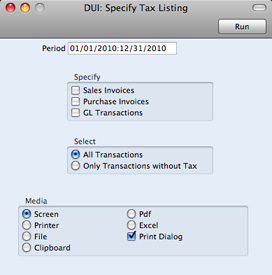

Reports in the General Ledger - Tax Listing

This report lists the transactions used in calculating the figures shown in the

Tax Report. For each transaction, the total including and excluding Tax, the Tax total and the overall Tax percentage are shown.

This report is compiled from the Sub System records (e.g. Invoices, Purchase Invoices) that are liable for Tax. The Tax Report is compiled from the General Ledger postings to the Tax Accounts. If there is a difference between the two reports, one possible reason is that the connection between a Sub System record and its related General Ledger Transaction is not correct. Perhaps the General Ledger Transaction does not exist at all, or perhaps it has been subject to a Correction Mark or Update Mark. It might be that the Tax Code in a Transaction row posting to a Sales or Purchase/Cost Account is incorrect or missing, in which case that row will not be included in the figure calculated by the VATRESULT or VATBALANCE commands in the Tax Report.

- Period

- Paste Special

Reporting Periods setting, System module

- Enter the period for which you want to print the report in the format "1/1/11:12/31/11". If you are using four-digit years as in the illustration, the leading digits will be inserted automatically. If your report period is a single day, simply enter the date once and this will be converted to a period format automatically. The first period in the Reporting Periods setting is the default value.

- Specify

- You can choose to have Sales Invoices, Purchase Invoices and/or General Ledger Transactions listed in the report. You must choose at least one section or the report will be blank. For each section, the list of transactions will be followed by a list of Tax Codes used by those transactions, together with totals.

- The Invoices option depends on whether you are using the Post Receipt Tax option in the Account Usage A/R setting in the Receivables module. If you are not using this option, the report will list the Invoices issued during the report period, together with Invoice Dates. If you are using this option (i.e. your Tax calculation is based on Receipts rather than Invoices), the report will list the Invoices paid during the report period, together with the dates they were paid. The Purchase Invoices option will similarly depend on the Post Payment Tax option in the Account Usage A/P setting in the Payables module.

- Select

- The report can show all Transactions or just those without Tax.

---

In this chapter:

Go back to: