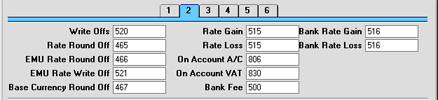

Account Usage S/L - Card 2

Many of the Accounts on this screen are used when the process of creating Nominal Ledger Transactions from Sales Invoices and Receipts involves a currency conversion. Please refer to

this page for full details.

- Write Offs, Rate Round Off, EMU Rate Round Off, EMU Rate Write Off

- These Accounts are used in the situation where an Invoice is to be treated as fully paid if the amount received is slightly different to that outstanding, providing that difference is within an allowable margin. The difference is posted to one of these Accounts on the following basis:

- Write Offs

- if the Received Currency is the same as the Invoice Currency, and the Received Currency is not a member of the EMU;

- Rate Round Off

- if the Received Currency is different to the Invoice Currency, and the Received Currency is not a member of the EMU;

- EMU Rate Round Off

- if the Received Currency is different to the Invoice Currency, and the Received Currency is a member of the EMU;

- EMU Rate Write Off

- if the Received Currency is the same as the Invoice Currency, and the Received Currency is a member of the EMU.

- The allowable margin is set in the Currency register. If this is done for the record representing the home Currency, this feature can also be used as an easy way of automatically writing off small outstanding amounts in domestic Invoices (i.e. those in the home Currency), reducing the need to use the 'Write off Invoices' Maintenance function.

- Please refer to the pages describing the 'EMU' and 'Round Off' cards of the Currency screen for more details about using this feature.

- Note that in the special case where the difference is caused by a change in Base Rate, it will not be posted to one of these Accounts, but to the Rate Gain or Loss Account.

- A more common use of the Write Offs Account will be for bad debts written off by the 'New Write-off' Operations menu function of the Receipt and by the 'Write off Invoices' Maintenance function.

- On Account A/C

- If you receive Prepayments or On Account Receipts from a particular Customer without reference to a specific Invoice (usually before you have raised the Invoice), you may want to use a special Account for such Receipts. Specify that Account here, and switch on the On Account check box on the 'Terms' card of the Customer in question. When a Prepayment or On Account Receipt is entered and approved, its value will be credited to this Account.

- The Account specified here will be overridden if a separate such Account has been specified for the Customer Category of the Customer.

- On Account VAT

- This field is used when the Nominal Ledger Transactions from On Account Receipts and Prepayments are to include a VAT element. This is the case in Russia and for users of the Cash VAT scheme in the UK. When a Prepayment or On Account Receipt is entered, the VAT Code and Amount should be specified on flip E. If the VAT Code field contains a value, the VAT Amount will be debited to this Account and credited to the O/P Account for the VAT Code (or the Output Account if the O/P Account is blank) when the Receipt is approved and saved.

- Bank Fee

- Enter here the Account Code of the Account to be credited by any bank charges that you may incur when banking Receipts.