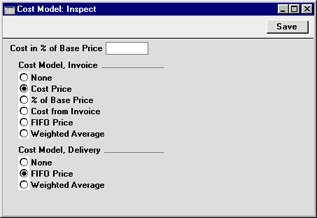

Cost Model

If you are using cost accounting (maintaining stock valuations in the Nominal Ledger), when each

Invoice or

Delivery is approved, Hansa will automatically calculate the cost of the goods sold and debit this figure to a Cost Account and credit it to a Stock Account. The valuation method (Cost Model) used in this calculation is chosen as follows:

- in the case of cost accounting transactions created from Deliveries, it will be the Cost Model, Delivery specified in this setting;

- in the case of cost accounting transactions created from Invoices, it will be the Cost Model specified on the 'Cost' card of the Item Group to which an individual Item belongs. If that Cost Model is "Default", or the Item Group does not have Cost and Stock Accounts, or an Item does not belong to an Item Group, then it will be the Cost Model, Invoice specified in this setting.

The options available for calculating the cost amount are listed below. Select one of the options in the Cost Model, Invoice area, to be used when cost accounting transactions are to be created on Invoice, and in the Cost Model, Delivery area for when they are to be created on Delivery. Cost accounting transactions will be created on Delivery if you have determined in the

Sub Systems setting in the Nominal Ledger that Nominal Ledger Transactions will be created when Deliveries are

approved. Otherwise, they are created on Invoice.

If you have determined that cost accounting transactions will be created on Delivery, it is recommended that you choose a Cost Model, Invoice as well, just in case Stocked Items are sold from an Invoice without a Sales Order (i.e. where a Delivery record has not been created).

The chosen Cost Model will sometimes be bypassed if the Cost Price for Serial No option in the Cost Accounting setting in the Stock module is in use. In this case, individual Cost Prices and Serial Numbers are linked. When an Item with a particular Serial Number is sold, the appropriate Cost Price for that Serial Number will be used in the resulting cost accounting transaction. This applies to Items with Serial Numbers only.

- None

- Select this option if you do not wish to use cost accounting.

- Cost Price

- Use the Cost Price of the Item (visible on the 'Costs' card of the Item screen). If this option is chosen, it is recommended that one of the Update Cost Price at Purchase options (also on the 'Costs' card of the Item) is chosen, to ensure the Cost Price is always up-to-date.

- % of Base Price

- Calculate the cost by applying a specified percentage to the Base Price (i.e. the retail price) of the Item. The percentage is specified in the Cost in % of Base Price field, just above this Cost Model selection area. This option can be used in cases where a consistent gross margin is required.

- Cost from Invoice

- Use the Cost Price of the appropriate row of the Invoice.

- FIFO Price

- A true FIFO cost is used based on the cost prices recorded in Goods Receipts.

- The Cost Model, Invoice should only use FIFO Prices if you will be entering all your Invoices directly to the Invoice register (i.e. you will not be using the Sales Order register). If you are using Sales Orders, Invoices cannot be created from Orders until at least one Delivery has been created and approved. FIFO values are calculated when Deliveries are approved and are stored in those Deliveries. They are not transferred to Invoices. If the Cost Model, Invoice has been set to FIFO, this means the Nominal Ledger Transaction created from the Invoice will not contain a cost accounting element because the FIFO values are not known to the Invoice. If you want to use the FIFO Cost Model and are likely to use Sales Orders as the method of creating Invoices, you must choose to have the cost accounting transaction created on Delivery (i.e. the Deliveries option in the Sub Systems setting should be switched on, and the Cost Model, Delivery should be set to FIFO).

- Weighted Average

- Use the Weighted Average Cost Price of the Item (the average unit price of all previous purchases, visible on the 'Costs' card of the Item screen).

- If the Cost Model, Invoice is set to Weighted Average, Weighted Average prices will also be used in Stock Movements and Stock Depreciations. If the Cost Model, Invoice is set to any other option, FIFO prices will be used in these transactions.

! | If the Cost Price, % of Base Price or Weighted Average option is selected, make sure that the appropriate field contains values for each Item. Otherwise, cost accounting Transactions with a zero amount may result. |

|

Please refer to the Cost Accounting page for full details of this feature.