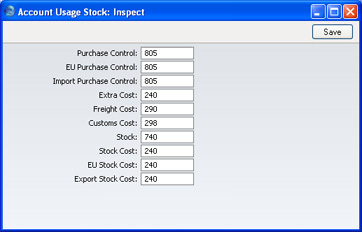

Account Usage Stock

This setting allows you to determine the Accounts that will be used as defaults in your stock transactions. Take care to ensure that the Accounts that you specify here exist in the

Account register. In each case, you can use the

'Paste Special' function (Ctrl-Return or ⌘-Return) to help you choose the correct Account.

- Purchase Control

- The suspense Account used to book goods received before a Purchase Invoice has been received and booked. It is credited when records in the Goods Receipt register in the Stock module are approved. You should specify three separate Purchase Control Accounts, one for each Zone.

- Please refer here for full details of this feature.

- Extra Cost

- A special expense account to collect any "extra costs" associated with the receipt of goods (entered to the Cost field for each row of a Goods Receipt record). It is credited when records in the Goods Receipt register in the Stock module are approved.

- Freight Cost

- Used to book the cost of freight on receipt of goods. It is credited when records in the Goods Receipt register in the Stock module are approved.

- Customs Cost

- Used to book the customs duty cost on receipt of goods. It is credited when records in the Goods Receipt register in the Stock module are approved.

- Stock

- The stock control Account. If you are using maintaining stock values in the Nominal Ledger ('cost accounting'), this Account will be debited when goods are received into stock and credited upon Invoice or Delivery, if the equivalent field for the appropriate Item Group is blank.

- Please refer here for full details of this feature.

- Stock Cost

- Cost Account used when shipping goods from stock. If you are using cost accounting, this Account will be debited upon Invoice or Delivery, if the equivalent field for the appropriate Item Group is blank. You should specify three separate Stock Cost Accounts, one for each Zone.

Please click

here for details about the Stock Gain Account added to this setting by the Stock Locations Value Pack.