Operations Menu - Create Purchase Invoice

To raise a Purchase Invoice from a Purchase Order, select 'Create Purchase Invoice' from the Operations menu. For the function to have any effect, you must first save all changes to the Purchase Order (use the [Save] button). In some cases (described later in this section), the Contact record for the Supplier must have a Cost Account specified on its

'Accounts' card. Usually, you must first have created an

approved Goods Receipt from the Purchase Order: exceptions to this are described later on this page.

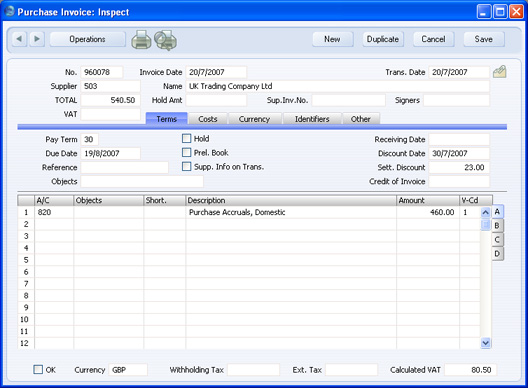

When you select the function, a new record will usually be created in the Purchase Invoice register (in the Purchase Ledger) and opened in a new window, entitled 'Purchase Invoice: Inspect'. This means that it has been created and saved and is being opened for amendment and approval. The exception is if you are using the Extra Costs Invoices from Different Suppliers option in the Purchase Order Settings setting: this situation is described towards the end of this section.

The Purchase Invoice takes its information from the Purchase Order, and, as a default, assumes that all previously uninvoiced Items on

approved Goods Receipts related to the Purchase Order are to be invoiced. The appearance of the Purchase Invoice will be determined by the set of Purchase Order Item Transfer Control options in the

Purchase Invoice Settings setting in the Purchase Ledger. These options operate in the following manner:

- Consolidate Items to Supplier Cost Account

- The ordered Items are grouped together on a single row on the Invoice indicating that they are to be posted to the same Cost Account (taken from the Cost Account on the 'Accounts' card of the Contact record for the Supplier). If the Items on the Purchase Order have different VAT Codes, there will be a separate row on the Invoice for each VAT Code. Objects specified in Purchase Order rows will not be transferred to the Invoice.

- Consolidate by Items and Project

- The Purchase Invoice will feature a separate row for each received Item/Project/Object combination on the Purchase Order. The Cost Accounts will be the Purchase Accruals Accounts for the Item Groups to which the Items belong (if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module) or that on the 'Purchase Cost' card of the Account Usage Stock setting, or the Cost Account on the 'Accounts' card of the Contact record for the Supplier. The appropriate Accounts for the Zone of the Supplier will be used. Objects specified in Purchase Order rows will be transferred to the corresponding rows in the Invoice. If you have assigned any Purchase Order rows to a Project (or you have assigned the Purchase Order as a whole to a Project), Objects from that Project will also be transferred to all relevant rows in the Invoice.

- Transfer Each Row Separately

- Each ordered Item will have its own row on the Invoice. The Cost Accounts will be the Purchase Accrual Account on flip B of the Purchase Order, the Purchase Accruals Accounts for the Item Groups to which the Items belong (if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module) or that on the 'Purchase Cost' card of the Account Usage Stock setting, or the Cost Account on the 'Accounts' card of the Contact record for the Supplier. The appropriate Account for the Zone of the Supplier will be used. Objects specified in Purchase Order rows will be transferred to the corresponding rows in the Invoice. If you have assigned any Purchase Order rows to a Project (or you have assigned the Purchase Order as a whole to a Project), Objects from that Project will also be transferred to all relevant rows in the Invoice.

If you need to produce Intrastat reports, you should use the second or third options (only the third option if you will also be

creating Purchase Invoices from Goods Receipts). The

Intrastat P/L document lists the Items that have been purchased from Suppliers in other EU countries. This document takes Item information from the fields on flip B of the relevant Purchase Invoices. If you are using the second or third option, these fields will contain the necessary information in Purchase Invoices created from Purchase Orders.

Usually, Stocked Items will not be invoiced until they have been received (i.e. included on an approved Goods Receipt). This also applies to Plain and Service Items if you are using the Consolidate Items to Supplier Cost Account option (described above). If you are not using this option, Plain and Service Items will be included to their full quantity on the first Invoice created from the Purchase Order (i.e. there must be an approved Goods Receipt, but this need not include any of the Plain or Service Items on the Purchase Order). The three exceptions to this are:

- If you are using the Always use Full Qty from Purch. Ord. option in the Purchase Invoice Settings setting. In this case every Item (Stocked, Plain and Service) on the Purchase Order will be included in the Purchase Invoice even if they have not been received: no Goods Receipt need exist.

- if the Invoice Before Goods Receipt box on the 'Terms' card of the Purchase Order or the Purchase Invoices Before Goods Receipt box in the Stock Settings setting is checked. In this case, you can create a Purchase Invoice for the whole Purchase Order before you create a Goods Receipt.

- If you are using the Automatic receiving of Service and Plain Items box in the Stock Settings setting, Goods Receipts will not be created for Service and Plain Items. Therefore, they can be included on Purchase Invoices immediately: no Goods Receipt need exist. Stocked Items must still be received unless point 1 also applies.

If you are using this option, when you include a Plain or Service Item in a Purchase Order, the Received Quantity will be changed to the Order Quantity when you save the Purchase Order. Therefore Plain and Service Items will never be included on Goods Receipts created from the Purchase Order. This also means that you cannot reduce the Order Quantity for such Items once you have saved the Purchase Order. This option is intended for use where Purchase Orders for Items such as labour or training are issued frequently and Goods Receipts are not required.

You can change the Amount of one or more rows on the Invoice screen as appropriate. You can also add more rows.

Two check boxes in the Account Usage P/L setting, Update Base Currency when Invoicing and Update Foreign Currency when Invoicing, control the Base and Exchange Rates on the 'Currency' card of the Invoice. If you are not using these options, the rates will be copied from the Order. If you are using them, the latest Base and Exchange Rates will be used in the Purchase Invoice. In the latter case, the prices in Currency in the Invoice will not be changed. This means you will still be charged the agreed price, but the value of the Invoice in the home Currency (and therefore in the Nominal Ledger) will be different to that of the Order.

When you have checked that the Purchase Invoice is correct, click the OK check box and save. This signifies that the Purchase Invoice has been approved. Associated Transactions in the Nominal Ledger will now be raised (if so defined in the Sub Systems setting in the Nominal Ledger and in the Number Series - Purchase Invoices setting) and you will no longer be able to modify the Invoice.

Please click here for a full description of the screen, including detailed information about approving the Invoice and Nominal Ledger Transactions.

To close the screen and return to the Purchase Order, click the close box. You will be asked if you want to save any changes. The Invoiced field of the Order (visible on flip C) will be updated automatically (you will need to close the Purchase Order and re-open it to see this). If you are using the Consolidate Items to Supplier Cost Account option, the Invoiced field will not be updated until you approve the Purchase Invoice, and therefore you will need to take care if you need to return to the Purchase Order to create a second Invoice before the first one has been approved.

The Purchase Order and the Invoice will remain connected to each other through the Attachments facility. This allows you to open the Order quickly and easily when reviewing the Invoice, or to open the Invoice from the Order. When viewing the Invoice or Order, click the button with the paper clip image to open a list of attachments. Then double-click an item in this list to open it.

If the function does not create a Purchase Invoice, the probable causes are:

- The Supplier has been marked as Closed.

- You are using the Consolidate Items to Supplier Cost Account or Consolidate by Items and Project options in the Purchase Invoice Settings setting and the Supplier does not have a Cost Account specified.

- There are no Items on the Purchase Order awaiting invoicing.

- You have logged in as a user that is not permitted to create Purchase Invoices from Purchase Orders. This is controlled using Access Groups. To do this, deny access to the 'Purchase Invoice from Purchase Order' Action.

- There is no valid record in the Number Series - Purchase Invoices setting (in the Purchase Ledger). This might be a fault in the setting itself, or it might be because the default Purch Inv Number on the 'Serial Nos' card of the current user's Person record or in the Number Series Defaults setting (in the System module) is not in a valid Number Series. This problem will usually occur at the beginning of a new year. If you make a change to the 'Serial Nos' card of the Person record, you will need to quit HansaWorld Enterprise and restart for it to take effect.

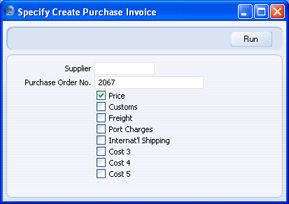

If you are using the Extra Costs Invoices from Different Suppliers option in the

Purchase Order Settings setting, a Purchase Invoice will not be created as soon as you select the function, as described above. Instead, the following window will be opened:

Proceed as follows, depending on what has been included in the paper Purchase Invoice:

- If the Purchase Invoice includes the Item(s) on the Purchase Order, leave the Supplier field empty (the Supplier will be taken from the Purchase Order). If the Invoice includes any of the Extra Costs as well, leave the Price box checked and check other boxes as appropriate. Then, click the [Run] button.

- If the Purchase Invoice does not include the Item(s) on the Purchase Order (i.e. it is for one or more of the Extra Costs only), specify the Supplier using 'Paste Special', specify the Extra Costs boxes as appropriate, remove the check from the Price box and click the [Run] button.

When you click the [Run] button, a Purchase Invoice will be created, as described earlier in this section. The Accounts for the Freight, Customs and Extra Costs will be the appropriate Accrual Accounts specified in the

Account Usage Stock setting. The VAT Codes determining how VAT will be calculated for these Extra Costs will be taken from the

'VAT' card of the Account Usage P/L setting.

Since it is possible that you will receive separate Invoices for the Item(s) and the Extra Costs, you can return to the Purchase Order to create the various Invoices at any time. You will not be able to create more than one Invoice for the Item(s).