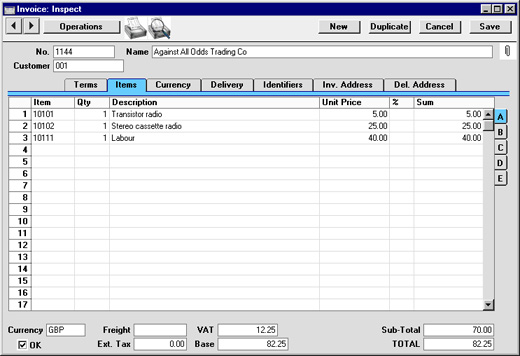

Entering an Invoice - Items Card

Use the grid on the 'Items' card to list the invoiced Items. This grid is divided into five horizontal flips. When you click on a flip tab (marked A-E), the two or three right-hand columns of the grid are replaced.

Before adding any rows to an Invoice, ensure that the Currency and Exchange Rate specified are correct. If an Exchange Rate is specified, all prices transferred from the Item register will be converted. However, if the Exchange Rate is altered after rows have been added, their prices will not be converted.

To add rows to an Invoice, click in any field in the first blank row and enter appropriate text. To remove a row, click on the row number on the left of the row and press the Backspace key. To insert a row, click on the row number where the insertion is to be made and press Return.

You can also bring Items into an Invoice by opening the 'Items: Browse' window, selecting a range of Items by clicking while holding down the Shift key, and then dragging them to the Item field in the first empty Invoice row.

Flip A

- Item

- Paste Special

Item register

- With the cursor in this field, enter the Item Number or Bar Code for each Item ordered. Pricing, descriptive and other information will be brought in from the Item record. If you leave this field blank, you can enter any text in the Description field, perhaps using the row for additional comments to be printed on Invoice documentation.

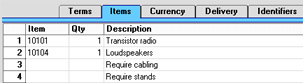

- If the Item is a Structured Item whose Show Components on Documents check box is on, its components will be listed on the following rows when you enter a Quantity. If you decide to change the Quantity, be sure to change the Quantities of the components as well.

- If the Customer has been assigned a Default Item record (on the 'Pricing' card of the Customer record), all Items in that record will be added to the Invoice automatically when the Customer Number is entered. Note that these Items will not have a Quantity, so be sure to enter one before printing and approving the Invoice.

- Qty

- Enter the number of units sold. Press Return to calculate the Sum, and the cursor will move to the Item field on the next row.

- You must specify a Quantity before a Sum can be calculated for the Invoice row.

- In the case of Invoices created from Orders, the Quantity will default to that delivered. You can reduce this if necessary. If you need to invoice a greater Quantity than was delivered, this must be done by adding a new row to the Invoice. Ensure that the Update Stock box on the 'Delivery' card is checked so that stock levels are updated accordingly and, if appropriate, to cause cost accounting transactions to be created in the Nominal Ledger for the extra quantity. This box will only apply to Invoice rows that are not related to the Order.

- Description

- Default taken from

Item

- This field shows the name of the Item, brought in from the Item register. If you want to add an extra description, you can do so: there is room for up to 100 characters of text. You can also use the next line if necessary.

- If you have specified various translations of the Description on the 'Texts' card of the Item screen, the correct translation will be brought in according to the Language of the Invoice (specified on the 'Identifiers' card). In addition, Hansa will take any rows of text that have been entered on the 'Texts' card of the Item record without a Language and move them into the Description field, using the next line if necessary.

- Unit Price

- The Unit Price according to the valid Price List for this Customer is brought in. If the Customer has no Price List specified, or the Item is not on the Price List in question, the Base Price from the Item screen is brought in. This figure will include VAT (and TAX) if the Price List specified is one that is Inclusive of VAT or if you have specified on card 1 of the Account Usage S/L setting that Base Prices include VAT (or VAT and TAX).

- If a Currency and Exchange Rate have been specified, the figure shown will be in the Currency concerned (i.e. having undergone currency conversion).

- %

- Discount percentage. If a Discount Matrix that includes this Item has been allocated to the Customer, this figure will be determined by the Item Number and Quantity. It can be changed to an adhoc rate if necessary. If there is a Discount Matrix applying to this Invoice, it will be shown on the 'Delivery' card.

