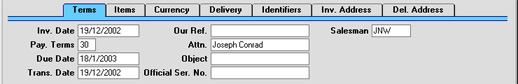

Entering an Invoice - Terms Card

- Invoice Date

- Paste Special

Current Date

- The current date according to the computer's clock is entered as a default.

- Our Ref.

- Use this field if you need to identify the Invoice by means other than the Invoice Number. A default will be taken from the Our Ref field on the 'Ser Nos' card of the Person record of the current user.

- Salesman

- Paste Special

Person register, System module

- Default taken from Customer or current user

- The Salesman responsible for the sale should be registered here: there are many reports in the Sales Ledger which can be broken down by Salesman. It is also possible to assign commission on Items sold, using the Bonus setting, the Bonus % field on the 'Pricing' card of the Item screen or the Bonus field on the 'Bonus' card of the Person screen. The Salesman can be changed after the Invoice has been approved.

- Pay Terms

- Paste Special

Payment Terms setting, Sales/Purchase Ledger

- Default taken from Customer

- Payment Terms entered here will determine the Due Date (below), in addition simply to ensuring that the correct Payment Terms appear on Invoices (in the Language of the Customer if necessary). Payment Terms records entered using the Sales Ledger setting can enable a system of early settlement discounts to be established.

- Specifying Payment Terms for each Invoice provides the basis for the debt-chasing reports provided in Hansa.

- Payment Terms are also the means by which Cash Notes and Credit Notes are distinguished from ordinary Invoices. Using 'Paste Special', select a Payment Term record of the "Cash" or "Credit Note" type respectively. When the record is then approved and saved, the appropriate Nominal Ledger Transaction will be created. In the case of Cash Notes, this will debit the Cash Account (as specified in the Account Usage S/L setting) rather than the Debtor Account, while in the case of Credit Notes, the Transaction will be a reversal of the original Invoice Transaction.

- Cash Notes are immediately treated as paid and so will not appear in your debtor reports. There is no need to enter a payment against them.

- When a Payment Term of the "Credit Note" type is selected, a crediting message is entered in the first row of the grid area. Enter the number of the Invoice to be credited, using 'Paste Special' if necessary to bring up a list of open (unpaid) Invoices. If the Use Credit Sales Accounts option on card 1 of the Account Usage S/L setting is in use, credit Sales Accounts and VAT Codes will be used in place of the standard ones. These will taken from the 'Credit A/C' card of the appropriate Item Group record or from card 4 of the Account Usage S/L setting. If the Credit Note was created by copying an Invoice, changing the Payment Terms to "CN" will cause the Sales Accounts and VAT Codes of the existing Items to be changed automatically.

- If a "Cash" or "Credit Note" Payment Term is used, the Invoice will not use the standard Invoice document when printed. Instead, the Cash Note or Credit Note (respectively) document will be used. Please refer to the Printing Invoices page for more details.

- In the Baltic States, in some circumstances Invoices should follow the same number sequence as that used by Receipts and Cash In records. For this to happen, define the number sequences using the left-hand From and To fields on flip C of the Payment Modes setting and check the Common Number Series box in the Cash Book Settings setting in the Cash Book module. Then, enter a Payment Mode to this field: the Invoice Number will change to one in the correct sequence. When the Invoice is approved, it is treated as paid and no posting to a Debtor Account is made. Instead, a debit posting is made to the Account of the Payment Mode (i.e. a bank or cash Account). In some installations, Payment Modes may be shown in the 'Paste Special' list.

- Attn.

- Paste Special

Contact Persons setting, Sales Ledger

- Default taken from Customer

- Record here the person for whose attention the Invoice is to be marked.

- Due Date

- Paste Special

Current Date

- This is calculated by Hansa using the Invoice Date and the Payment Term. It is the date on which the Invoice becomes due for payment.

- If the Payment Term is one with instalments, the Due Date of the final instalment is shown here.

- Object

- Paste Special

Object register, System module

- Up to 20 Objects, separated by commas, can be assigned to this Invoice and all transactions generated from it. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- In any Nominal Ledger Transactions generated from this Invoice, any Objects specified here will be assigned to the credit posting to the Sales Account(s), the debit posting to the Cost Account (if cost accounting is being used), and the debit posting to the Debtor Account (if the Objects on Debtor Account option in the Account Usage S/L setting is being used).

- Any Objects specified for the Customer will be copied here as a default, as will any Objects specified in the Person record for the current user.

- Trans. Date

- The Transaction Date for the Nominal Ledger Transaction. This is always the same as the Invoice Date and cannot be changed independently.

- Official Ser. No.

- Paste Special

Next number in number sequence

- In some countries it is a legal requirement to allocate an official serial number to each Invoice. This number may be supplied pre-printed on Invoice stationery. The number sequence allocated to your company should be entered in the Official Invoice Serial Number setting: the next unused number from that sequence will appear here by default. This can be changed: Hansa will check when the Invoice is saved that the new number is in the sequence, and future Invoices will continue the sequence from that new number.

- The Official Serial Number is shown in the 'Paste Open Invoices' window. Therefore, you will be able to allocate payments to Invoices using the Invoice Number or the Official Serial Number.

|