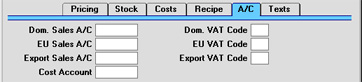

Entering an Item - A/C Card

- Sales Accounts

- Paste Special

Account register, Nominal Ledger/System module

- When using this Item in Orders or Invoices, one of the three Sales Accounts entered here is offered as a default, depending on the Zone of the Customer. It will override any Sales Accounts specified for the Item Group or in the Account Usage S/L setting. If there is a record in the Price register for the appropriate Item/Price List combination which has a Sales Account specified, that Sales Account will take precedence over the one entered here.

- The Accounts specified here will usually be used in both Invoices and Credit Notes. If you would like to use different Accounts in Credit Notes, these should be specified on the 'Credit A/C' cards of your Item Group records and on card 4 of the Account Usage S/L setting. You should also check the Use Credit Sales Accounts box on card 1 of the Account Usage S/L setting.

- VAT Codes

- Paste Special

VAT Codes setting, Nominal Ledger

- When entering Orders or Invoices and including this Item, one of the three VAT Codes entered here will be offered as a default, depending on the Zone of the Customer. It will override any VAT Code specified for the Item Group or in the Account Usage S/L setting. However, if the Customer has a VAT Code specified, that will take precedence over any entry here.

- This Code will determine the rate at which VAT will be calculated for this Item when it is bought or sold and the Accounts to be debited and credited respectively with the VAT amount.

- The VAT Codes specified here will usually be used in both Invoices and Credit Notes. If you would like to use different VAT Codes in Credit Notes, these should be specified on the 'Credit A/C' cards of your Item Group records and on card 4 of the Account Usage S/L setting. You should also check the Use Credit Sales Accounts box on card 1 of the Account Usage S/L setting.

- Cost Account

- Paste Special

Account register, Nominal Ledger/System module

- If you are maintaining stock valuations in the Nominal Ledger, specify here the Account to be debited with the calculated cost of goods when examples of this Item are sold (removed from stock). The cost of goods is calculated using the Cost Model chosen in the Cost Model setting in the Sales Ledger. If blank, the Stock Cost Account on card 5 of the Account Usage S/L setting will be debited.

- This Account will usually be used as described above if the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module is not in use.

- Please refer to the Cost Accounting page for full details of when this field is used.