Interest

You can charge interest on overdue Invoices (those which remain unpaid once the Payment Terms have expired).

Interest Invoices are raised using the 'Create Interest Invoices' Maintenance function. Each time this function is run, it will create one new Invoice (an "Interest Invoice") for each Customer with an overdue Invoice. The Customer will be charged interest on each overdue Invoice, and can also be charged an invoicing fee (levied once per Interest Invoice, irrespective of the number of overdue Invoices).

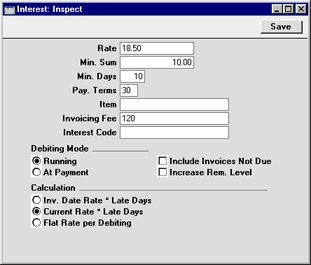

The operation of the 'Create Interest Invoices' function is controlled by this setting. Here you should determine the interest rate, the minimum amount that you wish to charge, the minimum numbers of days delayed, the Payment Terms for the Interest Invoice and the interest calculation method.

Check the Interest box on the 'Terms' card of the Customer screen for each Customer that is to be charged interest for late payment.

! | If the Interest box is not checked for a Customer, no Interest Invoices will be issued to them by Hansa, no matter how late their payments are. |

|

- Rate

- Enter the rate of interest to be used in interest calculations.

- If you are using the first or second Calculation option (below), enter an annual rate of interest. If you are using the third Calculation method, enter the interest rate that you wish to charge each time you raise an Interest Invoice.

- If an Interest Rate has been specified on the 'Terms' card of a Customer record, that figure will be used instead of the one specified here.

- Min. Sum

- You can indicate a minimum amount to charge. If the total interest (on all overdue Invoices and including any invoicing fee) chargeable to a Customer is less than this minimum figure, no Interest Invoice will be raised.

- Min. Days

- This field is only used if the Debiting Mode (below) is At Payment. Enter the lowest number of days overdue needed before an Interest Invoice can be created.

- For example, if the Min. Days is 5, interest will not be charged on an Invoice that is paid when it is overdue by four days. If the Invoice is paid when it is overdue by six days, interest will be charged for all six days.

- Pay Terms

- Paste Special

Payment Terms setting, Sales/Purchase Ledger

- Select the Payment Terms to be used for Interest Invoices. If left blank, the normal Payment Terms for the Customer will be used.

- Interest Item

- Paste Special

Item register

- An Item in the Item register. This Item will control the accounting of interest charges (Sales Account and VAT Code). This applies both when the Interest Rate is taken from the field above and when it is taken from the 'Terms' card of the Customer.

- Invoicing Fee

- Paste Special

Item register

- An Item in the Item register. The Base Price of this Item will be added to the Invoice as an invoicing fee (if any). This Item will also control the accounting of that invoicing fee (Sales Account and VAT Code). The invoicing fee is charged once per Interest Invoice, irrespective of the number of overdue Invoices.

- Debiting Mode

- Use these options to control when interest is to be charged on overdue Invoices.

- Running

- Interest Invoices are raised before the overdue Invoice is paid. Very late Invoices may therefore cause more than one Interest Invoice to be raised.

- For example, an Invoice becomes due on March 25th and is paid on May 10th. If you run the 'Create Interest Invoices' function at the end of every month, interest will be charged three times: at the end of March (for six days), at the end of April (for 30 days) and at the end of May (for nine days, making a total of 45 days).

- At Payment

- The Interest Invoice is not raised until the overdue Invoice is paid, so it will contain a single interest charge for the entire overdue period.

- In the example above, interest will be charged once at the end of May, for the whole overdue period of 45 days.

- Include Invoices Not Due

- Check this box if you would like Invoices which are not yet due for payment (i.e. unpaid Invoices whose Payment Terms have not yet expired) to be listed in Interest Invoices. Interest will not be charged on these Invoices. You might use this option if you want your Interest Invoices to act as statements as well.

- This option should only be used if the Debiting Mode (above) is Running. Make sure this check box is switched off if your Debiting Mode is At Payment.

- Increase Reminder Level

- Each Invoice contains a code (the Reminder Level) that indicates the number of times it has been subject to a Reminder, or included on a Customer statement. Check this box if you also want the Reminder Level to be updated when an Interest Invoice is raised.

- When sending Reminders the Reminder Level determines the message to be printed on the Reminder. These messages are entered using the Texts for Reminders setting.

- The Reminder Level for each Invoice is visible on the 'Delivery' card of the Invoice screen.

- Calculation

- Select one option to determine how the interest is to be calculated.

- Invoice Date Rate * Late Days

- Interest is calculated based on the interest rate valid on the day when the original Invoice was issued. This interest rate is taken from the 'Delivery' card of the Invoice, and is treated as an annual rate.

- For example, the interest rate is 18.5%. An Invoice for 117.50 (including VAT) becomes due for payment on March 25th. Assuming the Min. Days to be zero, interest will be charged for the last six days of March as follows:

- 117.50 x 18.5% x 6/365 = 0.36

- Interest will be charged for April as follows:

- 117.50 x 18.5% x 30/365 = 1.79

- If the original Invoice is paid on May 10th, interest will be charged for the first nine days of May as follows:

- 117.50 x 18.5% x 9/365 = 0.54

- Current Date Rate * Late Days

- This option is similar to the one above, with one exception. It uses the interest rate valid on the day when the Interest Invoice is issued. This interest rate is taken from the 'Terms' card of the Customer record or, if that is blank, from this setting.

- Flat Rate Per Debiting

- Use this option if interest is to be charged based simply on the fact that an Invoice is overdue, not on the number of days it is overdue. In this case, the interest rate is an absolute rate, not an annual figure.

- This option uses the interest rate valid on the day when the Interest Invoice is issued, taken from the 'Terms' card of the Customer record or, if that is blank, from this setting.

- Using the example above, interest will be charged for the last six days of March as follows:

- 117.50 x 18.5% = 21.74

- Interest will be charged for April as follows:

- 117.50 x 18.5% = 21.74

- If the original Invoice is paid on May 10th, interest will be charged for the first nine days of May as follows:

- 117.50 x 18.5% = 21.74