- Discount Matrices allow quantity discounts to be applied automatically, based on value, quantity, weight or volume. If the Discount Matrix is one that uses Item Groups rather than Items and more than one Item from the same Item Group has been used in the Invoice, the discount for those Items should be calculated from the overall quantity for that Item Group. To do this, select 'Recalculate Discount' from the Operations menu once the Invoice is complete. This function can also be used if the Discount Matrix record itself is changed before the Invoice is approved.

- In the Round Off setting in the System module, you can determine whether the discount is to be applied to the Unit Price before it has been multiplied by the Quantity, or to the Sum. In certain circumstances (where there is a very small unit price and a large quantity) this choice can cause the calculated discount to vary, due to the rounding system used in Hansa. Please refer here for details and an example.

- The percentage entered here can act as a discount, margin factor or markup. This is controlled using the General Options setting in the System module.

- Sum

- The total for the row: Quantity multiplied by Unit Price less Discount. Changing this figure will cause the Discount Percentage to be recalculated. This figure will include VAT (and TAX) if the Price List specified is one that is Inclusive of VAT or if you have specified on card 1 of the Account Usage S/L setting that Base Prices include VAT (or VAT and TAX).

- This figure will be rounded up or down according to rounding rules set for the Currency in the Currency Round Off setting in the System module.

Flip B

- A/C

- Paste Special

Account register, Nominal Ledger/System module

- This code determines the Nominal Ledger Sales Account for this Item. The Nominal Ledger Transaction generated by this Invoice will credit the Account specified here. A default is offered, taken from the record in the Price register for the Item/Price List combination. If there is no such record, or it has no Sales Account specified, the default will be taken from the Item record, the Item Group or from card 3 of the Account Usage S/L setting. This default can be changed for a particular Invoice row if necessary.

- If the Payment Term (above) is of the "Credit Note" type and the Use Credit Sales Accounts option on card 1 of the Account Usage S/L setting is in use, a credit Sales Account will be used in place of the standard one. This will taken from the 'Credit A/C' card of the appropriate Item Group record or from card 4 of the Account Usage S/L setting.

- Accrual

- Paste Special

N/L Accruals setting, Nominal Ledger

- Please refer to the Accruals page for details of this field and an illustrated example.

- Objects

- Paste Special

Object register, Nominal Ledger/System module

- Default taken from Item

- Up to 20 Objects, separated by commas, can be assigned to this Item and all transactions generated from it. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- In the Nominal Ledger Transaction generated from this Invoice, any Objects specified here will be assigned to the credit posting to the Sales Account and, if cost accounting is being used, the debit posting to the Cost Account. This assignment will merge these Objects with those of the parent Invoice (shown on the 'Terms' card).

- V-Cd

- Paste Special

VAT Codes setting, Nominal Ledger

- The VAT Code entered here determines the rate at which VAT will be charged on this Item and the VAT Account to be credited. A default is offered, taken from the Customer record. If none is specified, the default is taken from the Item, the Item Group or from card 3 of the Account Usage S/L setting. This default can be changed for a particular Invoice row if necessary.

- If the Payment Term (above) is of the "Credit Note" type and the Use Credit Sales Accounts option on card 1 of the Account Usage S/L setting is in use, a credit VAT Code will be used in place of the standard one. This will taken from the 'Credit A/C' card of the appropriate Item Group record or from card 4 of the Account Usage S/L setting.

- If you have checked the VAT Code Control option on card 1 of the Account Usage S/L setting, the VAT Code specified here must be the same as that specified for the Sales Account in the Account register. If the VAT Codes don't match, you will not be able to save the Invoice.

Flip C

- Cost

- Default taken from

Item (Cost Price + Extra Cost)

- The unit Cost Price is used in Gross Profit and Margin calculations. It can be altered if necessary.

- GP

- The Gross Profit for the Invoice row is calculated by subtracting the Cost Price (multiplied by the Quantity) from the Sum. The figure is therefore absolute, not a percentage.

