominal Transaction will be determined as follows:

- The Account specified in the Cost Account field in the Stock Depreciation transaction will be debited. By default, this is the Stock Cost Account from the Account Usage Stock setting. If you have entered a Cost Account in a particular row, that will be used instead of the Account entered for the Stock Depreciation overall.

- If you do not specify a Cost Account in the Stock Depreciation record, and you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting is on, the Cost Account for the Item Group to which the Item belongs will be debited.

The Credit Account(s) in the Nominal Transaction will be determined as follows:

- If you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting, the Stock Account for the Item Group to which the Item belongs will be credited.

- If this is blank, the Item does not belong to an Item Group or you are not using the Use Item Groups for Cost Accounts option, the Stock Account from the Account Usage Stock setting will be credited.

Note that

Plain Items will not be included in the resulting Nominal Ledger Transaction. If you enter a

Stocked Item in a Stock Depreciation record with a quantity greater than you have in stock, you will not be able to approve the Stock Depreciation if you are using the Do Not Allow Over Delivery option in the

Stock Settings setting.

Once the Transaction has been generated, you can look at it straight away using the

'Open NL Transaction' function on the Operations menu.