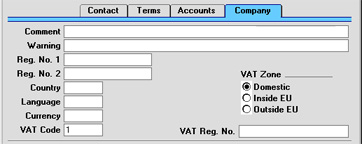

Entering a Supplier - Company Card

Comment

This field can be used to record any additional information about the Supplier.

Warning

Text entered here will appear as a warning to alert users whenever a Purchase Order or Invoice is entered for this Supplier.

Reg No 1

If the Supplier is a limited company, enter their Company Registration Number here.

Reg No 2

Paste Special Registration Defaults setting, Sales Ledger

This field is used in Finland, where companies have two registration numbers.

Elsewhere, the 'Paste Special' link to the Registration Defaults setting can be used to bring in a default VAT Code and Language.

Country

Paste Special Countries setting, System module

Specify a code for the Country in which the Supplier is located. Once this has been specified, entering a VAT Number below will cause Hansa to check it is in the correct format for the Country. VAT Number formats are defined in the VAT Number Masks setting in the System module.

Language

Paste Special Languages setting, System module

Enter the Language of the Supplier here. Some of the information shown in the Purchase Invoice record and on printed documents, such as Account Names, Payment Terms and Delivery Modes, will appear in the appropriate translation if that translation exists in the appropriate registers and settings.

Currency

Paste Special Currency register, System module

Used as default in Purchase Orders, Purchase Invoices

Specify here the Currency used by this Supplier on its Invoices. When entering Purchase Orders manually, all prices of Items will be converted from the home Currency to that specified here using the agreed Exchange Rate. When Purchase Orders for this Supplier are created using the automated 'Create Purchase Orders' function, the Currency specified here will be used.

Hansa will prevent the entry of Purchase Orders, Purchase Invoices and Payments in the name of this Supplier using Currencies other than that specified here. If you need to be able to use more than one Currency with a particular Supplier, leave this field blank.

Once a Currency has been entered in this field and the Supplier has been used in a transaction of any kind, this Currency should not be changed.

VAT Code

Paste Special VAT Codes setting, Nominal Ledger

The VAT Code entered here refers to a VAT Code record entered using the VAT Codes setting in the Nominal Ledger. It determines the rate at which VAT will be charged by this Supplier and the VAT Account to be debited.

When entering Purchase Invoices for this Supplier directly to the Purchase Invoice register, in determining which VAT Code is to be used, that entered here will take precedence over that specified in the Account Usage P/L setting in the Purchase Ledger, but will be overridden by the VAT Code specified for the Accounts).

Similarly, when creating Purchase Invoices for this Supplier from Goods Receipts, the VAT Code entered here will take precedence over that specified in the Account Usage P/L setting in the Purchase Ledger, but will be overridden by the VAT Code specified for the Item(s). If the Calculate VAT box is checked in the Purchase Invoice Settings setting in the Purchase Ledger, VAT will be calculated from the overall value of the Goods Receipt using the VAT Rate in that setting. Otherwise, VAT will be calculated using the VAT Codes on each row.

VAT Zone

Used as default in Purchase Orders, Purchase Invoices

Select a Zone for this Supplier. This will be used in Purchase Orders and Invoices to control VAT calculation and accounting. Separate default VAT Codes can be assigned to each Zone on card 3 of the Account Usage P/L setting in the Purchase Ledger.

VAT Reg. No.

It is important that the Supplier's VAT Number is recorded here if they are in the "Within EU" Zone as this information is required for EU VAT reporting purposes.

A check is made when the record is saved that the VAT Number has not been used in any other Supplier. If this check fails, you can find the other Supplier by searching for the VAT Number in the Supplier List report (Detailed version).

Hansa contains a feature whereby it will check that the VAT Number entered here is in the correct format for the Supplier's Country. The correct format should be defined in the VAT Number Masks setting in the System module. If the Country is blank, the Country from the Company Info setting will be used. If that is blank, no validation check will be made.

Because of this feature, be sure to enter the Supplier's Country above before their VAT Number.

|