- FIFO

- The average FIFO unit cost of the Items on this row. The total FIFO stock value of the Items on this Invoice row is shown on flip D. These figures are brought in automatically when the Invoice is approved, but are only shown for Stocked Items in Invoices that have not been generated from a Sales Order. For Invoices that have been generated from a Sales Order, FIFO values are shown in the appropriate Delivery record.

Flip D

- Serial No.

- Paste Special

Serial Numbers of Items in stock

- If Serial Numbers are required for the Item, they can be entered here.

- Serial Numbered Items must be recorded on separate Invoice rows each with a Quantity of one. This enables the recording of separate Serial Numbers and their correct removal from stock.

- If no Location is specified, the 'Paste Special' list will show the Serial Numbers of Items in all Locations, with an indication of the Location in which each Item is stored. However, if you have specified a Location on the 'Identifiers' card, only those Serial Numbers stored in that Location will be shown.

- If you would like Best Before dates to be shown in the 'Paste Special' list, switch on the Show Best Before Dates option in the Item Settings setting in the Sales Ledger. Best Before Dates are entered using the Batch Specifications setting in the Stock module.

- The 'Paste Special' list will not be shown if you are using the No Serial No. on Goods Receipts option in the Stock Settings setting. In this case, you must still enter a Serial Number and the Quantity must still be one, but no check will be carried out that the Serial Number you have used is valid (i.e. one that is currently in stock).

- Note that Serial Numbers must be allocated manually: there is no automatic FIFO allocation.

- The Cost Price for Serial No option in the Cost Accounting setting in the Stock module controls how the choice of Serial Number affects the FIFO field on flip C and the value of any cost accounting element in the Nominal Ledger Transaction resulting from the Invoice. If this option is not in use, the oldest Cost Price will be shown in the FIFO field, even where the Serial Number chosen is not the oldest one. If this option is in use, the actual Cost Price of the selected Serial Number will be shown in the FIFO field.

- P.Factor

- Default taken from

Item

- A Price Factor can be used to recalculate the Unit Price of an Item. For example, if the Item is normally purchased in boxes with 24 units, the Price Factor 24 can be entered in the Item record. The Unit Price for the Item will then refer to a box of 24 units. The Price Factor will be brought in to the Invoice from the Item and affect the Sum in an appropriate manner. It can be altered and Hansa will recalculate the Sum accordingly. The formula used is Sum = (Quantity/Price Factor) * Unit Price.

- Recipe

- Paste Special

Recipes setting, Stock module

- Default taken from Item

- If the Item is a Structured Item, its Recipe is recorded here, brought in from the Item record. A Structured Item is essentially an Item which is assembled by your company from purchased components: its Recipe lists those components with quantities. Recipes are set up using a setting in the Stock module.

- Row FIFO

- The total FIFO stock value of the Items on this Invoice row. This figure is brought in automatically when the Invoice is approved, but is only shown for Stocked Items in Invoices that have not been generated from a Sales Order. For Invoices that have been generated from a Sales Order, FIFO values are shown in the appropriate Delivery record.

- Coeff

- Default taken from

Item

- The Unit Coefficient of the Item is shown here, taken from the 'Stock' card of the Item. If you are maintaining stock quantities using different units of measurement, this coefficient is the ratio between those units of measurement.

Flip E

- Unit, Unit Qty, Unit Pr. of Unit

- These fields allow you to sell an Item using a different Unit to that specified on the 'Pricing' card of the Item record.

- When a Unit that has a Qty Factor is entered here, the Quantity and pricing for the Invoice row will change accordingly. For example, an Item is usually sold in single units. If you sell two dozen of them, you can enter the Unit representing one dozen (i.e. its Qty Factor is "12") in this Unit field and "2" in the Unit Qty field. The Quantity on flip A will change to "24" (i.e. 2 x 12) and the pricing will be adjusted accordingly. The Unit Price of Unit field will show the price for one dozen (i.e. the price of one of the new Unit).

- Use 'Paste Special' from the Unit field to choose from a list of Units.

- Use the 'Recalculate Weight and Volume' function on the Operations menu to update the Total Quantity, Weight and Volume on the 'Delivery' card of the Invoice.

- Width, Height, Depth

- Default taken from

Item

- These fields contain the dimensions of the Item. They can be used together with the Unit Qty field if the Item is sold by area or volume. Please refer to the description of the Units setting for details and an example.

