Settings in the Receivables module - Payment Terms

You can assign various terms for payment to your Invoices and Purchase Invoices. Payment Terms control the calculation of Invoice Due Dates, and you can also use them to establish systems of settlement discounts.

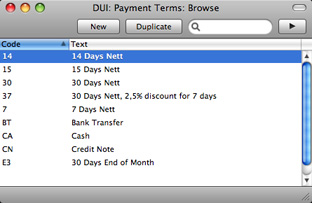

The Payment Terms setting is in both the Payables and Receivables modules. To open this setting, ensure you in either of these modules and then click the [Settings] button in the Master Control panel. Double-click 'Payment Terms' in the 'Settings' list. The 'Payment Terms: Browse' window is opened, showing the Payment Terms that you have previously entered.

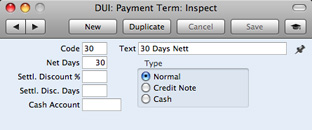

Double-click a Payment Term in the list to edit it, or add a new term by clicking the [New] button in the Button Bar. When the record is complete, save it by clicking the [Save] button in the Button Bar or by clicking the close box and choosing to save changes. To close it without saving changes, click the close box.

- Code

- Enter the unique code by which the Payment Term record is to be identified from elsewhere in Books by HansaWorld. The Code can consist of one or two characters, and you can use both numbers and letters.

- Text

- Enter the name for the Payment Term, to be shown in the 'Payment Terms: Browse' window and the 'Paste Special' list.

- Net Days

- The credit period in days. When you use the Payment Term in an Invoice or a Purchase Invoice, the value entered here will be added to the Invoice Date to calculate the Due Date of the Invoice.

- Settl. Discount %

- If the Type is "Normal", enter the rate of discount for the settlement discount, if any.

- Settl. Disc. Days

- Specify here the maximum number of days allowed for a settlement discount term. For example, if the setting is 10 days, the Customer will be given the assigned discount if you receive payment within 10 days.

- Cash Account

- Paste Special

Account register, General Ledger/System module

- If the Type (below) is "Cash", enter the Account to be debited by cash sales and credited by cash purchases. You must specify a Cash Account if the Type is "Cash". Cash Notes are described below in the section describing the "Cash" Type.

- Type

- The Payment Term can belong to one of three Types, as follows:

- Normal

- A normal payment. The Due Date in an Invoice will be calculated by adding value in the Net Days field to the Invoice Date.

- Credit Note

- This type is used for Credit Notes, to make sure that Accounts Receivable and Accounts Payable are updated correctly. You should have at least one Payment Term record of this type if you wish to raise Credit Notes. Credit Notes on the sales side are described here, and those on the purchase side here.

- Cash

- Use this Type for cash payments. The number of days is not relevant. Invoices with this Payment Term are known as "Cash Notes".

- On the sales side, when you approve a Cash Note, a General Ledger Transaction will be created which debits the Cash Account specified above and credits the appropriate Sales Account for each Item on the Invoice. Therefore, no posting to a Debtor Account is made as the Cash Note is immediately treated as paid. There is no need to enter a Receipt.

- Cash Notes behave in a similar fashion on the purchase side. In this case, the Cash Account above is credited. There is no need to enter a Payment.

---

In this chapter:

Go back to: