Switching Cost Accounting On

For cost accounting to operate, follow these steps:

- Using the 'Purchase Cost' and 'Stock' cards of the Account Usage Stock setting, define a Purchase Accruals Account, a Stock Account and a Cost Account (i.e. Cost of Sales Account). You should specify Purchase Accruals and Cost Accounts for each Zone. These Accounts will be used as defaults in the event that you have not defined equivalent Accounts for a particular Item, Item Group or Location. The roles of these Accounts are described on the Cost Accounting Transactions from Goods Receipts and Cost Accounting Transactions from Deliveries and Invoices pages. In the same setting, you should also define Extra Cost, Freight Accrual and Customs Accrual Accounts.

- If you have more than one Location where stock will be stored, enter these using the Locations setting in the Stock module. For each Location, you can define a separate Stock Account to be debited whenever stock is received into the Location and credited when stock is delivered.

If you are using Locations, it is recommended that you either switch on the Require Location option or specify a Main Location (both in the Stock Settings setting in the Stock module). This will ensure that you always specify a Location when adding or removing stock.

- In the Cost Accounting setting in the Stock module, specify the default Cost Model. This will be used to calculate cost values in outgoing stock transactions, if you have specified in your Items and Item Groups that the default Cost Model is to be used. The different Cost Model options are fully described on the page describing the Cost Accounting setting.

- Having defined default Accounts in step 1 above and a default Cost Model in step 3, you can if necessary define separate Accounts and Cost Models in each Item Group and in each Item (Cost Account and Cost Model only). If you want to do this in each Item Group, switch on the Use Item Groups for Cost Accounts and Use Item Groups for Cost Model options in the Cost Accounting) setting. If you do not switch on these options, the Accounts and Cost Models specified in Item Groups will play no part in your cost accounting structure.

- If you are using the Sales Orders module, you can decide whether you want outgoing cost accounting postings (Cost of Sales postings) to be made from Invoices or from Deliveries. If you want them to be made from Invoices, check the Don't Post Cost From Deliveries option in the Cost Accounting_Part_2 setting, and the Invoices Update Stock option in the Account Usage S/L setting. This will usually be the case in the UK where the dates of sales transactions and related Cost of Sales postings should be the same. This will also be the case if you are not using the Sales Orders module and therefore will not create Delivery records. If you want Cost of Sales postings to be made from Deliveries, do not check the Don't Post Cost From Deliveries option in the Cost Accounting setting, but it is still a good idea to check the Invoices Update Stock option, just in case you sell a Stocked Item from an Invoice without a Sales Order (i.e. where there is no Delivery).

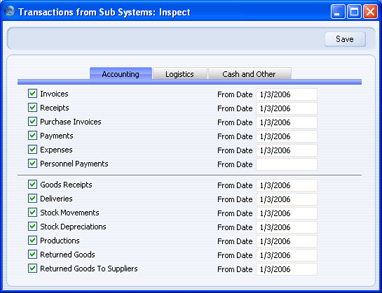

- Use the Sub Systems setting in the Nominal Ledger to specify that cost accounting transactions will be created in the Nominal Ledger when you approve Goods Receipts, Invoices, Returned Goods, Returned Goods to Supplier records and, if you so decided in step 5 above, Deliveries.

If you would like outgoing cost accounting postings (Cost of Sales postings) to be created when you approve Deliveries, switch on the Deliveries option. Otherwise, switch off the Deliveries option to ensure these postings will be created when you approve Invoices, (you must also switch on the Invoices Update Stock option as described in step 5 above). You should always switch on the Invoices option (even if Cost of Sales postings will be made from Deliveries) because otherwise you will prevent posting to the Sales, VAT and Debtor Accounts as well.

If you are using the Service Orders module, you should also switch on the Work Sheets option on the 'Cash and Other' card. Cost of Sales postings will not be created from Service Order Invoices, so if you need them they must be created from Work Sheets. These transactions will update the Nominal Ledger stock valuation when you remove spare parts from stock to effect repairs.

You should also switch on the Goods Receipts option. This will ensure inward cost accounting postings are made, to balance the outward postings made on Invoice or Delivery. As a result, an inward movement will see a Purchase Accruals Account being credited and a Stock Account being debited, while an outward movement will credit the Stock Account and debit a Cost Account.

- If you will be using Item Groups, define them as described here. In each Group, you can define Cost, Purchase Accruals and Stock Accounts and choose a Cost Model option, if the Item Group is not to use the defaults set in steps 1 and 3 above. If you want Accounts and/or Cost Model to be taken from Item Groups, switch on Use Item Groups for Cost Accounts and/or Use Item Groups for Cost Model options in the Cost Accounting setting, as described in step 4 above. If you are not using these options, the Accounts and Cost Models specified in Item Groups will play no part in your cost accounting structure. Although cost accounting transactions will be created for Items that do not belong to Item Groups, management of the system is easier using Item Groups since it is simple to change Cost Accounts and Cost Models for a particular Item Group.

- Ensure that each Item for which cost accounting transactions are to be created have been defined as Stocked Items using the option on the 'Pricing' card of the Item screen. If you are using the Use Item Groups for Cost Accounts and/or Use Item Groups for Cost Model options, allocate all Stocked Items to Item Groups. You can also specify a special Cost Account (on the 'A/C' card) and/or Cost Model (on the 'Cost Model' card) for a particular Item, to be used in place of the defaults set in steps 1 and 3. Cost accounting transactions will not usually be created for Plain and Service Items, unless you are using the Cost Accounting for Plain Items option in the Cost Accounting_Part_2 setting.

- Further cost accounting attributes are set using the Cost Accounting setting in the Stock module: please click here for full details.

|