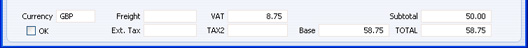

Entering a Sales Order - Items Card (Footer)

In addition to the Currency, the Order Footer contains various running totals as described below. Whenever an Order row is added or changed, these totals are updated.

- OK

- You can approve the Order by clicking this check box. Once you have done this and have saved the Order, it will no longer be modifiable. If you do need to change an approved Order, first remove the check from the OK box and save.

- You do not have to approve an Order to deliver goods from it, or for its Items to be included in the Order total displayed by the 'Item Status' function. Nevertheless, in larger systems, once you have finalised a Sales Order, it is recommended that you approve it for security reasons.

- You can use Access Groups to control who can approve Sales Orders, who can unapprove Sales Orders, who if anyone can create Deliveries from unapproved Sales Orders and who if anyone can receive Prepayments against unapproved Sales Orders. To do this, deny access to the 'OKing Orders', 'UnOK Orders', 'Disallow Delivery from not OKed Order' and 'Disallow Prepayment for not OKed Order' Actions respectively. The 'Delivery from Order' Action allows you to control the creation of Deliveries from both approved and unapproved Sales Orders.

- You can prevent the printing of Sales Orders that have not yet been approved. Taken together with the previous point, this helps prevent the fraudulent creation and printing of unauthorised Sales Orders. Please refer to the 'Printing Sales Orders' page for details.

- References in these web pages to approved Purchase Orders are to those whose OK check box has been switched on.

- Currency

- Paste Special

Currency register, System module

- Default taken from Contact (Sales Currency) or Default Base Currency

- The Currency of the Order: the exchange rate is shown on the 'Currency' card where you can change it for this particular Order if necessary. Leave the field blank to use the home Currency (unless you have set a Default Base Currency, in which case this will be offered as a default and should be treated as your home Currency).

- If the Contact record for the Customer has a Sales Currency specified on the 'Pricing' card, you can only use that Currency. Otherwise, you can use any Currency

- If you change the Currency after adding Items to the Order, the prices of those Items will be converted automatically and immediately using the appropriate Exchange Rate for the date of the Order. .

- Freight

- The Freight setting in the Sales Ledger allows a fixed amount for Freight to be added automatically to each Order (or a calculated amount based on the total weight of the Items on the Order). If you are using this setting, the appropriate amount will be placed in this field when you enter a Customer Number (or when you change the Quantity in one of the rows). You can change the figure if necessary. The VAT Code and the Sales Account for the freight charge will be taken from the Item entered in the Freight setting.

- If you are not using the Freight setting, enter a freight amount if applicable. In this case, VAT will not be charged and, and in the eventual Invoice, the amount will be posted to the appropriate Sales Account for the Zone of the Customer, set on the 'Sales' card of the Account Usage S/L setting.

- Ext. Tax

- When you define VAT Code records using the setting in the Nominal Ledger, you can specify that an additional tax, such as an environmental tax, is to be levied. If the VAT Code of any of the rows of the Order is one where you have defined such an additional tax, the amount of that tax will be shown in this field, in the Currency of the Order. That amount will be recalculated as you add Items to the Order. When you create an Invoice from the Order and then approve and save it, this Extra Tax will be credited to the Tax Account specified for the appropriate VAT Code. If you have specified a Tax Min. (minimum Extra Tax amount) for a VAT Code, and the Extra Tax in an Order is less than this minimum amount, this field will be blank. This field will also be blank if the Customer is one whose No Extra Tax box has been checked ('Terms' card).

- VAT

- The VAT total for the Order.

- This figure is rounded up or down according to rounding rules set for the Currency (in the Currency Round Off setting in the System module). If the Order does not have a Currency, or the Currency in question has not been entered in the Currency Round Off setting, the rounding rules are taken from the Round Off setting (also in the System module).

- VAT is calculated after the Sum of each row has been rounded up or down according to rounding rules set in the Currency Round Off setting.

- TAX2

- If the Order has a Region on its Del. Terms card, and the Region is one where a Regional Perception Tax is charged on at least one of the Items on the Order, the amount of that tax will be shown in this field, in the Currency of the Order. That amount will be recalculated as you add Items to the Order. When you create an Invoice from the Order and then approve and save it, this TAX2 will be credited to the Account specified in the appropriate Regional Perception Tax record. If you have specified a Min. (minimum Regional Perception Tax amount), and the TAX2 in an Order is less than this minimum amount, this field will be blank. This field will also be blank if the Customer is one whose No Region Perception box has been checked ('Terms' card).

- Base

- This shows the Order total including VAT in the home Currency (or in Base Currency 1 as defined in the Base Currency setting in the System module). It is not used if the Currency of the Order is blank.

- Subtotal

- The total for the Order, excluding VAT.

- TOTAL

- The total for the Order, including VAT.

- This figure is rounded up or down according to rounding rules set for the Currency (in the Currency Round Off setting in the System module). If the Order does not have a Currency, or the Currency in question has not been entered in the Currency Round Off setting, the rounding rules are taken from the Round Off setting (also in the System module).

|