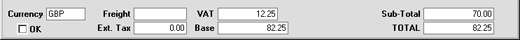

Footer

In addition to the Currency, the Invoice Footer contains various running totals as described below. Whenever an Invoice row is added or changed, these totals are updated.

- OK

- Checking this box approves the Invoice and causes it to be entered in the Sales Ledger. A corresponding transaction will also be created in the Nominal Ledger. If the Stock module is present and the Invoice was entered directly (rather than created from a Sales Order), stock levels of any Stocked Items on the Invoice will be adjusted. Because of these consequences, once this box has been checked and the Invoice saved, you will no longer be able to make changes to the Invoice. Exceptions to this rule are the Reminder Level and Last Reminder Date fields and the No Interest, No Reminder and Disputed check boxes on the 'Delivery' card and the Salesman field on the 'Terms' card.

- References in these web pages to approved Invoices are to Invoices whose OK check box has been switched on.

- Currency

- Paste Special

Currency register, System module

- Default taken from Customer or Default Base Currency

- The Currency of the Invoice: the exchange rate is shown on the 'Currency' card where it can be modified only for this particular Invoice if necessary. Ensure that the correct Currency is shown before any Items are added to the Invoice so that prices are converted correctly. If you forget, the 'Update Currency Price List Items' function is available on the Operations menu which retrospectively converts the prices of Items added to the Invoice before the Currency was specified (save the Invoice before selecting this function). Leave the field blank to use the home Currency (unless you have set a Default Base Currency, in which case this will be offered as a default and should be treated as your home Currency).

- If the Customer record has a Currency specified on the 'Pricing' card, only that Currency can be used. Otherwise, any Currency can be used.

- Freight

- The Freight setting can be used to attach a fixed amount for Freight to each Invoice (or a calculated amount based on the total weight of the Items on the Invoice). If this is being used, the appropriate amount will be placed in this field on the entry of a Customer Number (or when the Quantity is changed in one of the rows). This figure can be altered if necessary. The VAT Code and the Sales Account for the freight charge will be taken from the Item entered in the Freight setting.

- If the Freight setting is not being used, enter a freight amount if applicable. In this case, VAT will not be charged and the amount will be posted to the appropriate Sales Account for the Zone of the Customer, set on card 3 of the Account Usage S/L setting.

- Ext. Tax

- When defining VAT Code records using the setting in the Nominal Ledger, it is possible to specify that an additional tax, such as an environmental tax, be levied. If the VAT Code of any of the rows of the Invoice is one where such an additional tax has been defined, the amount of that tax will be shown in this field. That amount will be recalculated as Items are added to the Invoice. When the Invoice is approved, this Extra Tax will be credited to the Tax 1 Account specified for the appropriate VAT Code.

- VAT

- The VAT total for the Invoice.

- This figure is rounded up or down according to rounding rules set for the Currency (in the Currency Round Off setting in the System module). If no Currency has been specified, or the Currency in question has not been entered in the Currency Round Off setting, the rounding rules are taken from the Round Off setting (also in the System module).

- In the Nominal Ledger Transaction resulting from this Invoice, any amounts lost or gained in this rounding process are posted to the Round Off Account specified in the Account Usage S/L setting.

- VAT is calculated after the Sum of each row has been rounded up or down according to rounding rules set in the Currency Round Off setting.

- Base

- This shows the Invoice total including VAT in the home Currency (or in Base Currency 1 as defined in the Base Currency setting in the System Module). It is only used if the Currency of the Invoice is not blank and is not Base Currency 1.

- Sub-Total

- The total for the Invoice, excluding VAT.

- TOTAL

- The total for the Invoice, including VAT.

- This figure is rounded up or down according to rounding rules set for the Currency (in the Currency Round Off setting in the System module). If no Currency has been specified, or the Currency in question has not been entered in the Currency Round Off setting, the rounding rules are taken from the Round Off setting (also in the System module). In the Nominal Ledger Transaction resulting from this Invoice, any amounts lost or gained in this rounding process are posted to the Round Off Account specified in the Account Usage S/L setting.

|