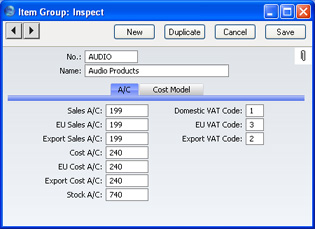

Item Groups - A/C Card

- Sales Accounts

- Paste Special

Account register, Nominal Ledger/System module

- Used as default in Invoices

- One of the Sales Accounts specified in these three fields will be credited whenever you use a member of this Group in an Invoice, depending on the Zone of the Customer (specified on the 'Company' card of the Customer screen). If the Item has a Sales Account specified for the appropriate Zone, or there is a record in the Price register for the appropriate Item/Price List combination with a Sales Account, those will take precedence over any entry here. If these fields are blank, the Sales Account will be taken from the Account Usage S/L setting in the Sales Ledger.

- VAT Codes

- Paste Special

VAT Codes setting, Nominal Ledger

- Used as default in Invoices

- Enter a VAT Code for each Zone. Each will specify the VAT Account to be credited whenever you use a member of this Group in an Invoice and the rate at which VAT will be charged. The Zone used will depend on that specified for the Customer.

- If the Customer or Item has a VAT Code specified, they will take precedence over any entry here. If these fields are left blank, the VAT Code will be taken from the 'VAT' card of the Account Usage S/L setting.

- Cost A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you are maintaining stock valuations in the Nominal Ledger, specify here the Account to be debited with the calculated cost of goods when Items that are members of this Item Group are sold (removed from stock). You should specify three separate Cost Accounts, one for each Zone. The cost of goods is calculated using the Cost Model chosen on the 'Cost Model' card or in the Cost Model setting in the Sales Ledger. If blank, the Stock Cost Account from the Account Usage Stock setting will be debited.

- This Accountwill only be used as described above if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module. If so, it is recommended that you assign every Stocked Item to an Item Group and that you specify Cost and Stock Accounts in every Item Group.

- Please refer to the Cost Accounting page for full details of this feature.

- As with all Accounts on this screen, make sure the desired Account is defined in the Account register (available in the Nominal Ledger and in the System module) to ensure that Nominal Ledger Transactions are generated without difficulty: FirstOffice will not attempt to post to non-existent Accounts.

- Stock Account

- Paste Special

Account register, Nominal Ledger/System module

- If you are maintaining stock valuations in the Nominal Ledger, specify here the Account to be credited with the calculated cost of goods when Items that are members of this Item Group are sold. The cost of goods is calculated using the Cost Model chosen on the 'Cost Model' card or in the Cost Model setting in the Sales Ledger. If this Account is blank, the Stock Account from the Account Usage Stock setting will be credited.

- This Account will be debited when Items that are members of this Item Group are received into stock. Again, if this field is blank, the Stock Account from the Account Usage Stock setting will be debited.

- For both goods out and goods in transactions, this Account will only be used as described above if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module. If so, it is recommended that you assign every Stocked Item to an Item Group and that you specify Cost and Stock Accounts in every Item Group.

|