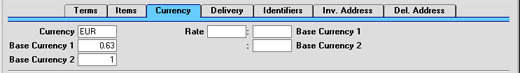

Entering an Invoice - Currency Card

- Currency

- Paste Special

Currency register, System module

- Default taken from Customer or Default Base Currency

- The Currency of the Invoice (also shown in the footer of the 'Items' card) is shown together with the exchange rate which can be modified only for this particular Invoice if necessary. Ensure that the correct Currency is shown before any Items are added to the Invoice so that prices are converted correctly. If you forget, the 'Update Currency Price List Items' function is available on the Operations menu which retrospectively converts the prices of Items added to the Invoice before the Currency was specified (save the Invoice before using this function). Leave the field blank to use the home Currency (unless you have set a Default Base Currency, in which case this will be offered as a default and should be treated as your home Currency).

- Exchange Rates

- Default taken from

Base Currency Rates setting and/or Exchange Rate register, System module

- The current exchange rates for the specified Currency will be entered to this card by Hansa. Ensure that they are correct before adding Items to the Invoice to ensure the correct currency conversion takes place.

- In the case of Invoices in Currency created from Orders, the exchange rates shown here will be those specified for the Order if the Update Base Cur when Invoicing and Update Foreign Cur. when Invoicing options in the Account Usage S/L setting are not in use. Otherwise, the latest Base and Exchange Rates will be used, although the prices in Currency of the Items will not be changed. This means the Customer will still be charged the agreed price, but the value of the Invoice in the home Currency (and therefore in the Nominal Ledger) will be different to that of the Order. If you want to update the pricing in the Invoice to reflect new Base and Exchange Rates (and therefore to maintain the original value in the home Currency in the Nominal Ledger), save the Invoice and then select 'Update Currency Price List Items' from the Operations menu.

- One of two conversion methods will be used. The Dual-Base system will be useful for companies that have offices in two countries that need to report in both Currencies, for companies operating in countries where there is a second Currency (usually the US Dollar or Euro) in common use in addition to the national one, and for companies in the Euro zone who retain their old national Currency for comparison purposes. The second method is a simple conversion from the foreign Currency to the home Currency, applicable to the majority of worldwide Currency transactions. These are described below.

- Exchange Rates (Dual-Base System)

- In the example shown above, the Currency of the Invoice is the Euro. Base Currency 1 is the home Currency (GBP, Pounds Sterling) and Base Currency 2 is the Euro. The fields on the left show in the form of a ratio the exchange rate between the two base Currencies (taken from the latest record in the Base Currency Rates setting). The illustration shows that GBP 0.63 buys one Euro.

- Note that European Monetary Union (EMU) regulations specify that the ratios must always show how many units of the home or foreign Currency can be bought with one Euro.

- Exchange Rates (Simple Currency Conversion System)

- In the case of a simple currency conversion system, the Rate and right-hand Base Currency 1 fields are used to show a simple exchange rate between the foreign and home Currencies. In the example shown below, the home Currency is US Dollars (USD) and the foreign Currency Japanese Yen (JPY). JPY 122.15 buys USD 1.00.

- Please click here for more examples.