On Account Receipts

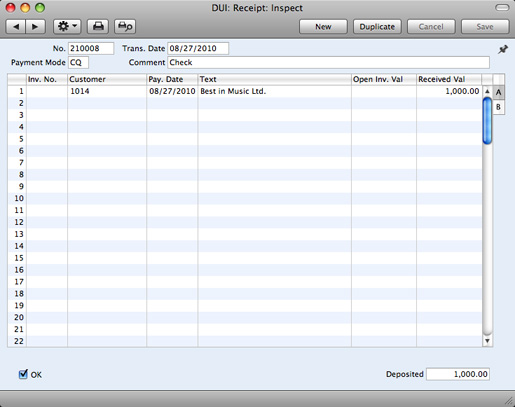

You can use On Account Receipts when you receive payments from Customers without reference to specific Invoices (usually before you have raised the Invoices). You can enter these payments to the Receipt register in the normal way but without specifying an Invoice Number:

In the Contact record of each Customer likely to pay deposits, switch on the On Account check box on the

'Terms' card. Then specify a separate control or suspense Account in the

Account Usage A/R setting, using the On Account A/C field. The Account that you specify should be one that acknowledges that receiving a deposit creates a liability. The

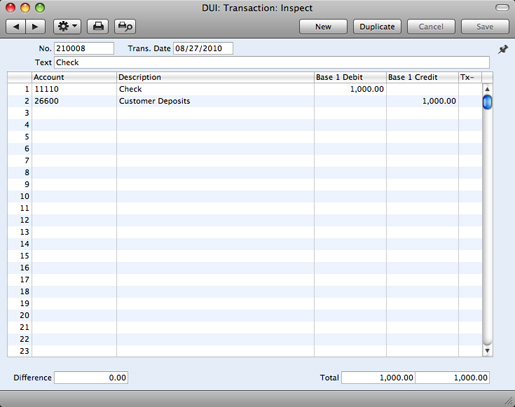

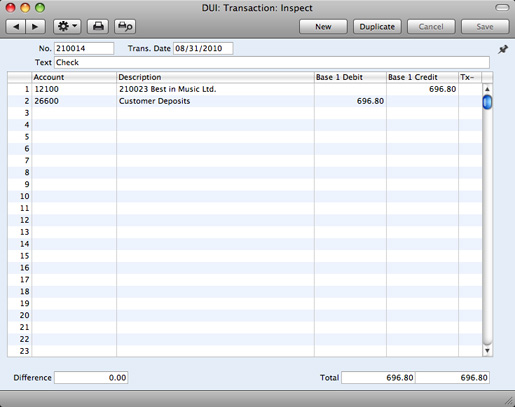

General Ledger Transaction generated when you approve and save an On Account Receipt will credit the Received Value to this Account. The debit Account will be taken from the Payment Mode as usual:

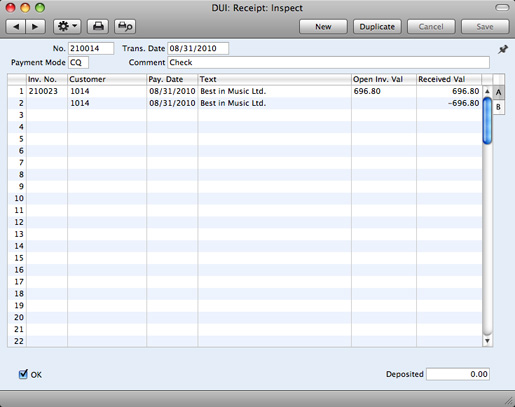

You can then connect the On Account Receipt to a subsequent Invoice, to remove it from your Accounts Receivable and your General Ledger. First, enter and approve the Invoice as normal and without reference to the On Account Receipt. You must then register that the Invoice has been paid by the On Account Receipt. You can do this in a Receipt record as a two-step process:

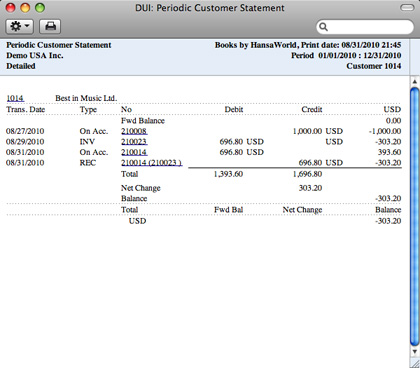

In order to update your Accounts Receivable correctly, you must enter the payment information twice as shown above: first as a normal row, and then with a negative sign as an On Account Receipt. The example Periodic Customer Statement below shows how the Invoice for 696.80 has been paid by the earlier On Account Receipt of 1,000.00. The remainder of the On Account Receipt is outstanding:

In the General Ledger, the Invoice is removed from the Debtor Account, and the balance of the On Account A/C is reduced by the value of the Invoice:

---

In this chapter:

Go back to: