Transactions in HansaWorld Enterprise - Sales Invoices

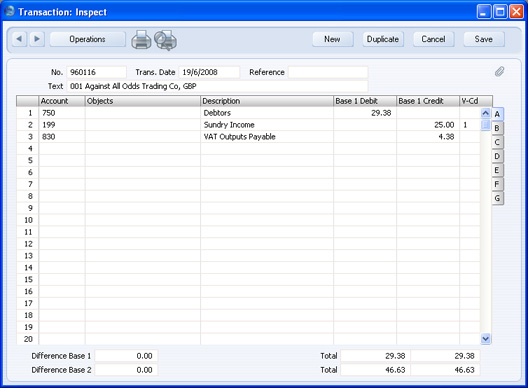

Invoices are demands for payment sent to Customers. You will create ("raise") them in the Sales Ledger, which therefore will keep track of how much is owed to your business by whom. The raising of an Invoice causes a Nominal Ledger Transaction to be created which debits the Debtor Account (which keeps a tally of how much your company is owed), credits a Sales Account (it is normal practice to maintain more than one Sales Account to keep a record of the sales of different types of product) and, in most cases, credits a VAT Account. Once you have raised Invoices in the Sales Ledger, the creation of the Nominal Ledger Transaction is handled automatically. Below is shown a typical such Transaction.

There are a number of methods that you can use to choose the Accounts that will be used in this Transaction. You can set the Debtor Account according to the Customer or Customer Category, you can use different Sales Accounts for the various Item Groups or individual Items, and you can control the VAT Account through the VAT Code. In addition, the Transaction can include Cost of Sales postings to the Stock and Cost of Sales Accounts. The number of options is great, and they are described in detail in this section.

Each individual Invoice, when approved, determines how the consequent Nominal Ledger Transaction is to be structured. The Accounts used are chosen as follows:

Sales Account

Sales Accounts record the levels of sales of different types of Items. To determine the Sales Account that will be used when you sell an Item, click flip B when you enter an Invoice. This reveals that you can specify a Sales Account for each row (in the column marked 'A/C'). Different Invoice rows can have different Sales Accounts.

When you add a row to an Invoice, a default Sales Account will be placed in the A/C field. You can overwrite this default if necessary. It is chosen as follows:

- When you enter an Item Number, if there is a Price List shown on the 'Delivery' card of the Invoice and there is a record in the Price register for that Item/Price List combination, the Sales Account will be taken from that Price record. If this Sales Account is blank, or there is no appropriate record in the Price register:

- The Sales Account will be taken from the relevant Item record (in the Item register). If this is blank:

- The Sales Account will be taken from the Item Group specified for the Item. If this is blank, or if no Item Group has been specified for the Item, or if no Item Code has been entered to the Invoice row:

- The Sales Account entered in the Account Usage S/L setting for the zone to which the Customer belongs will be used. There are three zones (Domestic, EU and Export), and each can have a different Sales Account.

If the selected Account is missing from the

Account register, you will be given the message "Sales Account missing, check Account Usage S/L" when you try to save the Invoice.

VAT Account

When you enter an Invoice, you must specify a VAT Code in each row. This code refers to a specific VAT Code record, which will determine the Output VAT Account in the subsequent Nominal Ledger Transaction and the rate at which VAT will be charged. Before entering Invoices, you should have entered the VAT Code records that you will need in the VAT Codes setting in the Nominal Ledger.

When you enter Invoice rows, you cannot leave the VAT Code field (marked 'V-Cd', visible on flip B) blank. A default will be placed in this field, chosen as follows:

- The Sales VAT Code in the record for the Customer in the Contact register will be used. Usually, you should only specify a Sales VAT Code for an individual Customer if for some reason your usual VAT accounting method does not apply to them (e.g. the Customer is a charity). If this is blank:

- When you enter an Item Number, the VAT Code entered for the relevant Item in the Item register will be used. If this is blank:

- The VAT Code will be taken from the Item Group specified for the Item. If this is blank, or if no Item Group has been specified for the Item, or if no Item Code has been entered to the Invoice row:

- The VAT Code entered in the Account Usage S/L setting for the zone to which the Customer belongs will be used.

If the selected VAT Code is missing from the

VAT Codes setting, you will be given the message "Code not registered" when you try to save the Invoice.

As shown in the illustration above, the VAT Code will be copied to the Transaction row crediting the Sales Account. If you would like it to be copied to the Transaction row crediting the VAT Output Account as well, use the Add VAT Code to VAT A/C rows option in the Transaction Settings setting in the Nominal Ledger.

Debtor Control Account

When you specify the Customer in an Invoice, a Debtor Account will be chosen and shown on the 'Delivery' card. You can overwrite this default if necessary. This Account will be chosen as follows:

- The Debtor Account specified in the Customer Category to which the Customer belongs will be used. If this is blank, or if the Customer does not belong to a Customer Category:

- The Debtor (or, if the Invoice is a cash Invoice, the Cash) Account entered in the Account Usage S/Lsetting will be used.

If the selected Account does not exist in the

Account register, you will be given the message "Account not registered" when you try to save the Invoice.

Stock Account and Cost Account

When you sell goods from stock, the Nominal Ledger Transaction created from the Invoice can include postings for the cost of goods, and for the stock outtake (together these two postings are known as "Cost Accounting" postings in HansaWorld Enterprise). You can specify that these postings will be made when you approve Invoices or when you approve Delivery Notes, or you can choose not to make these postings at all.

Cost accounting postings will usually only be made for Stocked Items. If you have specified that cost accounting postings will be made when you approve Invoices, this will mean that, in addition to posting to the Sales, VAT and Debtor Accounts, Nominal Ledger Transactions generated from Invoices will debit the specified Cost of Sales Account and credit the specified Stock Account. Further settings controlling the operation of cost accounting are discussed here and here.

The Cost of Sales Account debited by such cost accounting postings will be determined as follows:

- If you are not using the Use Item Groups for Cost Accounts option, the Cost Account for the Item will be used. This option is to be found in the Cost Accounting setting in the Stock module. If you are using this option, the Cost Account specified on the 'A/C' card of the Item Group to which the Item belongs will be used.

- In all other circumstances (e.g. the Cost Account for the Item or Item Group is blank), the Cost Account specified in the Account Usage Stock setting will be used.

The Stock Account credited by such cost accounting postings will be determined as follows:

- The Stock Account specified for the stock Location will be used. If this is blank, or if no stock Location is specified:

- If you are using the Use Item Groups for Cost Accounts option, the Stock Account specified on the 'A/C' card of the Item Group record will be used.

- In all other circumstances, the Stock Account specified in the Account Usage Stock setting will be used.

Various models (known as "Cost Models") are available by which the value of the cost accounting postings can be calculated (for example, cost price, FIFO price, weighted average cost price). You can use a different cost model for each

Item or

Item Group, or you can use a single default Cost Model. Full details can be found on the page describing the

Cost Accounting setting.

If any of the selected Accounts do not exist in the Account register, you will be given the messages "Cost Account missing" or "Stock Account missing" when you try to save the Invoice.

Round Off Account

If you are using the option to round the Invoice amount to the nearest whole monetary unit (Euro, Pound etc.), you must specify a Round Off Account in the Account Usage S/L setting. Optionally you can also specify a Round Off Loss Account in the same setting: if you do not, rounding gains and losses will both be posted to the Round Off Gain Account. To switch the rounding option on, use the Round Off and Currency Round Off settings in the System module.

This chapter describes the more common transactions as follows: