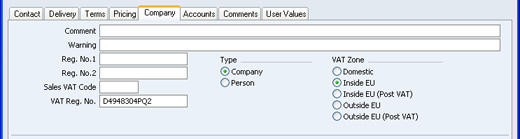

Entering a Contact - Company Card

- Comment

- Use this field to record any additional information about the Contact.

- Warning

- If the Contact is a Customer, text entered here will appear as a warning whenever you enter a Quotation in their name.

- Reg No 1

- If the Contact is a limited company, enter their Company Registration Number here.

- When you save the record, there will be a check that you have not already used the Company Registration Number in another Contact record. If you have, you will be warned, but you will still be able to save the record. The warning will contain the Contact Number of the other company.

- The Customer Status report contains a [Review Credit History] text button that will open a separate report showing the Customer's credit history. This is a chargeable Cloud Service: to use it you must have entered a Reg. No. in this field for the Customer whose credit history you are interested in, and you must have registered your database in Estonia as described on the Enabler Key page.

- Reg No 2

- This field is used in Finland, where companies have two registration numbers.

- Sales VAT Code

- Paste Special

VAT Codes setting, System module

- If the Contact is a Customer, the Sales VAT Code will determine the rate at which VAT will be quoted to the Contact.

- When you create Quotations for the Customer, this Sales VAT Code will take precedence over the VAT Codes specified in the Customer's Price List, in the Item and the Item Group. Usually, you should only specify a Sales VAT Code here for an individual Customer if for some reason your usual VAT accounting method does not apply to them.

- VAT Reg No.

- If the Contact is a Customer, record their VAT Number here.

- When you save the record, there will be a check that you have not already used the VAT Number in another Contact record. If you have, you will be warned, but you will still be able to save the record. The warning will contain the Contact Number of the other company.

- Type

- Use these options to specify whether the Contact is a company or an individual person. This will affect the check that the VAT Number is correct in Argentina and Paraguay.

- VAT Zone

- Used as default in

Quotations

- Select a Zone for this Contact. This will be used in Quotations to control VAT calculation. You can assign separate default sales VAT Codes to each Zone in the Item and Item Group records.

- When you enter Quotations for Customers in the "Inside EU" and "Outside EU" Zones, VAT will not be charged, irrespective of the VAT Code specified for those Zones in the relevant Item and Item Group records. If you want VAT to be calculated in the normal way, place these Customers in the Inside EU (Post VAT)" and "Outside EU (Post VAT)" Zones.

---

In this chapter:

Go back to: